China’s Benchmark Rate Becomes Endangered Species in Central Bank Shift

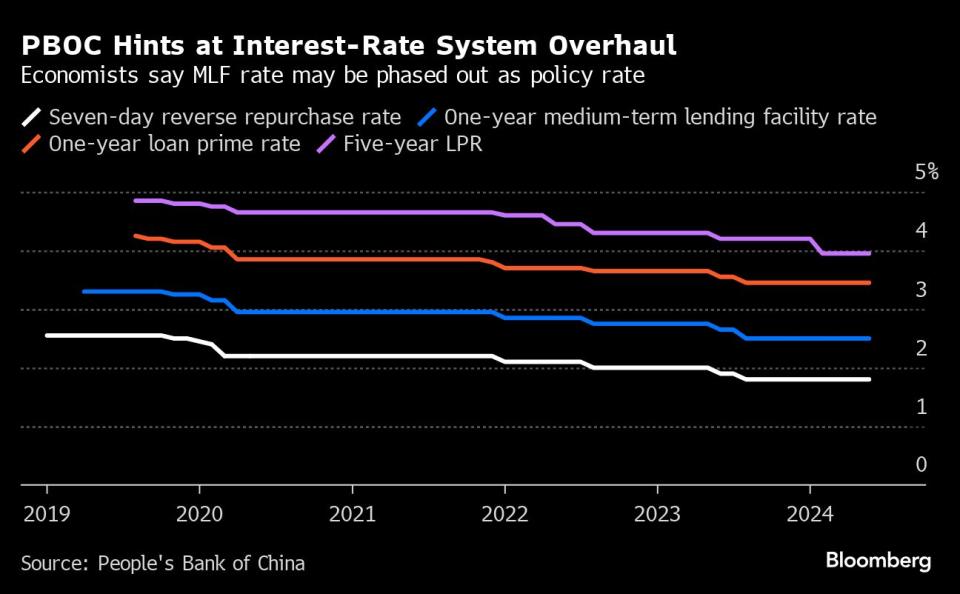

(Bloomberg) -- The People’s Bank of China’s Governor Pan Gongsheng last month said Beijing is studying shifting to a short-term rate to guide markets, spurring traders and economists to slap an endangered species tag on the existing one-year benchmark.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

Modi’s Embrace of Putin Irks Biden Team Pushing Support for Kyiv

NATO Singles Out China Over Its Support for Russia in Ukraine

Monday’s announcement of a new mechanism to influence short-term borrowing costs seems to have made that extinction all but certain. It’ll start conducting bond repurchase operations in the afternoon in addition to its traditional morning operations, narrowing volatility around the seven-day repurchase rate and strengthening expectations for it to become the new policy benchmark.

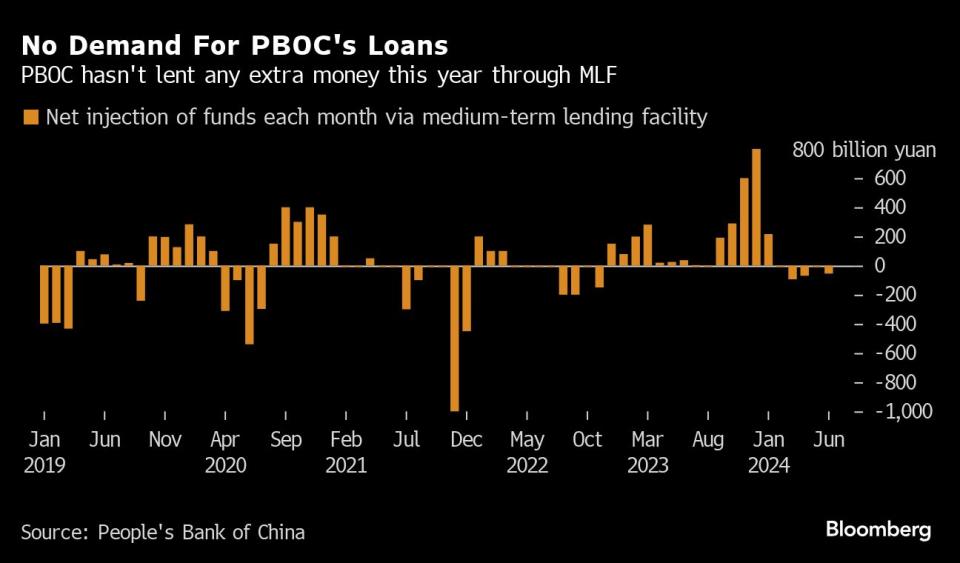

A rate decision next Monday for the current benchmark — the medium-term lending facility — is expected to highlight its fading importance after a decade of guiding markets. Economists are betting on an 11th straight hold, in part because the PBOC doesn’t want to weaken the currency any further.

“The MLF will likely fade into the background, and at one point may cease to exist,” said Frederic Neumann, chief Asia economist at HSBC Holdings Plc.

