Citrix (CTXS) Earnings and Revenues Miss Estimates in Q2

Citrix Systems Inc. CTXS reported second-quarter 2019 non-GAAP earnings of $1.21 per share, missing the Zacks Consensus Estimate of $1.33 per share. Moreover, the figure decreased by 7 cents from the year ago-quarter.

Revenues of $749 million lagged the Zacks Consensus Estimate of $772 million. However, the figure improved 1% from the year-ago quarter.

Product and license (19% of total revenues) decreased 27% year over year to almost $141 million. Support and services (60%) revenues rose 3% on a year-over-year basis to nearly $452 million.

Subscription (21%) revenues surged 41% from the year-ago figure to $156 million.

During the quarter under review, SaaS revenue came in at $91 million (41% of total subscription business) and was up 59% year over year. Notably, SaaS revenues are the most significant part of subscription transition.

Other subscription revenues during the reported quarter came in at $65 million, up 41% year over year.

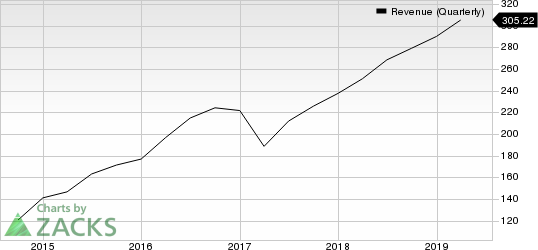

Mellanox Technologies, Ltd. Revenue (Quarterly)

Mellanox Technologies, Ltd. revenue-quarterly | Mellanox Technologies, Ltd. Quote

Revenues as per Product Group

Workspace revenues increased 7% year over year to $535 million (71% of total revenues) on the back of rapid adoption of unified workspace solutions. Workspace subscription revenues increased 40% year over year during the second quarter. Management stated that approximately 71% of new product bookings were subscription based.

Networking revenues declined 14% from the year-ago to $178 million (24% of total revenues). Notably, decline in the SSP business affected networking revenues during the reported quarter. Management stated that approximately 35% of new product bookings were subscription based. Networking subscription revenue increased 46% year over year. The company anticipates shift toward software-based solutions from traditional hardware.

Professional Services revenues advanced 5% on a year-over-year basis to $35 million (5% of total revenues).

Revenues as per Customer

Revenues from SSP customers came in at $24 million (3% of total revenues) during the reported quarter, down 39% year over year. Other customers revenues increased 3% year over year and came in at $725 million during the quarter.

Geographic Revenues

Revenues in Americas were flat year over year to $432 million. Europe, Middle East and Africa (EMEA) revenues advanced 3% from the year-ago quarter to $$240 million. Asia-Pacific and Japan (APJ) revenues decreased 3% year over year to $76 million.

Margin Details

Non-GAAP operating margin was reported at 27% during the reported quarter. Operating margin in during the quarter was primarily impacted by the shift toward subscription model.

Balance Sheet & Cash Flow

Cash and cash equivalents at the end of the quarter were $504.7 million compared with $1.612 billion in the previous quarter. Long-term debt at the end of the quarter came in at $742.5 million. Cash flow from operations was reported at $162 million.

Deferred and unbilled revenues of $2.23 billion grew approximately 15% year over year.

Citrix repurchased shares 1.7 million during the second quarter. Moreover, roughly $518 million is still remaining under share repurchase authorization.

The company paid out quarterly dividend of 35 cents worth $46 million during the quarter under review.

Guidance

For third-quarter 2019, Citrix anticipates revenues between $700 million and $720 million. The Zacks Consensus Estimate for revenues is pegged at $762.3 million.

Moreover, non-GAAP earnings are expected in the range of $1.15-$1.30 per share. The Zacks Consensus Estimate for earnings is pegged at $1.54 per share.

Citrix lowered guidance for 2019. The company now expects revenues between $2.97 billion and $3.01 billion, down from the previous guidance in the range of $3.08 billion and $3.09 billion. The Zacks Consensus Estimate for revenues for 2019 is pegged at $3.09 billion.

Non-GAAP operating margin is now anticipated to be in the range of 29% to 30%, down from the previously guided range of 31.5% to 32%.

Moreover, non-GAAP earnings are now expected to be in the range of $5.35-$5.60 per share, down from the previous guidance of approximately $6.00 per share. The Zacks Consensus Estimate for earnings for 2019 is pegged at $6.02 per share.

Zacks Rank and Key Picks

Citrix carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Mitek Systems, Inc. MITK, Alteryx, Inc. AYX and Lattice Semiconductor Corporation LSCC, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Mitek Systems, Alteryx and Lattice Semiconductor have a long-term earnings growth rate of 15%, 13.7% and 12.5%, respectively.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citrix Systems, Inc. (CTXS) : Free Stock Analysis Report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

Mitek Systems, Inc. (MITK) : Free Stock Analysis Report

Alteryx, Inc. (AYX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance