Charts: Half of the UK’s foreign investment comes from the countries it just snubbed

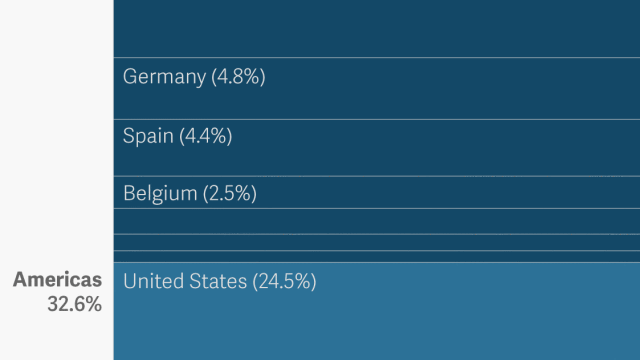

Nearly half of all foreign investment in the United Kingdom has come from other members of European Union. Many of those investments were made with the assumption that the UK has easy access to the rest of the European market. So long as the UK was a member of the EU, this was guaranteed. But with a vote to leave now in the rear-view mirror, the future of those investments—and others from outside Europe—may be in doubt.

In the years leading up to the vote there has been a fierce economic debate over exactly how a decision to leave would affect foreign investment in the UK. Optimists have argued that over the long-run the UK will be able to replace it’s European economic agreements with more favorable ones that it negotiates itself. However, even assuming that’s true, that process could take years, if not decades.

In the meantime, things look pretty bleak. Earlier this year a team from the London School of Economics estimated that leaving the EU will lead to a 22% decline in investment from abroad. (Other studies have projected both better and worse outcomes.) The supporting research focuses on the impact of leaving on the automobile manufacturing and financial industries.

In the event of an exit, automobiles and other products that are assembled from parts crafted throughout the EU will have to cross borders with tighter restrictions. This will upend established supply chains. In the best case, that might just slow down exports. In the worst case it could mean new tariffs, onerous new regulatory overhead, and the eventual relocation of manufacturers to elsewhere in Europe. According to research by the Financial Times, access to the larger European market was an important factor in more than 56% of UK projects funded with foreign investment (paywall).

Financial services account for 27% of all investment flowing into the UK, the largest amount by industry. Historically, many banks headquartered themselves in the UK and then established satellite offices throughout Europe. Under the EU’s so-called “single-passport” rules, those remote offices are beholden to the regulatory authorities of their home country, rather than the location where they operate. This can dramatically reduce their cost of operating across Europe. In order to maintain those privileges banks based in London could be forced to relocate to the mainland.

The financial crisis has slowed investment from the EU in recent years, but member countries are still major stakeholders in UK companies. The Netherlands, Luxembourg, and France are the UK’s largest sources of investment after the United States. Will those countries choose to continue investing in UK businesses if they won’t be able to bring their products and services back home cheaply and easily?

Maybe they won’t have to make that choice. It’s not a certainty that the UK will exit the single market—or exit the EU at all. Leave-campaign leader Boris Johnson has back-tracked from earlier statements that were unequivocally critical of the single market. He now argues that the UK could follow the model set by Norway, which is a member of the European Economic Union (EEU), but not the EU. This would allow them to retain access to the single-market, while leaving the rest of the EU behind.

There’s just one problem with that: EU diplomats have outright rejected the idea. One called it a “pipe dream”. That’s hardly surprising given the incredible snub they just received from the UK, who essentially flipped over the same table such agreements are negotiated on. Until a clear exit strategy emerges for the UK’s separation all possible outcomes are speculative. No one can lay any cards on the table until someone sets it back upright.

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz:

Yahoo Finance

Yahoo Finance