The Cibox Inter@ctive (EPA:CIB) Share Price Is Down 24% So Some Shareholders Are Getting Worried

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Cibox Inter@ctive (EPA:CIB) have tasted that bitter downside in the last year, as the share price dropped 24%. That's disappointing when you consider the market returned -19%. Looking at the longer term, the stock is down 20% over three years. It's down 41% in about a quarter. However, one could argue that the price has been influenced by the general market, which is down 31% in the same timeframe.

See our latest analysis for Cibox Inter@ctive

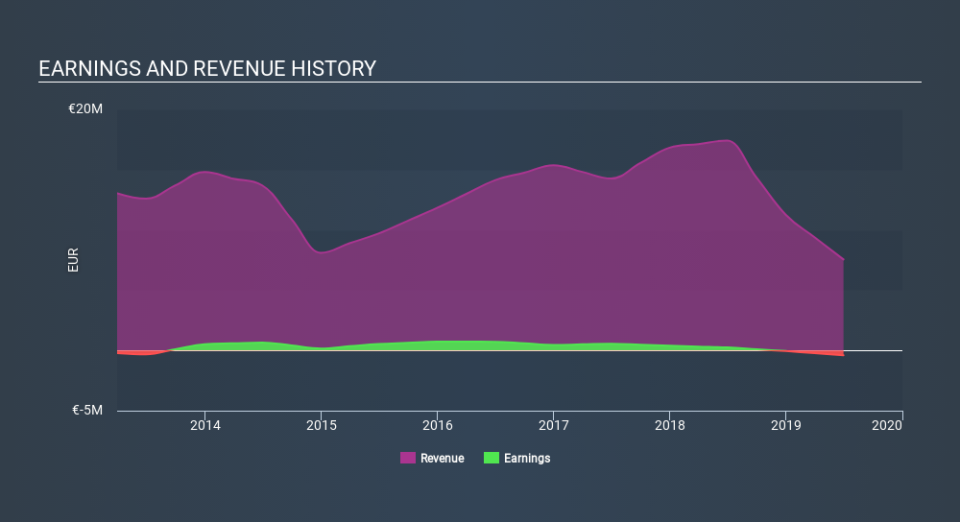

Given that Cibox Inter@ctive didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year Cibox Inter@ctive saw its revenue fall by 57%. If you think that's a particularly bad result, you're statistically on the money No surprise, then, that the share price fell 24% over the year. It's always work digging deeper, but we'd probably need to see a strong balance sheet and bottom line improvements to get interested in this one.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Cibox Inter@ctive's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Cibox Inter@ctive shareholders are down 24% for the year. Unfortunately, that's worse than the broader market decline of 19%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 2.7% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Cibox Inter@ctive (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance