Why the City expects Bank of England to raise interest rates

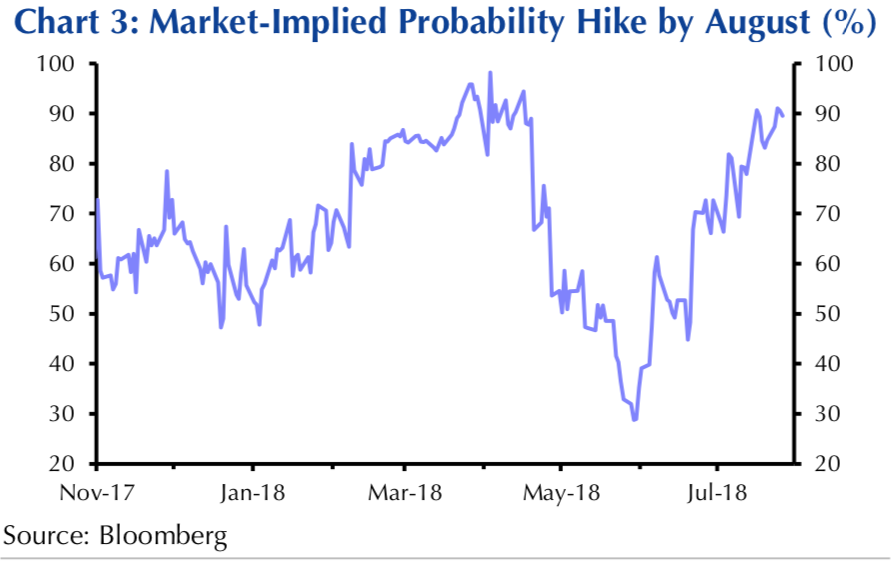

The City is putting the chances of an interest rate rise in the UK on Thursday at 90%.

If the expectations prove correct, the Bank of England’s monetary policy committee will raise rates to 0.75%. This will be the highest level since March 2009 when the Bank of England was grappling with the financial crisis and had embarked upon its sixth cut in as many months.

Rates stayed put at that level until they were cut in the wake of the EU referendum – to 0.25% in August 2016 – and then were raised for the first time in a more than a decade, back to 0.5%, in November 2017.

Economists do not expect the vote by the nine members of the MPC – chaired by governor Mark Carney – to be unanimous on Thursday but nevertheless to be weighted towards a rate rise.

While the market is pricing in a 90% chance of a rate rise, a poll by Bloomberg found 70% of economists expect a rate rise next week.

What has the MPC been looking at?

“Reaching the target rate of inflation is the main objective of monetary policy,” according to the MPC. “But we also have a secondary monetary policy objective, which is to support the government’s economic objectives, including those for growth and unemployment.”

The inflation target is 2% and inflation is running at 2.4%. Raising rates, in theory, should encourage people to spend less and keep inflation down. In practice, it is more complicated than that as spending power is not the only determinant of inflation.

What have the members of the MPC been saying?

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, has kept a handy list of the recent pronouncements of MPC members.

Andy Haldane, the Bank’s chief economist, who stunned the markets in June by voting for a rate rise, has since said: “The economy is experiencing a gradual, ongoing firming of pay pressures, with implications for underlying inflation.”

Ian McCafferty, an external member of the MPC who has previously voted for a rate rise, has said there is no time to “dally” in raising rates.

Carney attracted attention earlier this month when he appeared to signal a rate rise: “The incoming data have given me greater confidence that the softness of UK activity in the first quarter was largely due to the weather, not the economic climate.”

Ruth Gregory, senior UK economist at Capital Economics, noted that Sir Jon Cunliffe, one of the Bank’s deputy governors, may remain in the no-change camp. He voted against the rate rise in November, she said.

What do economists think?

Inflation is actually lower than the Bank of England had been forecasting – 2.4% rather than 2.5%, wage growth is slowing and while economic growth is picking up it is not as strong as economists believe it should be.

A much-anticipated rate rise after the first quarter was delayed by GDP data showing a 0.1% rise in the first three months of the year when Britain was hit by snow.

Tombs said that second quarter GDP was likely to pick up to 0.4%. While this matches the MPC’s forecast, he argued it should be above trend given that “builders and manufacturers likely had to work overtime in order to make up for some of the activity lost” in the first quarter.

The usually warm weather in the second quarter encouraged households to make purchases deferred when the weather was bad. “Taken together, the first and second quarters hardly suggest that the economy is on the brink of overheating,” said Tombs.

He said rates look likely to rise even though the latest data is “only just strong enough for the MPC to justify raising rates.”

Gregory said the decision will not be “clear cut” as CPI inflation is below the Bank’s own forecast and wage growth slowing. Annual pay growth fell from 2.8% to 2.7% in the three months to May.

James Smith at Dutch bank ING thinks the economy has rebounded enough for the MPC to raise rates on Thursday although he noted: “Real incomes remain under pressure from higher petrol prices (which rose by about 7% in [the second quarter), while consumer confidence remains depressed.”

“Interestingly, this pessimism is being predominantly driven by concern about the general economic situation, suggesting consumers are still wary of how Brexit may impact their finances and job security,” said Smith.

So how much of an issue is Brexit?

Uncertainty about the UK’s future relationship with the EU (and other trading partners) is a recurring theme. It is likely to make it difficult for the markets to interpret any efforts by the MPC to signal what might happen to rates in the coming months and years.

Tombs points out that any guidance the MPC gives about rate rises in the future may not “hold much sway” because of the uncertainty created by Brexit.

The ING economists note that after August, markets are barely pricing in another rate hike before the end of 2019. “We suspect policymakers would prefer investors to expect an earlier move, however realistically we think the Bank will struggle to hike rates again for quite some time. As long as Brexit talks remain in deadlock (specifically over the Irish backstop), talk of ‘no deal’ will only increase. If this starts to hit sentiment, it would complicate efforts to tighten policy further.”

The ING economists do not expect rates to rise again before May 2019 – two months after Brexit – “at the earliest”.

What about sterling?

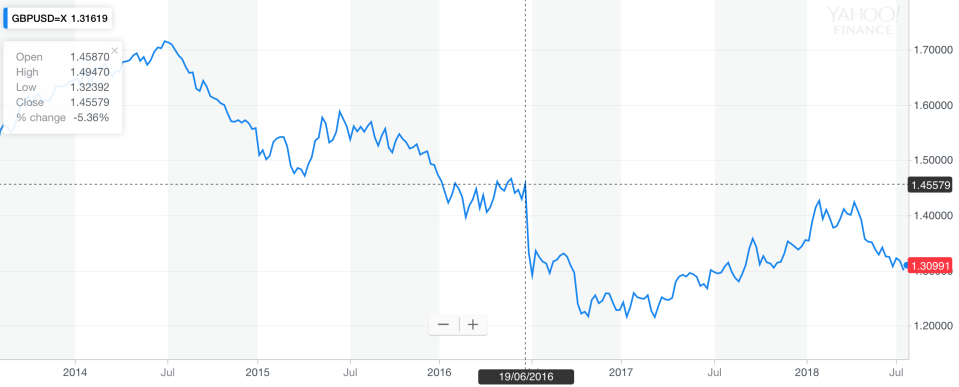

The GBP/USD exchange rate has been the barometer of Brexit since the EU referendum when the pound had been trading at $1.50 just before the polls closed.

It slumped further in the immediate aftermath of the the result and had steadied above $1.30, until it fell before that level earlier this month for the first time since September when lower than expected retail sales and fears of a “hard” Brexit unnerved the markets.

Technically, a rate rise could boost the value of the currency. But it is more complicated than that: Brexit uncertainty is likely to be weighing on the pound and the US dollar is strong.

Yahoo Finance

Yahoo Finance