China Should Use Quantitative Easing If Needed: Ex-PBOC Adviser

(Bloomberg) -- China should shake off its “taboo” regarding quantitative easing — the once-unorthodox central bank policy of buying government bonds — and recognize that it may be necessary in the interest of stoking economic growth, a former People’s Bank of China adviser said.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

Nvidia’s 591,078% Rally to Most Valuable Stock Came in Waves

Nvidia Becomes World’s Most Valuable Company as AI Rally Steams Ahead

Chinese policymakers have long rejected QE, which was used by most advanced economy central banks as a stimulus tool after they had lowered interest rates toward zero. It’s sometimes been associated with stagnant economic growth and excessive public debt, and by some critics as evidence of Western economies’ decline.

“China doesn’t have to embark on massive QE just yet,” Yu Yongding, who sat on the PBOC’s monetary policy committee between 2004 and 2006, wrote in an article on the country’s main social media platform WeChat. “But it’s necessary we shake off the thinking that QE is a taboo first so that we can launch it immediately when needed.”

Comments by Chinese President Xi Jinping published earlier this year encouraged the PBOC to engage in purchases and sales of government bonds in the secondary market — that is, not directly from the Finance Ministry — but economists said that was designed more to promote liquidity than to craft a new monetary tool.

Yu’s comments on QE were in the context of a call for China to consider scaling up its sovereign bond issuance and adopting a wider fiscal deficit in order to ensure it secures Beijing’s economic growth target of about 5% for this year. He suggested the proceeds could be used to increase infrastructure investment and address risks stemming from the property slump and from debt run up by local authorities.

A rally in Chinese bonds has pushed benchmark yields toward their lowest in more than two decades amid a wave of inflows into scarce fixed-income securities and pessimism over the country’s long-term growth potential. That has led to a series of warnings from the PBOC on the risks of a bond bubble, particularly in longer-dated debt.

Coupled with speculation the PBOC will add to its policy toolbox by buying and selling government bonds, the rally suggests to some that the latter is more likely in the near term, to prevent excessively low yields which it sees as endangering financial stability and weighing on the yuan.

‘Inevitable’ Step

Still, once central government debt sales are ramped up, Yu said it may be “inevitable” for the PBOC to start “massive buying” of the securities in the secondary market. “The ultimate solution to debt problems is not paying it off but to keep the economy growing,” he added.

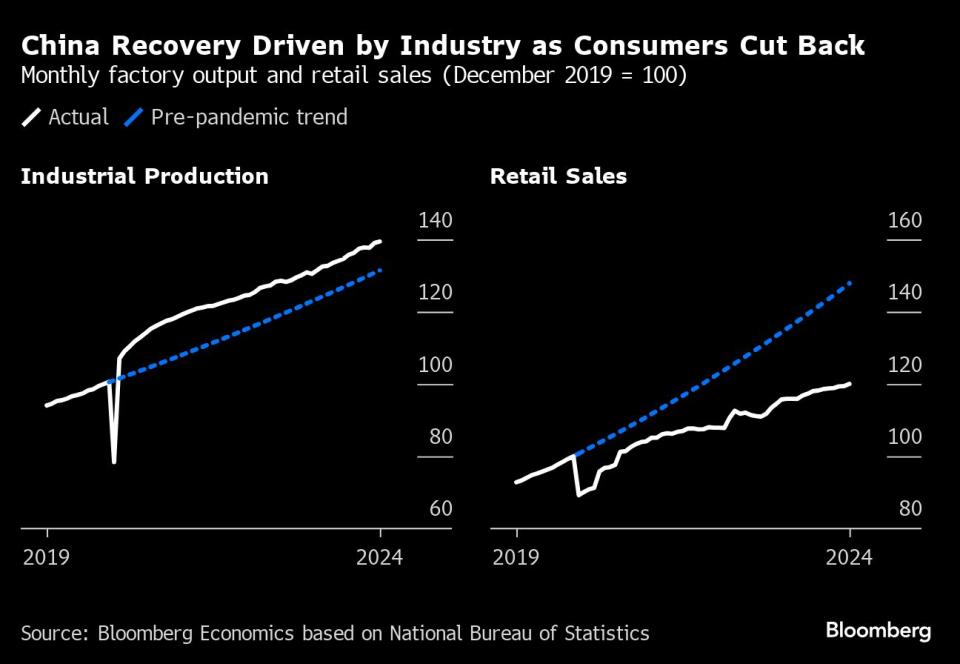

Yu’s post followed the release of a mixed set of economic data on Monday, with declines in real estate investment and home prices both gathering pace in May. Industrial production gains slowed from April, and missed the median forecast in a Bloomberg survey. Retail spending picked up, but remained weak by past standards.

Yu said it’s become more challenging for China to achieve 5% growth than expected at the beginning of the year. While strong manufacturing expansion has alleviated the need for infrastructure investment to step up, it’s not enough to offset the impact of the slowdown in consumption, he said.

He also indicated there’s a gap of about 6.5 trillion yuan ($896 billion) between the government funds budgeted for infrastructure spending and the amount needed to hit the annual GDP growth target, according to his calculations.

(Updates with context on China’s bond rally in six and seventh paragraphs.)

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance