Choice Hotels (CHH) Beats on Q3 Earnings & Revenues, Ups View

Choice Hotels International, Inc. CHH reported better-than-expected third-quarter 2019 results. The top and the bottom line not only surpassed their respective Zacks Consensus Estimate but also increased on a year-over-year basis. The upside can be primarily attributed to solid progress on its flagship Comfort brand, renovated hotels that are capturing more business travel on strong developer demand and rapid growth in upscale Cambria brand across the country.

The lodging franchisor reported adjusted earnings of $1.37 per share, beating the consensus mark of $1.29 and increasing 10% year over year. Notably, this marked its seventh straight quarter of earnings beat.

In the quarter under review, total revenues came in at $310.7 million. The figure increased 7% from the year-ago quarter’s level and topped the consensus mark of $307 million.

Let’s discuss the quarterly numbers.

Franchising & Royalties

Domestic royalty fees totaled $107.8 million, up 3% year over year. However, domestic system-wide RevPAR dipped 0.7% year over year. Average daily rate (ADR) declined 0.4% and occupancy was down 20 basis points compared with the prior-year quarter’s level.

The company’s newly-executed domestic franchise agreements were 100 in the third quarter. As of Jun 30, 2019, the number of domestic franchised hotels and rooms rose 1.8% and 1.8% year over year, respectively.

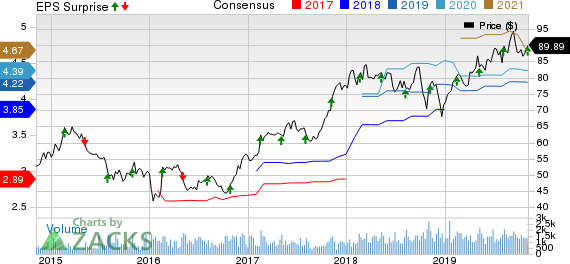

Choice Hotels International, Inc. Price, Consensus and EPS Surprise

Choice Hotels International, Inc. price-consensus-eps-surprise-chart | Choice Hotels International, Inc. Quote

Operating Results

Total operating expenses increased 15.5% from third-quarter 2018 to $208.3 million. Adjusted EBITDA also increased 7% from the prior-year quarter’s number to $111 million.

Balance Sheet

As of Sep 30, 2019, the company had cash and cash equivalents of $31.6 million compared with $26.6 million on Dec 31, 2018.

Long-term debt in the same period was $875.8 million, up from $753.5 million at 2018-end. Goodwill, as a percentage of total assets, was 11.6% at the end of the second quarter, down from 14.8% at 2018-end.

In the first nine months of 2019, Choice Hotels paid cash dividends of $36 million. Based on the current quarterly dividend rate of 21.5 cents per share, the company expects to payout dividends worth approximately $48 million in 2019. Meanwhile, management repurchased roughly $0.6 million shares for nearly $45 million under the share repurchase program during the said period. As of Sep 30, 2019, it authorized up to 4 million additional shares of common stock under the share repurchase program.

Fourth-Quarter Guidance

For the fourth quarter, adjusted earnings per share (EPS) are anticipated in the range of 82-86 cents. Notably, the guidance is below the Zacks Consensus Estimate of 90 cents. Domestic RevPAR is expected between 0% and 2%.

2019 Guidance

Choice Hotels now expects EPS between $4.21 and $4.27, up from prior expectation of $4.16-$4.22. The mid-point of the guidance is higher than the current Zacks Consensus Estimate of $4.23. Domestic RevPAR is expected to be in the range of flat to down 1%.

Choice Hotels currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Hilton Worldwide Holdings Inc HLT reported third-quarter 2019 results, with earnings and revenues surpassing the respective Zacks Consensus Estimate. Hilton’s adjusted earnings of $1.05 per share surpassed the consensus mark of $1.02 and improved 13% on a year-over-year basis. Revenues totaled $2,395 million, which surpassed the consensus mark of $2,377 million. Moreover, the reported figure improved 6.3% from the year-ago quarter’s level on higher comparable RevPAR.

Marriott Vacations Worldwide Corporation VAC reported mixed third-quarter 2019 results, with earnings missing the Zacks Consensus Estimate and revenues beating the same. Adjusted earnings of $1.97 per share missed the consensus mark of $2.04 by 3.4%. Nevertheless, the figure increased 38.7% year over year. Quarterly revenues amounted to $1,139 million, which beat the Zacks Consensus Estimate of $1,127 million by 1.1% and increased 51.9% from the year-ago quarter’s figure.

Hyatt Hotels Corporation H reported better-than-expected third-quarter 2019 results. The company’s bottom line surpassed the Zacks Consensus Estimate for the 15th straight quarter, while the top line outpaced the same for the third consecutive quarter. Adjusted earnings came in at 37 cents per share, which outpaced the Zacks Consensus Estimate of 26 cents. Total revenues amounted to $1,215 million, which beat the Zacks Consensus Estimate of $1,178 million and improved 13.1% from the prior-year quarter’s number.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriot Vacations Worldwide Corporation (VAC) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance