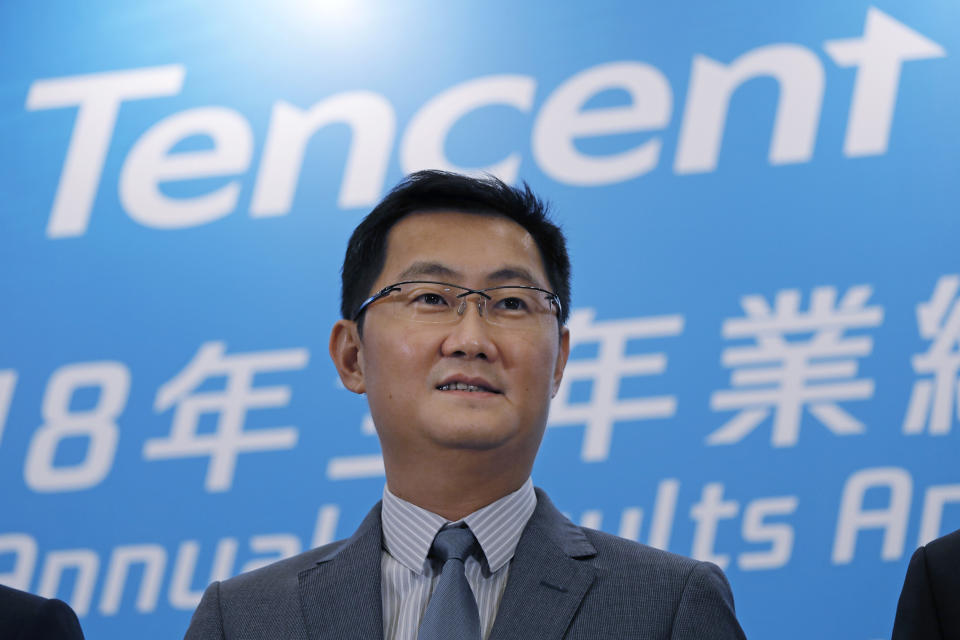

China's Tencent leads $35m investment in London fintech start-up

A London-based fintech startup has raised $35m (£27.5m) in a funding round led by Chinese technology giant Tencent.

The startup, TrueLayer, has created an open banking platform that allows software developers to create tools for sharing and aggregating payment and banking information.

Temasek, an investment firm owned by the government of Singapore, also led the round. The funding round brings its total funding to date to $47m.

Previous investors Northzone and Anthemis also participated in the round.

TrueLayer, which was founded in 2016, said it would use the money to expand its platform in Europe.

It has already launched in Germany, France, Italy, and Spain, and partnered with Monzo, the UK-based digital bank that is popular with millennials, and Zopa, a peer-to-peer lending company, among other firms.

By the end of 2019, TrueLayer said that it wants to have connected the majority of European banks so that it can expand to Asia and Australia.

In a statement, CEO and co-founder Francesco Simoneschi said that he wanted his company to be the “driving force” behind change in the financial industry, noting that four million UK consumers cannot access credit and 20 million are using the wrong financial product.

Open banking, he said, will help consumers “benefit from modern, fair and competitive access to financial products and services.”

Tencent has recently made significant headway in the fintech sector. Its fintech and business division, which saw a 44% spike in revenue in the first quarter of 2019, is now its second largest.

This was in large part thanks to growth in the payments wallet offered on its popular WeChat messaging service.

Yahoo Finance

Yahoo Finance