Cimpress (CMPR) Q4 Earnings and Revenues Beat Estimates

Cimpress plc CMPR reported better-than-expected fourth-quarter fiscal 2022 results, wherein earnings surpassed the Zacks Consensus Estimate by 5.7% and sales beat the same by 5.6%.

CMPR reported an adjusted loss of $1.17 per share, narrower than the Zacks Consensus Estimate of a loss of $1.24. Cimpress had incurred a loss of 45 cents per share in the year-ago quarter.

For fiscal 2022, CMPR’s adjusted loss was $2.08 per share.

Top-Line Details

Total revenues in the fiscal fourth quarter were $723 million, reflecting an increase of 13.8% from $635.2 million in the year-ago quarter. The top line surpassed the consensus estimate of $684 million.

In fiscal 2022, Cimpress’ revenues totaled $2,887.6 million.

Segmental Information

The National Pen segment generated revenues of $75.6 million, up from $69 million in the prior-year quarter. Vistaprint — the largest revenue-generating segment — reported aggregate revenues of $368 million, up from $346 million in the year-ago quarter.

The Upload and Print segment’s revenues increased to $236.3 million from $178.8 million in the year-ago quarter. The segment consists of two subgroups, namely PrintBrothers and The Print Group. PrintBrothers’ revenues increased to $143.9 million from $105.9 million. The Print Group generated revenues of $91.3 million, up from $72.9 million. Revenues from All Other Businesses increased to $52.8 million from $49.1 million.

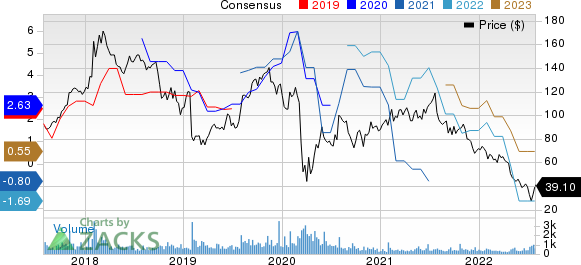

Cimpress plc Price and Consensus

Cimpress plc price-consensus-chart | Cimpress plc Quote

Margin Details

In the quarter, Cimpress' cost of revenues was $382.3 million, up 18.1% on a year-over-year basis. The metric represented 52.9% of total revenues. Total selling, general & administrative expenses were $262.5 million, up 18.3%. The same represented 36.3% of total revenues in the quarter.

Gross profit increased 9.3% year over year to $340 million with a margin of 47.1%, down 190 basis points. Net interest expenses fell 18.9% to $24.1 million.

Balance Sheet and Cash Flow

As of Jun 30, 2022, Cimpress had $277.1 million of cash and cash equivalents compared with $161.5 million at the end of the previous quarter. Also, CMPR’s total debt (net of issuance costs) was $$1,685.9 million, down from $1,710.4 million, sequentially. In the fiscal fourth quarter, Cimpress refrained from buying back shares.

In fiscal 2022, net cash provided by operating activities was $219.5 million compared with $265.2 million a year ago.

Zacks Rank & Stocks to Consider

Cimpress currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks from the Zacks Consumer Discretionary sector are discussed below.

Bassett Furniture Industries, Incorporated BSET presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. Its earnings surprise in the last four quarters was 12.25%, on average.

In the past 60 days, BSET’s earnings estimates have increased 2.4% for fiscal 2022 (ending October 2022). Bassett’s shares have rallied 21.9% in the past six months.

Acushnet Holdings Corp. GOLF presently flaunts a Zacks Rank of 1. Its earnings surprise in the last four quarters was 88.8%, on average.

GOLF’s earnings estimates have increased 0.7% for 2022 in the past 60 days. Shares of Acushnet have inched up 3% in the past six months.

iQIYI, Inc. IQ is presently Zacks #1 Ranked. Its earnings surprise in the last four quarters was 22.6%, on average.

IQ's earnings estimates have increased 17.6% in the past 60 days for 2022. The stock has lost 2.4% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Acushnet (GOLF) : Free Stock Analysis Report

Cimpress plc (CMPR) : Free Stock Analysis Report

Bassett Furniture Industries, Incorporated (BSET) : Free Stock Analysis Report

iQIYI, Inc. Sponsored ADR (IQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance