CHART: US payrolls growth almost always disappoints in August

GETTY

Financial markets are now entering a holding pattern before the release of August US non-farm payrolls on Friday.

While always a closely watched report, perhaps the single most important data release globally each and every month, this report has taken on added significance given the lift in US interest rate expectations following last weeks Jackson Hole central bank symposium.

Another strong lift in payrolls growth, along with a further acceleration in average weekly earnings, could potentially bring on a near-term rate hike from the Fed, perhaps as soon as September.

Well, if history is any guide, hopes for a September hike based on strong payrolls growth in August may about to be dashed.

According to analysis from Richard Franulovich, Westpac’s New York based G10 FX strategist, August payrolls growth almost always undershoots market expectations, whether looking back five years or two decades.

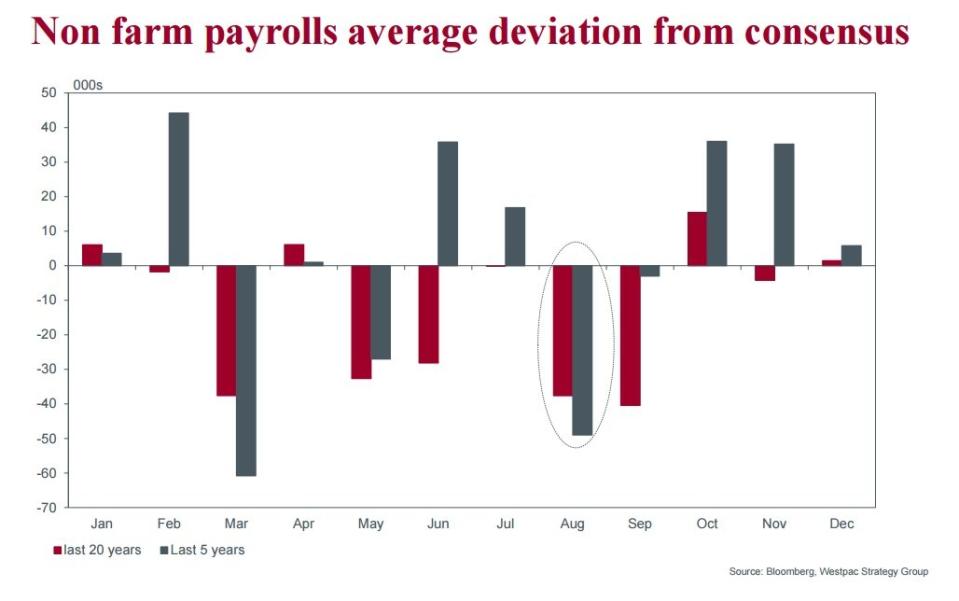

The chart below from Westpac shows the average deviation from consensus forecasts for payrolls growth for every month of the year.

Second only to March, August has the largest downward deviation from forecasts for any given month, averaging a miss of 49,000 over the past five years and 38,000 over the past two decades.

GETTY

“August payrolls have been weaker than consensus expectations in each of the last 5 years and in 14 of the last 18 years of available data,” says Franulovich, noting that “August has produced the fewest positive surprises over both the last 5 years and 20 years”.

He suggests that August is a tricky month for statisticians with “peak summer holidays affecting the response rate”.

While August has a tendency to disappoint, Franulovich notes that over subsequent months “August payrolls are usually revised up, often substantially”.

“The average final revision to August over the last five years has been 71,000, the largest average final revision for any month of the year.”

A tasty tidbit for investors to digest, particularly for those trading around the event.

According to a survey of 91 economists polled by Thomson Reuters, the median forecast for payrolls looks for a gain of 180,000.

The August payrolls report will be released at 8.30am EDT (10.30pm AEST) on Friday.

NOW WATCH: New guidelines have led to a big change for uniforms at the Rio Olympics

See Also:

Yahoo Finance

Yahoo Finance