Citrix Systems (NASDAQ:CTXS) Has A Pretty Healthy Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Citrix Systems, Inc. (NASDAQ:CTXS) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Citrix Systems

How Much Debt Does Citrix Systems Carry?

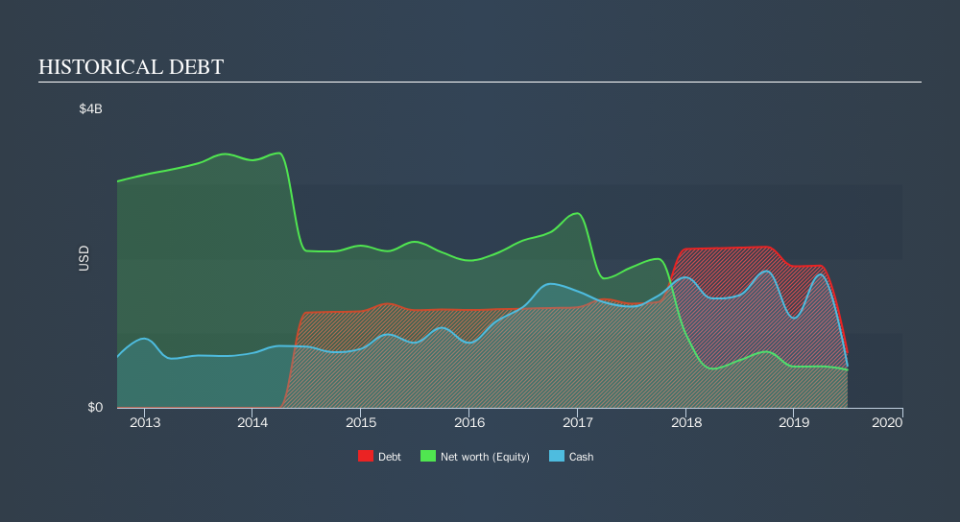

As you can see below, Citrix Systems had US$742.5m of debt at June 2019, down from US$2.15b a year prior. However, because it has a cash reserve of US$563.1m, its net debt is less, at about US$179.3m.

A Look At Citrix Systems's Liabilities

Zooming in on the latest balance sheet data, we can see that Citrix Systems had liabilities of US$1.68b due within 12 months and liabilities of US$1.75b due beyond that. Offsetting this, it had US$563.1m in cash and US$530.1m in receivables that were due within 12 months. So it has liabilities totalling US$2.33b more than its cash and near-term receivables, combined.

Of course, Citrix Systems has a titanic market capitalization of US$12.6b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Carrying virtually no net debt, Citrix Systems has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Citrix Systems's net debt is only 0.23 times its EBITDA. And its EBIT covers its interest expense a whopping 19.2 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. But the bad news is that Citrix Systems has seen its EBIT plunge 16% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Citrix Systems's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, Citrix Systems actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, Citrix Systems's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its EBIT growth rate. Looking at all the aforementioned factors together, it strikes us that Citrix Systems can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Citrix Systems insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance