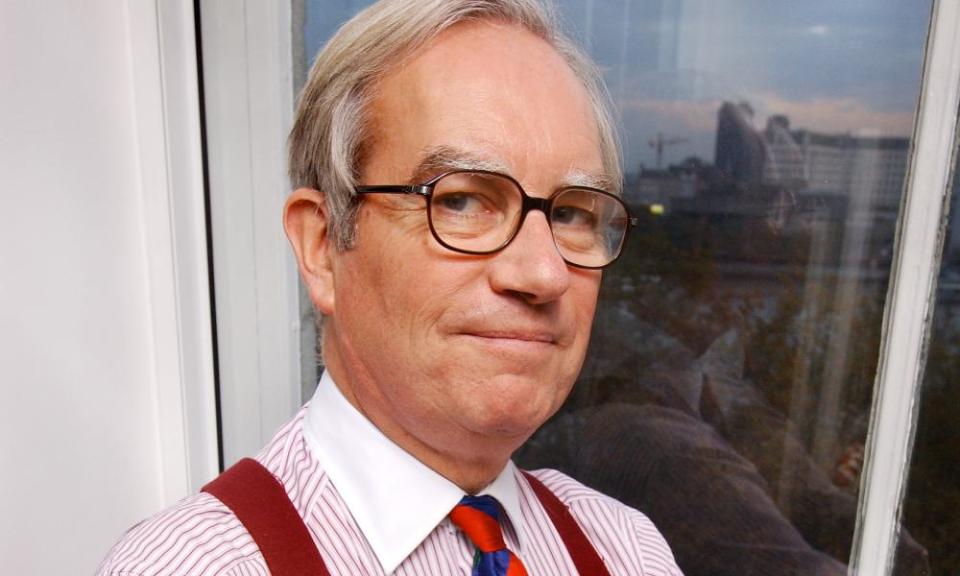

Christopher Gent fined £80,000 by FCA for disclosing inside information

Sir Christopher Gent, the former chief executive of Vodafone and ex-chair of GlaxoSmithKline, has been fined £80,000 by the UK financial watchdog for disclosing inside information to shareholders while chair of the medical-devices maker ConvaTec.

The Financial Conduct Authority (FCA) has fined Gent, one of the most prominent figures in British business, after ruling that he shared information relating to a revision of the financial performance of ConvaTec and plans for the retirement of its chief executive to senior individuals at two of the London-listed company’s biggest shareholders.

“Private disclosure of inside information, especially by the chair of a listed issuer, risks investor confidence and the integrity of financial markets,” said Mark Steward, the executive director of enforcement and market oversight at the FCA. “Sir Christopher failed to properly apply his mind to the question of what information he could properly disclose.”

In its 53-page ruling, the FCA said that Gent breached his fiduciary duties and committed “market abuse” by sharing the information about ConvaTec – which listed on the FTSE 250 in 2016 – before it was revealed in a public stock exchange announcement in October 2018.

At the time Gent shared the information, the company’s brokers had said more information was needed in relation to the revision to financial performance guidance and no announcement should be made until it had “sufficiently precise information”.

Gent, who left the company in a restructure in 2019, also told one of ConvaTec’s brokers and a board level executive at the company that “he was intending to call, and/or had called, the major shareholders”.

ConvaTec had a relationship agreement with one of the major shareholders that imposed on them confidentiality and no-dealing obligations. This agreement extended to Gent and senior individuals to whom he shared the insider information.

“Inside information is not a private commodity for those with privileged access to it,” Steward said. “The law requires inside information to be disclosed properly and not to major shareholders or others in advance of announcements, as in this case. We will continue to rigorously enforce against breaches when we see them to ensure this important principle remains uppermost in the minds of issuers and their senior officers.”

In a statement, Gent said that he was “encouraged” to share the information in the belief he was acting in the best interests of the company, but that he would not be referring the FCA’s decision to a tribunal.

“I am very disappointed that the FCA has found against me in circumstances where I believed I had sought advice and received encouragement to act as I did,” he said. “The decision acknowledges the steps I took to obtain advice at the time and has not questioned my belief that I was acting in the best interests of the company.”

Gent said that he has never in his professional business life been subject to an FCA investigation and he had found the process “long and difficult”.

“The FCA also confirm that there was no impact on the markets and that I made no gain personally, nor intended to do so,” he said. “The events in question took place over three and a half years ago. I have since retired from business life and wish now to draw a line under the matter.”

Yahoo Finance

Yahoo Finance