China plenum to deliver policy agenda hindered by conflicting goals

By Kevin Yao

BEIJING (Reuters) -China's leaders will seek to inject confidence in the economy at a highly anticipated meeting next week, but conflicting goals, such as boosting growth while cutting debt, may mean little progress toward implementing change.

The Communist Party leadership meeting will outline efforts to promote advanced manufacturing, revise the tax system to curb debt risks, manage a vast property crisis, boost domestic consumption and revitalise the private sector, policy advisers say.

With business, employment and consumer sentiment near record lows, the four-day plenum starting on Monday will seek to quell concerns that the world's second-biggest economy is drifting towards a prolonged period of low growth or even the deflation Japan has often faced since the 1990s.

But China's leaders have not shown how they can cut debt and stimulate growth, get consumers to spend more while channelling resources to producers and infrastructure, or increase urbanisation while revitalising rural areas.

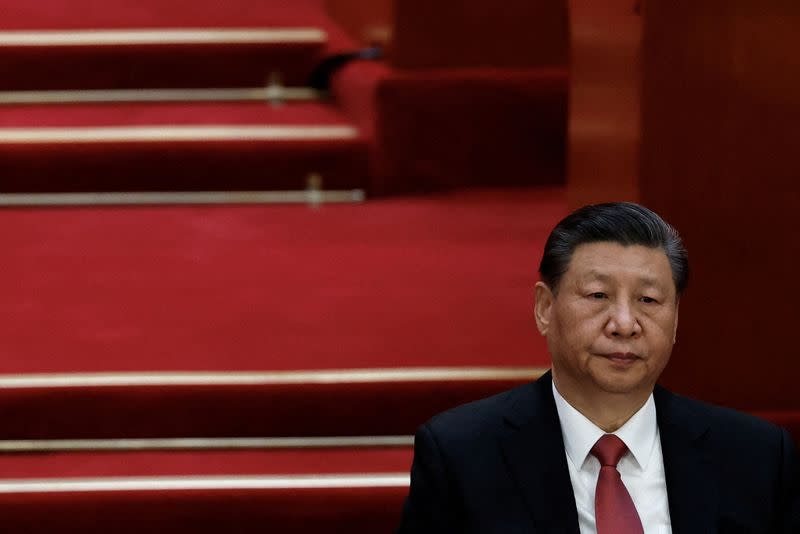

As a result, the communique at the end of the closed-door meeting, chaired by President Xi Jinping, may contain lofty goals but offer few pathways to them. This could disappoint tense financial markets and global officials calling for China to change its growth model.

"Reforms are needed as several risks are overlapping: an ageing population, property bubbles, local government debt risks and financial risks," said a policy adviser who asked for anonymity due to the topic's sensitivity. "But implementing reforms will be very difficult."

SEVERE CHALLENGES

The plenum, previously held every five years, was expected last autumn but delayed without explanation to this month.

China's leaders have sometimes used these gatherings to announce significant shifts - such as Deng Xiaoping launching reform and opening policies in 1978 that ignited China's rise to superpower, and Xi consolidating power with the scrapping of presidential term limits at the last plenum, in 2018.

Now, though, policymakers face seemingly intractable challenges.

Officials want to double China's economy by 2035, requiring average annual growth of 4.7%. Few believe that is feasible, with the International Monetary Fund predicting a slowdown to 3.3% by 2029 from 5.2% last year.

"We must unleash new growth drivers," said a second policy adviser. "If we don’t reform, the economy is likely to slow in line with IMF forecasts."

Many economists have called on China to reduce its reliance on debt-fuelled investment projects and exports, instead promoting growth by stimulating household spending - something leaders pledged at a 2013 plenum but have made little progress on. It would require transferring resources from government and business to households through social welfare and higher wages, undermining debt-reduction and industrial goals.

Long-held ambitions such as dismantling a Mao-era internal passport system, blamed for huge urban-rural inequality, and raising the retirement age, which is among the lowest in the world, would risk social instability.

Beijing says it has an open-door policy to investment from abroad, but foreign companies complain about raids and arrests, broad national security laws and state support to domestic competitors.

'GOVERNMENT IS TOO STRONG'

"The likelihood is that the meeting will conclude with a long list of pledges of reform," said Mark Williams, chief Asia economist at Capital Economics. "Typically though, the post-plenum statement offers no suggestions about implementation, no sense of priorities or how tensions between reforms will be addressed."

The party-controlled parliament in March focussed on "new productive forces", a buzzword coined by Xi last year that envisions scientific research and industrial innovation leading to technological breakthroughs that propel China into a new era of high growth.

But this is complicated by U.S. and European trade partners, as well as some emerging economies, erecting barriers against Chinese exports of manufactured goods. Industrial policies also squeeze funding for such consumer-oriented measures as raising unemployment benefits or pensions for the ageing population.

"The unintended consequence is that deflationary pressure becomes protracted, unless strong measures to support demand are enacted, which seems unlikely," said Alicia Garcia-Herrero, chief Asia-Pacific economist at Natixis.

China's private sector feels pressured as the Communist Party tightens its grip over the economy, vowing to "unswervingly" support both state-owned and private companies.

"It’s very difficult to let market mechanisms play a decisive role because the government is too strong," said the first adviser.

"We want to open up the economy further and adopt international standards but at the same time we strengthen the party's leadership by integrating it in government and enterprises, which feels contradictory to the outside world."

(Reporting by Kevin Yao in Beijing; Editing by Marius Zaharia and William Mallard)

Yahoo Finance

Yahoo Finance