City centre grocery stores struggle as remote working boosts suburban shops

Many city centre grocery stores in the UK have seen “massive declines” in sales as office staff they rely on have moved to remote working, according to new figures.

Supermarkets have seen grocery demand boom during the pandemic, but new analysis suggests the gains have not been evenly shared between stores.

Sales overall have surged around 8% year-on-year, according to data firm Nielsen, with an estimated £9bn ($12bn) additional sales because of lockdown restrictions. Supermarkets have hired tens of thousands of extra staff to meet demand.

But it found 41% of all UK grocery stores had seen sales decline. “This is being driven by the ongoing travel and COVID-related restrictions, with the majority of losses seen in high density city centre districts filled with offices, commuter hubs and tourist attractions, and stores in these locations have seen massive declines,” according to analysis published on Tuesday.

READ MORE: Record decline in UK consumer borrowing but mortgage approvals hit new high

More suburban areas have by contrast seen “unprecedented growth” since the virus hit, with more workers shopping locally as many more are working from home. Almost one in 10 stores has seen their sales more than double, according to the research.

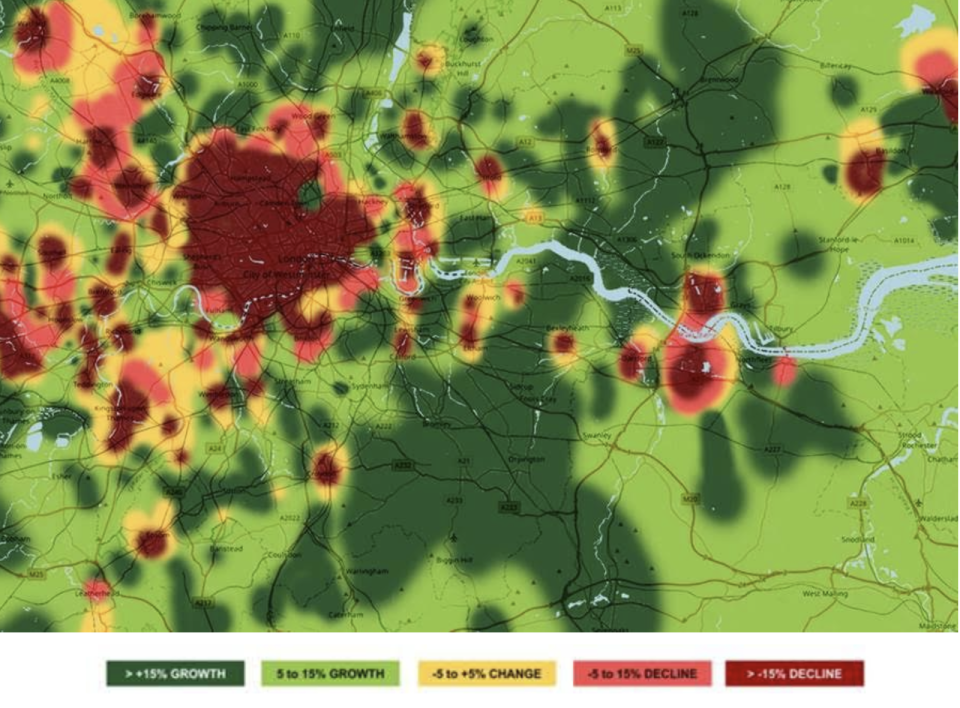

The findings are vividly illustrated in a graphic heatmap of grocery store sales in London and surrounding areas to the east, showing struggling central areas in red and booming suburban areas in green.

“COVID-19 has forced us all to shop differently but this investigation demonstrates just how deep the changes in our habits are – and the need for retailers and manufacturers to respond quickly to the massive changes we’re now seeing in store dynamics,” said Scott McKenzie, global intelligence leader at Nielsen.

“Companies around the world are already signaling they will no longer operate the way they did in the past. People will commute less, work from home more and move further away from urban settings.

“The consequences of this for the locations of stores, the formats of stores, and the assortment in those stores are far reaching. If you add in the dynamic of a massive rise in ecommerce for the fast-moving consumer goods space, the need to respond to these new shifts is critical.”

WATCH: Study finds coronavirus infections dropped by a third in England’s lockdown

Yahoo Finance

Yahoo Finance