Christmas card slump batters Card Factory

Poor sales in the run-up to Christmas sent shares in Card Factory (CARD.L) crashing on Thursday, with the UK retailer blaming weak consumer confidence and the general election.

Karen Hubbard, CEO of the high street card supplier, said Christmas had been “challenging,” with a long-running trend of falling high street footfall continuing.

Like-for-like sales dropped by 0.6% in the 11 months to 31 December, a steeper decline than the 0.1% slide reported a year earlier.

The company did not provide specific figures for the run-up to Christmas, a decision met with surprise from at least one analyst.

But Nick Bubb, a retail analyst and consultant, noted the 11-month decline marked a stark contrast to the 0.9% increase in sales reported in a nine-month update before the festive season. Christmas is one of the most crucial periods of the year for retailers.

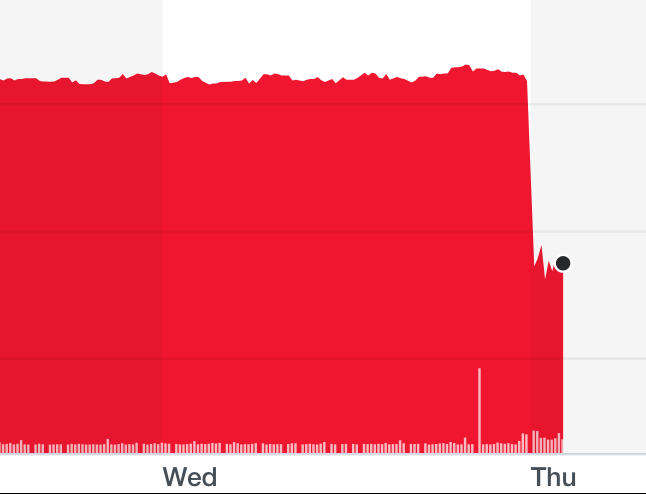

The company’s shares were trading 18.9% lower at around 8.50am in London.

READ MORE: John Lewis could pay no staff bonus for first time since 1950s

The retailer said it now expected its adjusted underlying earnings to come in between £81m ($106m) and £83m.

It said a “comprehensive review of strategy” was ongoing. But it highlighted a potential need for “additional strategic investment” in 2021 to support “a number of attractive medium-term growth opportunities” that could arise from the review.

It added that average spending per shopper had increased by the firm making “more sophisticated use of data.”

Online sales growth grew by 14.8%, but it marked a significantly slower expansion than the previous year’s growth of 59.1%.

Hubbard said: “The Christmas trading period continued to be challenging given the general election and weak consumer confidence, the impact of which can be seen in the footfall decline experienced in the period.

“Our investment in our customer experience, operational efficiency and data to improve our ranges has helped us to mitigate some of the effects of the tougher retail environment and higher costs experienced in the year.

“We plan to invest further in the business, enhancing our ability to operate more efficiently, service new sales channels and increase our competitive advantage, enabling a return to profit growth after the next financial year."

Russ Mould, investment director at AJ Bell, said the announcement there would be no special divided in 2020 was what had "torn a huge hole" in the share price above all else.

Mould said a weak pound and rising staff wages had hit the company as well as lower footfall, and warned a weak economy could further erode profits.

"Sceptics will argue that the simple art of remembering someone’s special day with a posted card or even a gift-wrapped present could be forgotten in the event of an economic downturn, or as a result of the rise of digital communication.

"The prospect of a third straight drop in annual profits will surely start to beg the question of whether even the ordinary dividend is sustainable over the long term."

READ MORE: ‘Awful’ productivity of UK threatens future pay rises

Yahoo Finance

Yahoo Finance