Trade war bites as Chinese growth slides to lowest in three decades

China’s economy is growing at its slowest rate in almost three decades, according to government figures that raise fresh fears over the health of the world economy.

GDP growth dropped to 6% year-on-year in the third quarter, coming in lower than widely expected and the lowest figure since official records began in 1992.

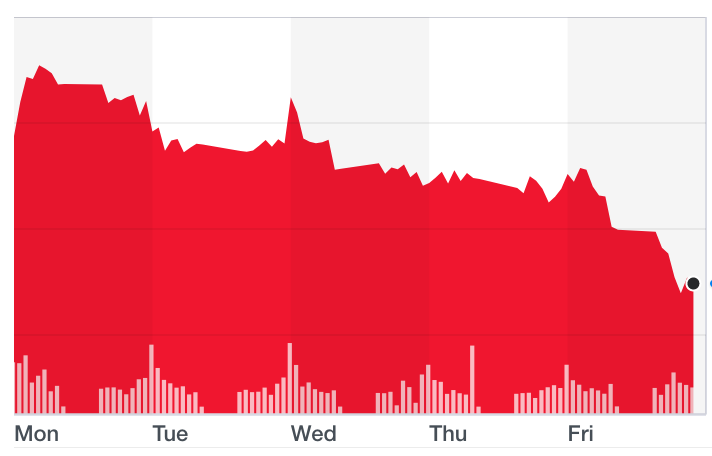

The data sent Asian stocks tumbling, with the Shanghai Stock Exchange composite index (000001.SS) sliding 1.3% overnight.

The figures suggest the US trade war is battering the Chinese economy, with factory output suffering from tariffs and the hostile trade climate.

READ MORE: World Economic Forum warns world ‘ill-prepared for a downturn’

Exports in September fell by 0.7% year-on-year, while imports slid further, down by 6.2% according to China’s national bureau of statistics.

Freight shipments, factory power generation, employment levels and spending on entertainment are reported to have suffered particularly from lower global and domestic demand.

The statistics bureau said in a statement: “We must be aware that given the complicated and severe economic conditions both at home and abroad, the slowing global economic growth, and increasing external instabilities and uncertainties, the economy is under mounting downward pressure.”

Beijing plans to bring forward a local government bond issue that had been scheduled for next year to stimulate growth, according to Reuters.

Russ Mould, investment director at AJ Bell, said UK investors’ reactions in China-sensitive stocks such as mining suggested they were betting on government stimulus.

“Interestingly the mining sector didn’t respond in its usual fashion to weak Chinese data. Normally such a result would drag down shares in the sector as investors fear it represents a potential reduction in demand for commodities by the Asian superpower,” said Mould.

“This time round, commodities trader Glencore and miner Rio Tinto both slipped less than 1%, perhaps indicating that investors have some confidence in the Chinese government rolling out more stimulus measures to boost the economy such as increased spending on infrastructure.”

It comes after the International Monetary Fund (IMF) warned this week the US-China trade tensions would wipe 0.8% off global growth by 2020.

The IMF said the global economy was in a “synchronized slowdown,” downgrading its forecast for 2019 growth to 3%-the lowest since the financial crisis.

“Growth continues to be weakened by rising trade barriers and increasing geopolitical tensions,” it said as it predicted output could revive if tariffs were cut back.

Yahoo Finance

Yahoo Finance