But it’s not going to happen overnight. Neumann expects a transition phase of at least another year or so where the MLF will continue to be used to guide commercial lending rates while the PBOC firms up the market architecture around the seven-day reverse repo so it’s usable as the principal interest-rate anchor.

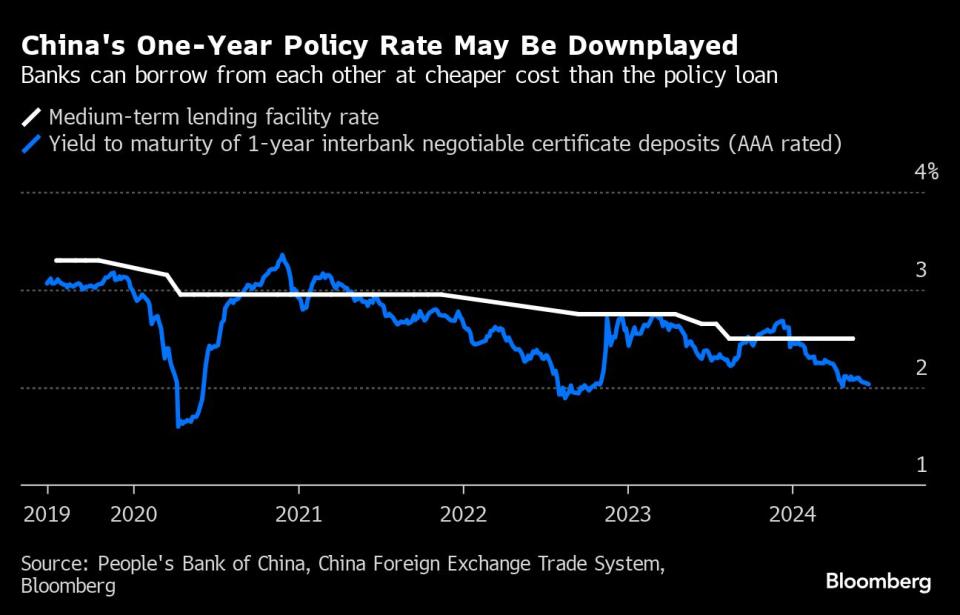

The one-year MLF is the rate at which a select group of commercial banks can borrow from the central bank for that duration. But in recent months, banks’ demand for these funds has languished as it became cheaper for them to borrow from each other instead. That has eroded its ability to steer borrowing costs in the real economy.

Compared with the MLF, the rate on seven-day reverse repos — short-term loans available to banks every day — offers more flexibility for policy fine-tuning.

“The focus is not about rushing to phase out the MLF, but rather directing more attention toward the short-term rate as a main policy tool,” said Lynn Song, Greater China chief economist at ING Bank. “We could see more frequent open market operations to manage the short-term interest rate.”

President Xi Jinping’s economic officials are trying to balance the need to boost growth with stimulus. But at the same time, they’re constrained from cutting rates because that would lead to more pressure on the yuan to weaken.

China’s economic recovery is patchy, with manufacturing at times a bright spot while consumption has been hampered by a prolonged real estate slump and a weak job market.

Second-quarter growth figures will also be released Monday, and while economists predict growth will be above target for the first half, retail sales are likely to disappoint and investment is forecast to slow.

Last month, a newspaper managed by the PBOC cited unnamed industry experts as saying that the central bank should weaken the link between MLF and the loan prime rates. Currently, LPRs are based on the interest rates that 20 banks offer their best customers, which are quoted as a spread over the MLF rate.

What Bloomberg Intelligence Says...

As the seven-day reverse repo rate can be adjusted on any trading day, whereas the MLF is only set once a month, the market might find it harder to prepare for rate cuts.

“But the PBOC might be able to time its easing better in relation to key events like Fed meetings, and using a short-tenor rate as the policy anchor is the norm for most central banks.”

— Stephen Chiu, Chief Asia FX and Rates Strategist

Read the full report here.

“If history is a guide, the PBOC will still take one or two years for migration,” said Raymond Yeung, chief economist for greater China at Australia & New Zealand Banking Group.

In 2013, the PBOC scrapped the one-year benchmark lending rate, allowing commercial banks to set their LPR, but they kept releasing the rate until 2015 because many outstanding loans remain linked to the old benchmark, said Yeung.

Economists tend to discount the likelihood that the PBOC will try to link the seven day repo rate to banks’ loan prime rate (which is usually set for one or five years), largely because of the mismatch between durations.

“If the transmission mechanism improves, adjustments to the short-term interest rates should affect the longer-term rates as well. It will consequently have an indirect impact rather than a peg on the LPR,” said ING’s Song.

The PBOC’s Pan didn’t outline his plans for the MLF in his wide-ranging June speech. But a consensus is forming that the central bank is moving more in line with global peers such as the US Federal Reserve in its shift to a short-term benchmark.

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance