Ciena's (CIEN) Q1 Earnings and Revenues Surpass Estimates

Ciena Corporation CIEN reported first-quarter fiscal 2018 non-GAAP earnings of 15 cents, beating the Zacks Consensus Estimate of 12 cents but declining 42.3% year over year.

Revenues of $646.1 million increased 3.96% year over year and beat the consensus mark of $643.2 million.

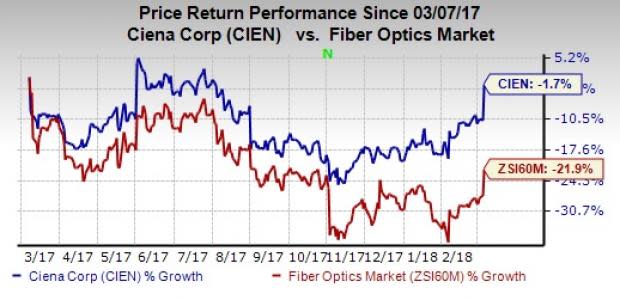

Although shares of Ciena have lost 1.7% in the past year, it outperformed the industry's 21.9% decline.

Segmental Details

Product revenues (81.3% of revenues) were up 3.7% year over year to $525.6 million. Services revenues (18.7% of revenues) increased 5.2% year over year to $120.5 million.

Segment-wise, networking platforms (76.8% of total revenue) grew 1.2% year over year to $496 million. The company’s stackable data center interconnect platform, WaveServer, generated nearly $65 million in revenues and currently has more than 80 global customers.

In the quarter, the company witnessed seven new wins for its 400 gig per wavelength chip, Wavelogic AI, taking the total count to 17. The solution is gaining adoption mainly among the global Tier 1 service providers.

Ciena’s submarine business grew 10% year over year on strong webscale traffic growth. The company signed two new deals for trans-pacific cable system and trans-Atlantic system in January.

The company’s non-telco business accounted for 35% of total sales this quarter, driven mostly by GCN.

Fiber Deep technology represents a big opportunity for the company driven by strong adoption of its products among all major cable operators in the global market. The company expects 5G network solutions to be a key driver in the long term.

Revenues from Software and software-related services (8.3% of total revenue) rose 36.1% year over year to $53.5 million, buoyed by rapid uptake of the Blue Planet analytics and orchestration platforms.

Global services revenues (15% of total revenues) increased a whopping 544% from the year-ago quarter to $96.6 million.

Region-wise, revenues declined 0.7% in North America and 1.7% in CALA but rose 6.9% in Europe, the Middle East and Africa (EMEA) and 24.6% in Asia Pacific. Growth in Asia is fueled by continued strength in India and key wins in Japan and Korea. The company is also optimistic about the prospects in India. Australia-based Telstra also holds considerable promise.

U.S. customers accounted for 59.3% of its revenues, of which 25% was contributed by two major customers — AT&T and Verizon. The company, however, expects shares of international customers to go up. Currently, two of them hold about 8-9%.

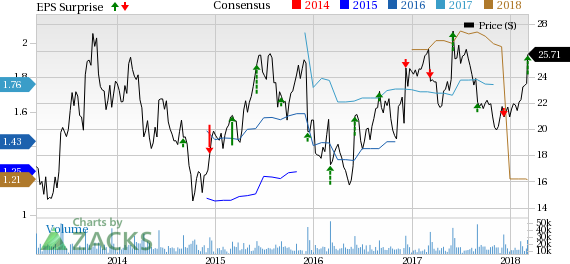

Ciena Corporation Price, Consensus and EPS Surprise

Ciena Corporation Price, Consensus and EPS Surprise | Ciena Corporation Quote

Margins

The company’s non-GAAP gross margin contracted 230 basis points (bps) year over year to 42.6%.

Ciena incurred non-GAAP operating expenses of $234.4 million, up 3.6% from the year-ago quarter. However, as a percentage of revenues, it decreased 10 bps from the year-ago quarter to 36.3%.

Non-GAAP operating margin declined 220 bps to 6.3%.

Balance Sheet

The company ended the quarter with cash, cash equivalents and short-term investments of $927.6 million, compared with $919.6 million at the end of the previous quarter.

Ciena generated operating cash flow of $35.7 million in the quarter compared with approximately $138.5 million last quarter.

Ciena repurchased 874K shares through Mar 5, 2018, for a total amount of $20 million.

Guidance

Ciena also issued guidance for second-quarter fiscal 2018. Revenues for the quarter are forecast in the range of $710-$740 million. Non-GAAP gross margin is anticipated in the low to mid-40% range. Non-GAAP operating expenses are projected at $240 million.

Zacks Rank and Stocks to Consider

Ciena carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the broader technology sector are NVIDIA Corporation NVDA, Lam Research Corporation LRCX and Paycom Software PAYC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for NVIDIA, Lam Research and Paycom is projected at 10.3%, 14.9% and 25.8%, respectively.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley, Goldman Sachs and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

Ciena Corporation (CIEN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance