Chesapeake (CHK) Posts Strong Q1 Earnings on Higher Output

Chesapeake Energy Corporation CHK reported strong first-quarter 2018 earnings, courtesy of higher oil equivalent production and price realizations. As a result, in the premarket trading, the stock gained more than 3%.

Earnings per share (excluding special items) of 34 cents surpassed the Zacks Consensus Estimate of 25 cents and the year-ago 23 cents.

Total revenues fell to $1,243 million from $1,469 million a year ago. The top line also fell shy of the Zacks Consensus Estimate of $1,297 million.

Operational Performance

Chesapeake’s production in the reported quarter was approximately 50 million barrels of oil equivalent (MMBoe), reflecting a year-over-year increase of 4.2%. Production consisted of approximately 8 million barrels (MMbbls) of crude (flat year over year), 222 billion cubic feet (bcf) of natural gas (up 5.2%) and 5 MMbbls of NGL (flat).

Oil equivalent realized price — excluding unrealized gains (losses) on derivatives — in the reported quarter was $27.31 per barrel of oil equivalent, up 13.5% year over year.

Total capital expenditure increased to $611 million from $576 million in the first quarter of 2017.

On the cost front, quarterly production expenses increased 3.5% year over year to $2.94 per Boe.

Expenses

Total first-quarter 2018 operating expenses were $2,211 million, down almost 12% year over year.

Financials

At the end of the first quarter, Chesapeake had cash balance of $4 million. Net long-term debt totaled $9,325 million.

The company could lower its long-term debt by roughly $581 million. This was possible as Chesapeake managed to generate record net quarterly cashflow of $609 million — the most in roughly three years.

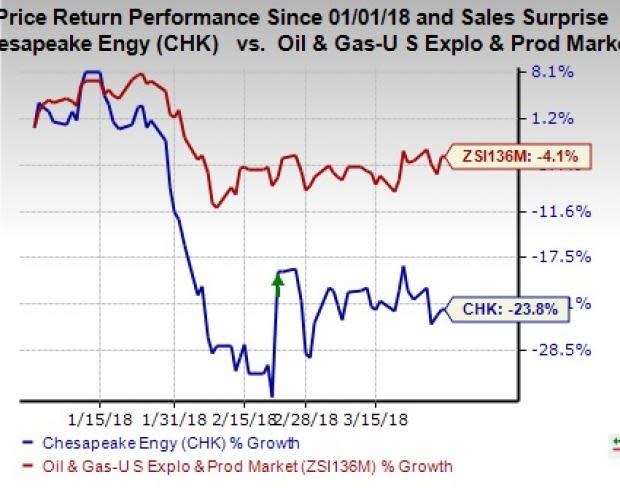

Q1 Price Performance

During first-quarter 2018, Chesapeake lost 23.8% compared with the industry’s decline of 4.1%.

Guidance

Chesapeake’s production guidance for 2018 is maintained at the range of 515,000-550,000 Boe per day. Moreover, the capital budget projection for 2018 has been reiterated at $1,975-$2,375 million.

Zacks Rank & Key Picks

Chesapeake carries a Zacks Rank #3 (Hold). A few better-ranked players in the energy space are Baytex Energy Corp. BTE, W&T Offshore, Inc. WTI and Canadian Natural Resources Limited CNQ. All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Baytex managed to beat the Zacks Consensus Estimate in the last three quarters.

W&T Offshore, Inc. will likely post earnings growth of 7.1% in 2018.

Canadian Natural is expected to see year-over-year earnings growth of 151.1% in 2018.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Baytex Energy Corp (BTE) : Free Stock Analysis Report

Chesapeake Energy Corporation (CHK) : Free Stock Analysis Report

W&T Offshore, Inc. (WTI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance