Chemical Distribution Global Market Opportunities and Strategies Report to 2033 - Launch of Full-Line Chemical Distribution Platforms Strengthening Market Presence

Global Chemical Distribution Market

Dublin, June 24, 2024 (GLOBE NEWSWIRE) -- The "Chemical Distribution Global Market Opportunities and Strategies to 2033" report has been added to ResearchAndMarkets.com's offering.

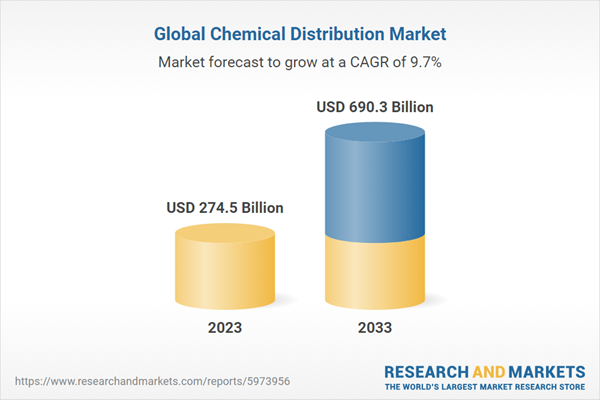

The global chemical distribution market reached a value of nearly $274.5 billion in 2023, having grown at a compound annual growth rate (CAGR) of 4.4% since 2018. The market is expected to grow from $274.5 billion in 2023 to $431.6 billion in 2028 at a rate of 9.5%. The market is then expected to grow at a CAGR of 9.8% from 2028 and reach $690.3 billion in 2033.

Growth in the historic period resulted from the growth of manufacturing activities, rapid growth in urbanization and growth of the pharmaceutical industry. Factors that negatively affected growth in the historic period were growing environmental concerns.

Going forward, growing demand for specialty chemicals, growing construction industry, increasing international trade and increasing penetration of online retail platforms will drive the growth. Factors that could hinder the growth of the chemical distribution market in the future include fluctuating raw materials prices.

The chemical distribution market is segmented by product into specialty chemical and commodity chemical. The commodity chemical market was the largest segment of the chemical distribution market segmented by product, accounting for 60.4% or $165.9 billion of the total in 2023. Going forward, the specialty chemical segment is expected to be the fastest growing segment in the chemical distribution market segmented by product, at a CAGR of 10.7% during 2023-2028.

The commodity chemicals market is segmented by product into performance chemicals and bulk chemicals. The bulk chemicals market was the largest segment of the commodity chemicals market segmented by product, accounting for 42.5% or $116.6 billion of the total in 2023. Going forward, the performance chemicals segment is expected to be the fastest growing segment in the commodity chemicals market segmented by product, at a CAGR of 9.5% during 2023-2028.

The chemical distribution market is segmented by type into pipelines, containers, barrels and sacks. The pipelines market was the largest segment of the chemical distribution market segmented by type, accounting for 54.4% or $149.2 billion of the total in 2023. Going forward, it is expected to be the fastest growing segment in the chemical distribution market segmented by type, at a CAGR of 9.9% during 2023-2028.

The chemical distribution market is segmented by end-user into transportation, construction, agriculture, pharmaceuticals, industrial manufacturing, personal care, food and other end-users. The industrial manufacturing market was the largest segment of the chemical distribution market segmented by end-user, accounting for 23.3% or$ 64 billion of the total in 2023. Going forward, the pharmaceuticals segment is expected to be the fastest growing segment in the chemical distribution market segmented by end-user, at a CAGR of 11.4% during 2023-2028.

Asia Pacific was the largest region in the chemical distribution market, accounting for 44.3% or $121.6 billion of the total in 2023. It was followed by Western Europe, North America and then the other regions. Going forward, the fastest-growing regions in the chemical distribution market will be Asia Pacific and South America where growth will be at CAGRs of 11.2% and 10.6% respectively. These will be followed by Middle East and North America where the markets are expected to grow at CAGRs of 9.3% and 8.5% respectively.

