Cisco Systems, Inc. (CSCO) Stock Dips on Toothless Q4 Earnings

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Cisco Systems, Inc. (NASDAQ:CSCO) has mostly missed out on the tech rally this year. CSCO stock has headed only about 7% higher to underperform not just the broader market, but also tech peers such as Oracle Corporation (NYSE:ORCL) and Microsoft Corporation (NASDAQ:MSFT).

Source: Shutterstock

Fiscal fourth-quarter earnings aren’t going to help that any.

Cisco reported its quarterly results after Wednesday’s bell, and a weak performance has Wall Street selling off Cisco stock to the tune of about 2%.

Fiscal Q4 earnings came to 61 cents per share, down 3% year-over-year and merely in line with expectations. CSCO did report a revenue beat — the $12.1 billion top line crawled over analysts’ estimates for $12.06 billion — but that still came to a 4% year-over-year decline.

That marks seven consecutive quarters of top-line decay.

Guidance was nothing for CSCO stock bulls to get behind, either. Cisco is projecting fiscal 2018 Q1 earnings between 59 and 61 cents per share on a drop in revenues between 1% and 3%. Analysts were forecasting profits of 60 cents and a 2.4% decline in sales.

A few other highlights from the report:

For the year, cash flow from operating activities came to $13.9 billion, up 2%. In all, Cisco now sports $70.5 billion in the bank.

During the prior quarter, the company repurchased 38 million shares of CSCO stock at an average of $31.61. The remaining amount on the buyback authorization is $11.7 billion.

Cisco completed the acquisition of MindMeld (a developer of advanced analytics) and announced the purchases of Viptela (a provider of defined wide area networking products) and Observable Networks (a developer of cloud security systems).

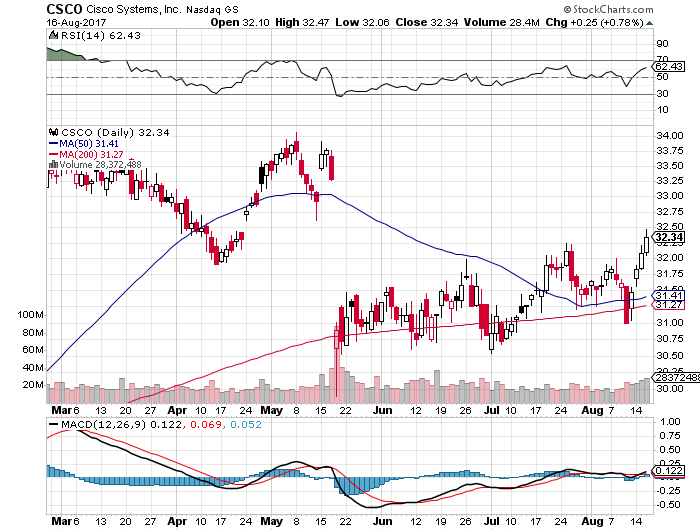

Technically speaking, nothing is setting off alarm bells in Wednesday’s immediate after-hours action. While CSCO is pulling back from a bounce off its major moving averages, the slight decline hasn’t brought shares back to either of those averages.

Investors will want to keep an eye out on both the 50- and 200-day moving averages tomorrow, however. The stock has tested the longer-term MA (currently at $31.27) as support three times since breaking above in May, and a sustained drop below could lead to a further collapse.

Not Much for the Longs

On a fundamental basis, CSCO stock still boasts a few pluses. Cisco trades at a reasonable 13 times forward earnings estimates, and the dividend yield is now an attractive 3.7%.

But is that enough reason to jump into a low-growth tech stock?

In technology, equities can stall for years in the face of stagnant revenues, and that’s the environment Cisco currently is mired in. Despite all the company’s efforts to restructure operations, cut the workforce and unload non-core businesses, Cisco isn’t anywhere closer to a turnaround.

Cisco’s competition hasn’t become any less tenacious or numerous, either. The main networking business still faces rivals including Juniper Networks, Inc. (NYSE:JNPR), Hewlett Packard Enterprise Co (NYSE:HPE) and Arista Networks Inc (NYSE:ANET), not to mention low-cost Chinese firms including Huawei.

Worse, some of Cisco’s large customers — like Alphabet Inc (NASDAQ:GOOGL) and Facebook Inc (NASDAQ:FB) — are building their own networking technologies!

And the security business, while potentially a nice catalyst for Cisco at some point, isn’t bearing the juicy fruits Wall Street has expected. The latest quarter saw security revenues crawl just 3% higher, to $558 million … well short of Wall Street’s consensus estimate of $580.5 million.

This quarter was shy of reasons to get excited about CSCO stock. It’s time for management to go back to the drawing board.

Tom Taulli runs the InvestorPlace blog IPO Playbook and operates PathwayTax.com, which provides year-round tax services. Follow him on Twitter at @ttaulli. As of this writing, he did not hold a position in any of the aforementioned securities.

More From InvestorPlace

Forget Advanced Micro Devices, Inc. (AMD), Buy This ETF Instead

Why Amazon.com, Inc. (AMZN) Stock Will Head Back to $1,000 ... And Beyond

The post Cisco Systems, Inc. (CSCO) Stock Dips on Toothless Q4 Earnings appeared first on InvestorPlace.

Yahoo Finance

Yahoo Finance