Chow Sang Sang Holdings International And 2 Other SEHK Dividend Stocks To Enhance Your Portfolio

In the wake of the U.S. Federal Reserve's recent interest rate cut, global markets have shown varied reactions, with Hong Kong's Hang Seng Index gaining 5.12% amid broader optimism. This positive momentum presents a timely opportunity to explore dividend stocks on the SEHK that can enhance your portfolio. A good dividend stock in today's market should offer not only reliable income but also resilience amid economic fluctuations, making Chow Sang Sang Holdings International and two other SEHK-listed companies worth considering for their potential to provide steady returns.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Consun Pharmaceutical Group (SEHK:1681) | 9.70% | ★★★★★☆ |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.42% | ★★★★★☆ |

Lenovo Group (SEHK:992) | 3.93% | ★★★★★☆ |

Chow Tai Fook Jewellery Group (SEHK:1929) | 8.70% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.51% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 5.54% | ★★★★★☆ |

Zhongsheng Group Holdings (SEHK:881) | 8.81% | ★★★★★☆ |

China Construction Bank (SEHK:939) | 7.68% | ★★★★★☆ |

Zhejiang Expressway (SEHK:576) | 7.45% | ★★★★★☆ |

Tian An China Investments (SEHK:28) | 4.99% | ★★★★★☆ |

Click here to see the full list of 80 stocks from our Top SEHK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Chow Sang Sang Holdings International

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chow Sang Sang Holdings International Limited is an investment holding company that manufactures and retails jewellery, with a market cap of HK$4.12 billion.

Operations: Chow Sang Sang Holdings International Limited generates revenue primarily from the retail of jewellery and watches (HK$22.65 billion) and wholesale of precious metals (HK$1.14 billion).

Dividend Yield: 9%

Chow Sang Sang Holdings International's recent share repurchase program, authorized to buy back up to HK$100 million worth of shares, aims to enhance net asset value and earnings per share. Despite a decrease in interim dividends to HK$0.15 per share and a drop in half-yearly earnings from HK$827.21 million to HK$525.99 million, the company maintains a low cash payout ratio of 21.6%, ensuring dividends are well covered by cash flows.

Datang Environment Industry Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Datang Environment Industry Group Co., Ltd. operates in the environmental protection industry, focusing on flue gas desulfurization, denitrification, and other environmental services, with a market cap of HK$2.23 billion.

Operations: Datang Environment Industry Group Co., Ltd. generates revenue primarily from Renewable Energy Engineering (CN¥243.94 million) and Environmental Protection and Energy Conservation Solutions (CN¥5.56 billion).

Dividend Yield: 8.8%

Datang Environment Industry Group's dividend payments have been volatile over the past seven years, though they are well covered by earnings (42.5% payout ratio) and cash flows (13.1% cash payout ratio). The company recently declared an interim dividend of RMB 0.03 per share for the first half of 2024, supported by a significant increase in net income to CNY 399.85 million from CNY 266.22 million a year ago, indicating potential for future stability in dividends despite past inconsistencies.

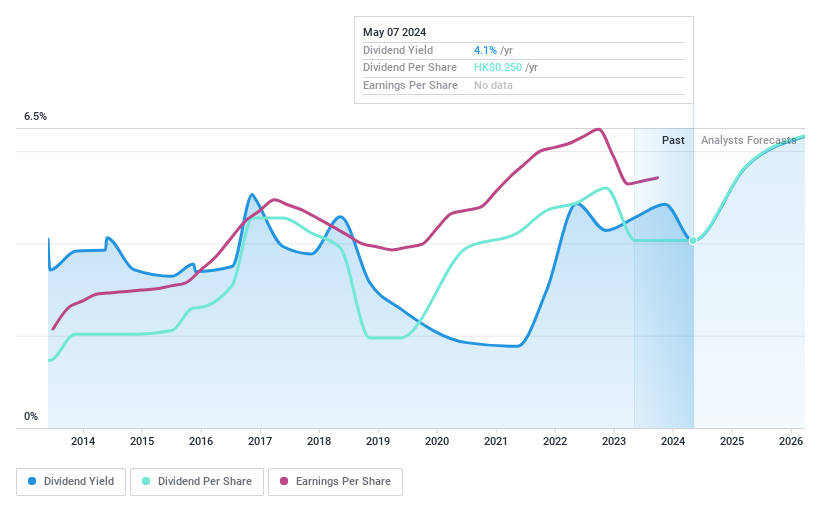

Man Wah Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Man Wah Holdings Limited is an investment holding company involved in the manufacture, wholesale, trading, and distribution of sofas and ancillary products across China, Europe, Vietnam, Mexico, and globally with a market cap of HK$18.11 billion.

Operations: Man Wah Holdings Limited generates revenue primarily from Sofa and Ancillary Products (HK$12.66 billion), Bedding and Ancillary Products (HK$2.99 billion), Home Group Business (HK$674.14 million), Other Products (HK$1.82 billion), and Other Businesses (HK$270.78 million).

Dividend Yield: 6.4%

Man Wah Holdings' recent approval of a final dividend of HK$0.15 per share for the year ended 31 March 2024, to be paid by 22 July 2024, highlights its commitment to returning value to shareholders. The company's dividends are covered by earnings (50.8% payout ratio) and cash flows (84.4% cash payout ratio). However, despite a decade-long increase in dividend payments, they have been volatile and remain lower than the top quartile of Hong Kong's dividend payers at 6.42%.

Navigate through the intricacies of Man Wah Holdings with our comprehensive dividend report here.

Our valuation report unveils the possibility Man Wah Holdings' shares may be trading at a discount.

Next Steps

Delve into our full catalog of 80 Top SEHK Dividend Stocks here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:116 SEHK:1272 and SEHK:1999.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com