The global chemical distribution market is fairly fragmented, with a large number of players operating in the market. The top ten competitors in the market made up to 19.2% of the total market in 2022. Brenntag AG was the largest competitor with a 5.2% share of the market, followed by Univar Solutions Inc. with 4.3%, Tricon Energy with 3.4%, Nagase & Co. with 2.1%, Caldic B.V. with 0.9%, IMCD with 0.8%, Azelis with 0.7%, Helm AG with 0.7%, Barentz with 0.6% and Omya AG with 0.6%.

The top opportunities in the chemical distribution market segmented by product will arise in the commodity chemical segment, which will gain $84.9 billion of global annual sales by 2028. The top opportunities in the chemical distribution market segmented by type will arise in the pipelines segment, which will gain $89.9 billion of global annual sales by 2028. The top opportunities in the chemical distribution market segmented by end-user will arise in the industrial manufacturing segment, which will gain $34.6 billion of global annual sales by 2028. The top opportunities in the commodity chemicals market segmented by product will arise in the bulk chemicals segment, which will gain $56.8 billion of global annual sales by 2028. The chemical distribution market size will gain the most in China at $38.1 billion.

Major Market Trends

Strategic Collaborations and Partnerships Fostering Growth and Expansion in Chemical Distribution

Facility Expansions and Investments Driving Growth in the Chemical Distribution Industry

Launch of Full-Line Chemical Distribution Platforms Strengthening Market Presence

Adoption of Product Information Management Systems Streamlining Chemical Data Management

Emergence of Online B2B Marketplaces and Digital Platforms Transforming Chemical Distribution

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider chemical distribution market; and compares it with other markets.

Markets Covered:

By Product: Specialty Chemical; Commodity Chemical

Commodity Chemical By Product: Performance Chemicals; Bulk Chemicals

By Type: Pipelines; Containers; Barrels; Sacks

By End-User: Transportation; Construction; Agriculture; Pharmaceuticals; Industrial Manufacturing; Personal Care; Food; Other End-Users

Key Companies Mentioned: Brenntag AG; Univar Solutions Inc.; Tricon Energy; Nagase & Co.; Caldic B.V.

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; Italy; Spain; UK; Russia

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; chemical distribution indicators comparison.

Key Attributes:

Report Attribute | Details |

No. of Pages | 338 |

Forecast Period | 2023 - 2033 |

Estimated Market Value (USD) in 2023 | $274.5 Billion |

Forecasted Market Value (USD) by 2033 | $690.3 Billion |

Compound Annual Growth Rate | 9.7% |

Regions Covered | Global |

Companies Profiled:

Brenntag AG

Univar Solutions Inc.

Tricon Energy

Nagase & Co.

Caldic B.V.

IMCD

Azelis

Helm AG

Barentz

Omya AG

KISCO Ltd

KPL International Limited

Jebsen & Jessen (SEA)

Perstorp Chemicals Asia PTE Ltd

REDA Chemicals Holding S.A

Univar Solutions

DKSH

Nexeo Plastics

Biesterfeld AG

UNGERER Limited

Stockmeier Chemie

Ashland Global Holdings Inc

Brenntag North America

Palmer Holland

Parchem Fine & Specialty Chemicals

Sialco Materials Ltd

Shrieve Chemical Company

Harcros Chemicals Inc

Quimex S.A

Brenntag Argentina S.A.

IMCD Colombia S.A.S

Norkem Chemicals SA (Pty) Ltd.

Saudi Basic Industries Corporation (SABIC)

Saudi Aramco Chemicals

Gulf Petrochemical Industries Company (GPIC)

National Petrochemical Industrial Co. (NATPET)

Brenntag Africa

AECI Group

Omnia Holdings Limited

Nampak

Sasol

Orascom Construction Industries (OCI)

Egyptian Ethylene and Derivatives Company (ETHYDCO)

Ethiopian Midroc Chemical Technology Group

OCP Africa

Chemi & Cotex Industries Limited

For more information about this report visit https://www.researchandmarkets.com/r/v0hrh

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance