Will Cigarette Woes Hurt Philip Morris (PM) in Q3 Earnings?

Philip Morris International Inc. PM is slated to release third-quarter 2019 results on Oct 17. The company’s earnings have surpassed the Zacks Consensus Estimate in the trailing four quarters, the average being 10%. Let’s take a look at the factors that are likely to impact this tobacco giant’s upcoming quarterly results.

Estimates Picture

The Zacks Consensus Estimate for revenues is currently pegged at $7,610 million, which indicates a rise of almost 1.4% from the year-ago quarter’s tally.

Further, the Zacks Consensus Estimate for third-quarter 2019 earnings has declined by 2 cents in the past 30 days and is currently pegged at $1.35 per share. The figure indicates a decline of 6.3% from $1.44 in the year-ago quarter.

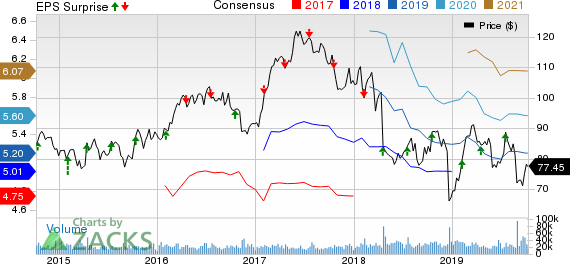

Philip Morris International Inc. Price, Consensus and EPS Surprise

Philip Morris International Inc. price-consensus-eps-surprise-chart | Philip Morris International Inc. Quote

Weak Cigarette Category & Adverse Currency Rates

Regulatory hurdles, anti-tobacco campaigns and consumers’ rising health consciousness are exerting pressure on cigarette sales. Markedly, Philip Morris’ cigarette shipment volumes have been sluggish, as witnessed in the second quarter of 2019. Going ahead, management anticipates total shipment volumes, including cigarettes, to dip nearly 1% in 2019. This mars hopes for the upcoming results announcement.

Moreover, adverse impacts from currency fluctuations have been a drag. Management expects currency to make an unfavorable impact of close to 14 cents on earnings in 2019. Persistence of such a hurdle during the third quarter is likely to dent quarterly results.

Pricing & RRPs Likely to Aid

Philip Morris is witnessing rapid growth in reduced risk products (RRPs) such as e-cigarettes. Continued research in this arena is aiding the company to introduce unique offerings that are helping adult smokers to switch from traditional cigarettes to smoke-free options. This in turn is driving revenues.

Speaking of RRPs, the company’s IQOS is performing exceptionally well in various markets, especially in Japan. We expect Philip Morris’ performance in the third quarter to gain from consistent growth in RRPs space. Other tobacco companies like Altria MO, British American Tobacco BTI and Vector Group VGR are also striving to expand in low-risk tobacco products arena.

Pricing is also a vital factor that is supporting Philip Morris’ business. In fact, higher pricing at the combustible tobacco portfolio has been aiding the company’s performance for a while. Strategic pricing is likely to support the company’s performance in the to-be-reported quarter.

Zacks Model

Our proven model shows that Philip Morris is not likely to beat earnings estimates in the upcoming quarterly results. A stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can see the complete list of today’s Zacks #1 Rank stocks here.

Although Philip Morris carries a Zacks Rank #3, its Earnings ESP of -1.58% makes us less confident about an earnings beat. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

British American Tobacco p.l.c. (BTI) : Free Stock Analysis Report

Vector Group Ltd. (VGR) : Free Stock Analysis Report

Altria Group, Inc. (MO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance