Chemed (CHE) Beats on Q1 Earnings & Revenues, Retains View

Chemed Corporation’s CHE first-quarter 2018 adjusted earnings per share (EPS) were $2.72, compared with the year-ago $1.82. The figure surpassed the Zacks Consensus Estimate of $2.37.

Quarter in Details

Revenues in the quarter increased 8.2% year over year to $439.2 million, beating the Zacks Consensus Estimate of $420 million.

Chemed operates through two wholly-owned subsidiaries, namely, VITAS Healthcare Corporation (a major provider of end-of-life care) and Roto-Rooter (a leading commercial and residential plumbing and drain cleaning service provider).

In the first quarter, net revenues at VITAS Healthcare totaled $292 million, reflecting an increase of 5.5% year over year. Revenues were driven by a 0.7% increase in the average net Medicare reimbursement rate and a 6.1% rise in average daily census. Further, a decrease in Medicare Cap drove revenues by 0.6%. However, this was partially offset by acuity mix shift which impacted revenues by 1.8%.

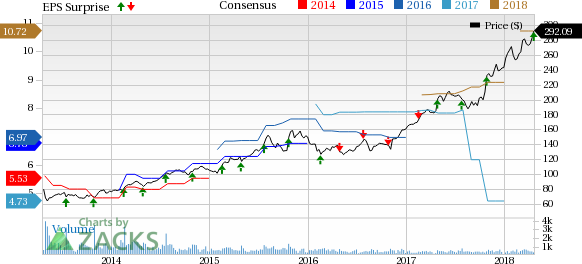

Chemed Corporation Price, Consensus and EPS Surprise

Chemed Corporation Price, Consensus and EPS Surprise | Chemed Corporation Quote

Roto-Rooter reported sales of $147.2 million in the first quarter, up 20.2% year over year. According to the company, revenues from water restoration increased 53.3% year over year to $27.7 million.

Gross margin expanded 90 basis points (bps) year over year to 30.7%. Adjusted operating margin also expanded 240 bps to 15% in the quarter owing to a 0.7% contraction in selling, general and administrative expenses to $69 million.

Chemed exited the first quarter of 2018 with total cash and cash equivalents of $13.7 million, up from $11.1 million at the end of 2017. The company had total debt of $132.5 million at the end of the first quarter, reflecting a sharp increase from $91.2 million at 2017-end. As of Mar 31, 2018, the company had approximately $244 million of undrawn borrowing capacity under its existing five-year credit agreement.

During the first quarter, the company repurchased shares worth $81.1 million. The board has authorized an additional $150 million for stock repurchase under Chemed’s existing plan. As of Mar 31, 2018, the company had $124.4 million of remaining share repurchase authorization under this plan.

2018 Outlook Intact

The company projects VITAS Healthcare revenue growth for 2018 in the range of 2.5% to 3.5%, prior to the Medicare Cap. Also, the admissions and Average Daily Census in 2018 are expected to increase 3% to 4%. Medicare Cap billing limitations are expected at around $5 million in 2018.

The Roto-Rooter business is likely to grow 4% to 5% in the full year. The guidance was backed by a 2% increase in job pricing and water restoration services growth.

Full-year adjusted EPS is expected to grow in the band of $10.60 to $10.85 as compared with $8.43 reported in 2017. The Zacks Consensus Estimate of $10.72 is within the guided range.

Our Take

Chemed exited the first quarter on a solid note. Also, the company witnessed year-over-year growth in both the fronts. Moreover, we are encouraged to note that the company’s subsidiaries saw year-over-year revenue growth in the quarter. The expansion in gross margin also buoys optimism.

Further, reimbursement-related issues, seasonality in business, a competitive landscape and dependence on government mandates continue to pose challenges.

Zacks Rank & Key Picks

Chemed carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical sector are Abaxis, Inc. ABAX, Bio-Rad Laboratories, Inc. BIO and Laboratory Corporation of America Holdings LH or LabCorp. While Abaxis and Bio-Rad sport a Zacks Rank #1 (Strong Buy), LabCorp carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Abaxis is expected to release fourth-quarter fiscal 2018 results on Apr 26. The Zacks Consensus Estimate for adjusted EPS is pegged at 32 cents and for revenues stands at $67.2 million.

Bio-Rad is expected to report first-quarter 2018 results on May 3. The Zacks Consensus Estimate for adjusted EPS is 90 cents and for revenues is $530.4 million.

LabCorp is slated to release first-quarter 2018 results on Apr 25. The Zacks Consensus Estimate for adjusted EPS is $11.55 and for revenues is $11.48 billion.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abaxis,Inc. (ABAX) : Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance