Cisco's (CSCO) Q3 Earnings Top Estimates, Revenues Up Y/Y

Cisco Systems CSCO reported third-quarter fiscal 2022 non-GAAP earnings of 87 cents per share, which beat the Zacks Consensus Estimate by 1.16%. The bottom line increased 4.8% year over year.

Revenues inched up 0.2% year over year to $12.84 billion. Revenues lagged the consensus mark by 3.70%.

Quarter in Detail

Region-wise, the Americas revenues increased 3% year over year to $7.64 billion. Revenues from both EMEA and APJC increased 6% each year over year to $3.271 billion and $1.926 billion, respectively.

Service revenues (26.4% of total revenues) decreased 7.6% year over year to $3.39 billion, driven by growth in software and solution-support services.

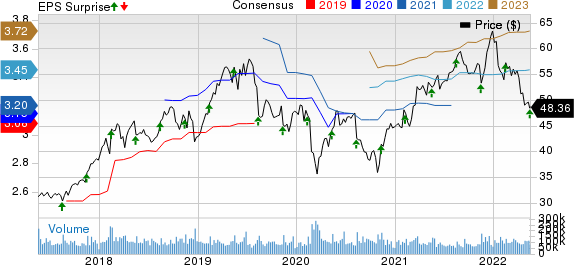

Cisco Systems, Inc. Price, Consensus and EPS Surprise

Cisco Systems, Inc. price-consensus-eps-surprise-chart | Cisco Systems, Inc. Quote

Annualized recurring revenues (“ARR”) came in at $22.4 billion, up 11% year over year. Product ARR growth was 20% in the quarter under review.

Product revenues (73.6% of total revenues) increased 3.4% on a year-over-year basis to $9.45 billion.

Total product orders rose 8% on a year-over-year basis.

Break Down of Product Revenues

Secure, Agile Networks (62.1% of total Product revenues) revenues increased 7% year over year to $5.869 billion.

Collaboration (12% of Product revenues) revenues declined 7% on a year-over-year basis to $1.132 billion.

End-to-End Security (9.9% of Product revenues) revenues were up 7% to $938 million.

Internet for the Future (14% of Product revenues) revenues climbed 6% to $1.324 billion.

Optimized Application Experiences (1.9% of Product revenues) revenues were up 8% to 183 million.

Revenues from Other Products decreased 58% to $2 million.

Operating Details

Non-GAAP gross margin contracted 60 basis points (bps) from the year-ago quarter’s level to 65.3%.

On a non-GAAP basis, product gross margin contracted 80 bps to 64.1%. Service gross margin expanded 20 bps to 68.9%.

Non-GAAP operating expenses were $3.93 billion, down 5.2% year over year. As a percentage of revenues, operating expenses contracted 170 bps to 30.7%.

Non-GAAP operating margin expanded 110 bps year over year to 34.7%.

Balance Sheet and Cash Flow

As of Apr 30, 2022, Cisco’s cash & cash equivalents and investments balance were $20.1 billion compared with $21.1 billion as of Jan 29, 2022.

Total debt (short-term plus long-term) as of Apr 30, 2022, was $9.42 billion compared with $11.47 billion as of Jan 29, 2022.

Cash flow from operating activities was $3.7 billion compared with $2.5 billion reported in the prior quarter.

Cisco declared a quarterly dividend of 38 cents per share, up 3%, to be paid on Apr 27, 2022 to all stockholders of record as of the close of business on Apr 6, 2022.

In the quarter under review, Cisco returned $1.8 billion to shareholders, including dividend payments of $1.6 billion and share repurchases worth $252 million.

Remaining performance obligations (“RPO”) at the end of the fiscal third quarter were $30.2 billion, up 7%, with 54% of this amount to be recognized as revenues over the next 12 months. Product RPO was up 13% and service RPO was up 3%.

Guidance

For fourth-quarter fiscal 2022, revenues are expected to decline between 1% and 5.5% on a year-over-year basis.

Non-GAAP gross margin is anticipated between 64% and 65% for the quarter.

Non-GAAP operating margin is anticipated between 31.5% and 33.5% for the quarter. Non-GAAP earnings are anticipated between 76 cents and 84 cents per share.

For fiscal 2022, revenues are expected to rise by 2-3% on a year-over-year basis. Non-GAAP earnings are anticipated between $3.29 and $3.37 per share.

Zacks Rank & Upcoming Earnings to Watch

Cisco currently carries a Zacks Rank #2 (Buy).

CSCO’s shares are down 23.7% compared with the Zacks Computer and Technology sector’s decline of 24.8% year to date.

Smilarly ranked stocks in the broader Zacks Computer and Technology sector that are scheduled to report their earnings soon are Pure Storage PSTG, The Descartes Systems DSGX and Coupa Software COUP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Pure Storage shares have outperformed the sector year to date, declining 21.5%.

PSTG is set to report first-quarter fiscal 2023 results on Jun 1.

Descartes’ shares have underperformed the sector year to date, declining 28.1%.

DSGX is set to report first-quarter fiscal 2023 results on Jun 1.

Coupa Software’ shares have underperformed sector year to date, declining 58.8%.

COUP is set to report first-quarter fiscal 2023 results on Jun 6.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

The Descartes Systems Group Inc. (DSGX) : Free Stock Analysis Report

Coupa Software, Inc. (COUP) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance