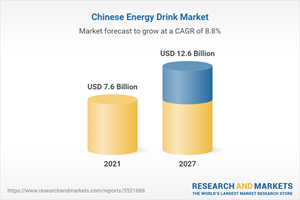

China $12.6 Bn Energy Drink Markets to 2027

Chinese Energy Drink Market

Dublin, April 28, 2022 (GLOBE NEWSWIRE) -- The "China Energy Drink Market, Share, Insight, Forecast 2022-2027, Industry Trends, Growth, Size, Impact of COVID-19, Company Analysis" report has been added to ResearchAndMarkets.com's offering.

China Energy Drink Market is expected to reach US$ 12.6 Billion in 2027

Similar to other countries, energy drinks are most favoured among young people in China who drink them as a normal beverage. They are a relatively new sort of drink among the youngsters.

Still, in recent years, imported energy drinks to China are growing, and the highest consumption group is the more youthful generation who find energy drinks as some fashion and trend. Energy drinks are popular dietary supplements with high stimulant ingredients, such as guarana, caffeine and sugar, vitamins, Yohimbe, carnitine, taurine, ginseng, bitter orange, and glucuronolactone.

COVID-19 Impact on China Energy Drink Growth Trends

In 2020, the impact of COVID-19 in China's energy drink market was positive. In the COVID-19 pandemic, the fitness clubs and other sporting arenas were shut down in China. Nonetheless, the customers are sticking to workouts and employing various exercise regimes in the convenience of their homes, showing a continued need for energy drinks.

At the same time, long and variable working hours have further driven Chinese consumers towards energy drinks. The Chinese energy drink significant companies in the market are Red Bull, Monster Beverage Corporation, Taisho Pharmaceutical Holding Company, Dali food group co ltd, Rockstar Inc, Taisho Pharmaceutical Holding co. lmt., Pepsico, Coca cola.

China Energy Drinks Market Size was US$ 7.6 Billion in 2021

Nevertheless, the driving factors for the growth of the China energy drinks industry are robust urbanization and industrialization, growing buyers' purchasing power, and increasing people's living standards. Further, initiatives are taken by the market prospects to improvise the distribution infrastructure, the burgeoning rage of energy drinks amongst youngsters, beverage products, and rising consumer spending on food which are significant in promulgating the demand for energy drinks in China.

Energy Drink and Energy Shots industry is Expected to Grow in Future

In terms of type, China's energy drinks market is segmented into Energy drinks, Energy shots, and Energy mixers. China is projected to experience significant growth in both the energy drink and energy shots industry. Energy drinks are non-alcoholic beverages containing energy impulses. Energy drinks are widely drunk by adolescents due to their claims of endurance, enhancing performance, and alertness.

The general progress in the quality of life in China in recent years has inspired many individuals to engage in sports activities. Athletes also tend to prefer nutritious and energizing drinks over water. Red Bull has held a strong brand presence in the energy drink market in China.

The increased consumption of energy drinks and the giant coffee culture in China has propelled the notion of energy shots into the mainstream, which is a significant factor compelling the sales of energy drinks in the country.

China Energy Drink Industry will Grow with a CAGR of 8.8% during 2021-2027

Based on distribution channel, China energy drink market is categorized into Hypermarket, Supermarket, mass merchandisers, Convenience stores, Foodservice outlets, Online, and Others. Foodservice outlets fuel the energy drink market over the forecast period.

Moreover, canned and bottled energy drinks are sold everywhere in China, from supermarkets & hypermarkets to convenience stores, food service outlets, and online. Online purchasing of energy drinks along with other grocery items has gained maximum traction in last few years. This COVID-19 pandemic has further accelerated this online purchasing trend.

Key Topics Covered:

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenge

5. China Energy Drink Market

6. Market Share - China Energy Drink

6.1 By Type

6.2 By Distribution Channel

6.3 By Packaging Type

7. Type - China Energy Drink Market

7.1 Energy drink

7.2 Energy shots

7.3 Energy mixers

8. Distribution Channel - China Energy Drink Market

8.1 Hypermarket, Supermarket, Mass Merchandisers

8.2 Convenience Stores

8.3 Food Service Outlets

8.4 Online

8.5 Others

9. Packaging Type - China Energy Drink Market

9.1 PET

9.2 Glass bottles

9.3 Cans

9.4 Cartons

9.5 Others

10. Porters Five Forces

10.1 Overview

11. Key Players Analysis

Red Bull

Monster Beverage Corporation

Taisho Pharmaceutical Holding Company

Dali food group co ltd

Rockstar Inc

Taisho Pharmaceutical Holding co. lmt.

Pepsico

Coca cola

For more information about this report visit https://www.researchandmarkets.com/r/i9x39p

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance