City handed post-Brexit boost as Hunt strikes trade deal with Switzerland

Jeremy Hunt has handed the City a post-Brexit boost by agreeing a trade deal with Switzerland.

The Treasury on Wednesday announced a new financial services agreement that will reduce costs for UK businesses accessing the Swiss market and vice versa.

The UK-Swiss deal will be signed in Bern on Thursday by Mr Hunt and Karin Keller-Sutter, head of Switzerland’s federal department of finance.

It marks a further boost to the City as Mr Hunt slashes red tape in hopes of increasing the competitiveness of Britain’s financial services industry following Brexit.

The Bern Financial Services Agreement means each country will recognise the other’s domestic laws and regulations on financial services.

It is expected to make it easier for financial companies to offer cross-border services relating to insurance, banking, asset management and capital market infrastructure.

The bilateral agreement, which will simplify operations for companies and wealthy clients in both countries, comes more than three years after the then-chancellor Rishi Sunak launched negotiations in June 2020.

Mr Hunt on Thursday will claim that leaving the EU has allowed Britain to negotiate independent deals with major financial hubs, the Financial Times first reported.

The Treasury said: “The Bern Financial Services Agreement is only possible due to new freedoms granted to the UK following its exit from the EU.”

The UK risked losing the benefit of pre-Brexit trade agreements between the EU and Switzerland, which is not a member of the bloc.

Leaving the 27-member bloc meant that Britain faced being relegated to a third country and stripped of most access rights.

The new deal will permanently restore the UK’s access to Switzerland’s financial sector following Brexit, creating the possibility of a wider trade deal.

The Treasury said: “This relationship is underpinned by a commitment to international standards and a shared belief in the value of open and resilient financial markets.”

Switzerland is the UK’s third largest partner outside of the EU, after the US and China. Swiss banks manage approximately nearly £3 trillion in international assets.

According to the Treasury, UK trade in financial and insurance services with Switzerland reached £3.28bn in 2022.

Read the latest updates below.

06:31 PM GMT

Signing off

Thanks for joining us today. Chris Price will be back in the morning but I’ll leave you with some of our latest business stories at The Telegraph:

We won’t sacrifice growth for environmental concerns, says billionaire Louis Vuitton heir

Millions face festive disruption as BT scrambles to rip out Huawei tech

06:28 PM GMT

BAE Systems wins US Navy contract

BAE Systems has won a five-year contract to operate air traffic control and landing systems for the US Navy.

The deal, worth $92m (£73m), will also involve the British defence giant supporting the US Marine Corps, Military Sealift Command and coast guard.

The contract, which BAE originally won in 1993, also includes software development and maintenance, with the work carried out in Maryland, Virginia and California.

BAE said it was proud to have spent 30 years helping the US “bolster their readiness”.

It follows the award earlier this month of a $8.8bn (£6.9bn) contract with the US Army to continue operating an ammunition plant in Tennessee over the next decade.

Shares in the defence giant were up 2.2pc today.

05:29 PM GMT

Fresh investigation into collapsed London law firm Axiom Ince

The Legal Services Board (LSB) has become the latest regulator to launch an investigation into the collapse of London law firm Axiom Ince. Here’s our reporter Adam Mawardi:

The oversight body on Wednesday said it will examine the events leading up to the Solicitors Regulation Authority’s (SRA) decision to shut down the scandal-hit law firm in October.

The LSB, sponsored by the Ministry of Justice, will consider the SRA’s handling of the case, including whether it followed correct policies and procedures.

Decisions made by the SRA, which regulates the professional conduct of more than 200,000 solicitors in England and Wales, will also be under scrutiny. The SRA plans to fully cooperate with the review.

The LSB’s independent review follows criticism that SRA failures meant that the disappearance of client funds were discovered too late.

Axiom Ince’s former managing partner, Pragnesh Modhwadia, admitted to the High Court in September that most of the missing funds had already been spent.

He confirmed that client monies were used to acquire two law firms in pre-pack administration deals earlier this year, including £2.2m for the Ince Group, once London’s largest listed law firm.

Mr Modhwadia also spent cash purchasing six properties and redeveloping seven others, according to an affidavit with the High Court.

Axiom Ince was closed by the SRA at the start of October, the day after the law firm announced plans to appoint administrators.

The full scope of its independent review will be announced in January, with plans to publish any findings and recommendations in the spring.

The LSB’s review, conducted with the help of Northern Ireland law firm Carson McDowell, is understood to be an assurance and learning exercise, with potential enforcement action not considered at this stage.

An SRA spokesman said: “We look forward to working with the LSB and Carson McDowell on this review.”

05:00 PM GMT

Citi thinks UK inflation could drop below 2pc by May

The investment bank Citi believes inflation will likely fall below the Bank of England’s target of 2pc by May but warns that our central bank is likely to engage in “overtightening”.

It says:

Today’s data is good, substantive news. The reduction in services inflation leave these data 60bps [basis points] below the MPC’s [Monetary Policy Committee’s] November profile.

Some drivers here are idiosyncratic - including the reduction in airfares. But these data suggest momentum in the services complex is continuing to moderate.

On goods, we are cautious of overinterpretation given the uncertainty around Black Friday - although moderation in items such as cars we think reflects more widespread easing of previous supply constraints.

For now, the key question is whether the MPC trust these data enough to begin to move away from previous conclusions that inflation is embedded.

For now, we expect the MPC are more likely to cry ‘bah humbug.’

But with inflation now we think likely to fall below 2% in May, the risk of cuts in Q2 are growing. And regardless, a high burden of proof for cuts means overtightening remains the most likely scenario

04:56 PM GMT

Strong day for the Footsie

The Footsie grew today, with its large-cap index, the FTSE 100, up 1.02pc. The biggest riser was testing company Intertek, up 3.66pc, followed by property company Segro, up 3.23pc. The biggest fallers were NatWest, down 0.46pc, followed by Rightmove, down 0.21pc.

The mid-cap FTSE 250 was up 1.62pc, with magazine publisher Future leading the pack, up 6.00pc, followed by Great Portland Estates, up 5.74pc. Biggest fallers were Diversified Energy, down 3.52pc, followed by Wag Payment Solutions, down 3.41pc.

04:50 PM GMT

Electric scooter start-up Bird files for bankruptcy

An electric scooter start-up once valued at $2.5bn (£2bn) has filed for bankruptcy in the US. Our reporter Matthew Field has the details:

Bird, which became the fastest start-up ever to achieve $1bn unicorn status five years ago, has said it has launched a “financial restructuring process” to safeguard the business.

Founded by former Uber executive Travis VanderZanden in 2017, Bird was among the first e-scooter rental companies to expand globally.

Bird’s initial success sparked a flurry of rivals as venture capital investors ploughed billions of dollars into the so-called “micromobility” sector.

Dockless e-scooters, hired using a smartphone app, subsequently flooded the streets of hundreds of US and European cities.

However, e-scooters’ popularity prompted complaints as they blocked pavements and sparked safety concerns.

Bird attempted to launch in the UK several years ago but its scooters never went further than limited trial areas - one of which was in London’s Olympic Park.

As part of the bankruptcy, Bird will receive $25m in loans from investors, which includes US private equity giant Apollo.

Michael Washinushi, Bird’s interim chief executive, said: “We are making progress toward profitability and aim to accelerate that progress by right-sizing our capital structure through this restructuring.”

04:38 PM GMT

Prada buys flagship New York store for $425m despite luxury slowdown

Prada has agreed to buy the building that hosts its flagship New York store on Fifth Avenue for $425m (£336.3m). Riya Makwana reports:

The Italian fashion brand has purchased the 12-storey building at 724 Fifth Avenue, where Prada has rented since 1997, from property mogul Jeff Sutton.

“The board believes that the property’s location offers high strategic value being characterised by increasing scarcity and long-term potential,” Prada said in its statement.

New York’s Fifth Avenue, which runs through Midtown Manhattan, is the world’s most expensive retail street, according to property company Cushman & Wakefield. Brands with shops on the road include Armani, Cartier and Gucci.

Prada’s significant investment in the area comes despite a global downturn in luxury sales, as high interest rates and slowing growth hit the world’s wealthy.

Prada’s sales in the US have dropped by 1.3pc during the first nine months of the year.

US credit card data from Barclays showed that spending on luxury goods declined in November, just a month before Christmas. Sales were down by 15pc year on year.

Analysts at Barclays said the data “doesn’t bring much optimism” for trade in the run up to Christmas.

04:33 PM GMT

Ikea warns of delays from Houthi militant attacks in the Red Sea

Ikea has said that it faces delays in some products as it looks to reroute goods away from the Red Sea, after attacks by Houthi militants on ships passing through the waters.

“What we can share for now is that the situation in the Suez Canal will result in delays and may cause availability constraints for certain Ikea products,” Oscar Ljunggren, a spokesperson for Ikea, told Bloomberg.

The Swedish flat-pack furniture giant said that it was looking for other options for routing goods from Asian factories to its European markets.

The company said it was working with shipping providers “to ensure the safety of people working in the Ikea value chain and to take all the necessary precautions to keep them safe.”

04:25 PM GMT

Spain hits back at Saudi stakebuilding in Telefonica

The Spanish government is planning to buy a €2bn (£1.7bn) stake in Telefonica as it steps up defences against stakebuilding by Saudi Arabia. James Warrington reports:

SEPI, Spain’s state holding company, will buy as much as 10pc of the telecoms giant to provide “greater shareholder stability”.

It added that the move would help to safeguard the company’s “strategic capabilities”.

Telefonica, which co-owns Virgin Media O2 with Liberty Global, said in response to the announcement that it remained focused on executing its recently announced strategic plan.

Shares in the telecoms group jumped as much as 7pc on Wednesday.

Spain’s rearguard action comes after Saudi Telecom (STC) revealed in September that it had spent €2.1bn amassing a stake in Telefonica.

This consists of a 4.9pc shareholding and financial instruments giving it another 5pc in so-called economic exposure.

STC, which is majority-owned by Saudi Arabia’s sovereign wealth fund, reportedly plans to convert this into a 9.9pc stake, which would make it Telefonica’s biggest shareholder.

The move has sparked concerns in Spain, which has been considering rolling out restrictions on the Gulf state’s investment plans.

Spanish Prime Minister Pedro Sanchez has said the Government will not allow foreign investors to have “undue influence” over strategic companies.

04:20 PM GMT

Slug & Lettuce owner bags new financing agreement

Britain’s biggest pub chain Stonegate is raising £638 million through a fresh financing agreement, according to a Bloomberg report.

The Slug & Lettuce owner, created in 2010 by TDR Capital, who also co-own Asda, is reportedly splitting out 1,000 pubs into a separate company known as a special purpose vehicle in order to raise the funds, which are expected to be from Apollo Global Management.

03:58 PM GMT

Ocado leads the FTSE 100 with 12-day rally

The online supermarket and logistics group Ocado is leading the risers in the FTSE 100 today, the 12th day in a row that it has pushed higher. Shares have reach 795.8p

The company, which hit an all-time high at 2,819p in October 2020 as the Covid pandemic continued to bite, has been gaining traction selling its expertise and distribution skills to other retailers, even outside of its core grocery sector.

However, its original UK retail business, which it now owns jointly with M&S, is struggling, with 2022 revenues declining slightly as customers have faced inflationary pressures.

03:43 PM GMT

Consumer confidence data supports the idea we're heading for a soft landing

How effective will central bankers be in preventing a recession while squeezing out inflation? The latest data from The Conference Board, a business think tank founded in 1916, suggests that America might be on track for a soft landing - despite a period of high interest rates. Will Britain mirror this?

The research found that US consumers are feeling more confident than they did in the summer, and that their confidence has grown for the second month on the trot.

The Bank of England has taken a more cautious approach to inflation than the US Federal Reserve, but today’s inflation figures are encouraging the markets to anticipate interest rate cuts sooner than previously expected.

Michael Hewson, chief market analyst at CMC Markets UK, said:

Markets are currently pricing in the prospect of rate cuts next year, even with headline inflation still well north of the central bank’s 2pc inflation targets. That may well happen; however, the degree of cuts being priced could well be where markets come unstuck, especially since the move back to 2pc from current levels may prove to be the hardest part of the journey.

Nonetheless there is no reason to suppose that stock markets won’t maintain the resilience seen through 2023, with the FTSE100 having strong support at 7,200 which needs to hold to maintain the outlook for further gains on a move through 7,750 and revisit the highs this year at 8,046.

03:34 PM GMT

Handing over

It’s been an eventful one and at this point I’ll head for home and hand you over to the furious-typing Alex Singleton.

I’ll leave you with a quick look at data showing American consumers are feeling more confident than they have since summer ub good news for businesses with the all-important Christmas shopping season reaching its peak.

The Conference Board, a business research group, said that its consumer confidence index rose for the second straight month, to 110.7 in December from 101 in November. That’s much better than analysts’ forecasts of 104.5.

It seems Americans have a positive view on the state of their economy:

Consumer confidence rose to a 5-year high.

BUT what caught my eye was how much Americans' perspective of the economy's present state jumped this month.

Up 12 pts, the biggest monthly jump since May 2021. pic.twitter.com/SgFjqdFBwF— Callie Cox (@callieabost) December 20, 2023

03:09 PM GMT

US home sales rise amid easing mortgage rates

Sales of previously occupied US homes rose in November, ending a five-month slide, as easing mortgage rates encouraged homebuyers.

Existing home sales rose 0.8pc last month from October to a seasonally adjusted annual rate of 3.82m, the National Association of Realtors said.

It tops the 3.78m sales pace economists were expecting, according to FactSet.

Sales were still down 7.3pc compared with November last year.

The pickup in sales helped push up home prices compared with a year earlier for the fifth month in a row. The national median sales price rose 4pc from November last year to $387,600.

Lawrence Yun, the NAR’s chief economist, said: “Home sales always respond to lower interest rates.”

It comes as the average rate on a 30-year mortgage has eased after climbing to 7.79pc in late October to its highest level since late 2000. The average dropped to 6.95pc last week, according to mortgage buyer Freddie Mac.

United States Mortgage Ratehttps://t.co/ByLQtXPixB pic.twitter.com/kOLnzHd51K

— TRADING ECONOMICS (@tEconomics) December 20, 2023

02:50 PM GMT

Lenders gear up for ‘mortgage January sale’ as inflation falls below 4pc

Mortgage lenders are gearing up to cut rates further in January as falling inflation raises hopes that the Bank Rate will come down faster than expected next year.

Senior money writer Fran Ivens has the details:

Inflation fell to 3.9pc in November, according to the latest data from the Office for National Statistics, the lowest rate in two years. The figure is down from 4.6pc in October.

As a result lenders are expected to drop their fixed mortgage rates further over the coming weeks and into the new year, with some already taking the plunge.

Lender Generation Home will tomorrow introduce the first sub-4pc fixed mortgage rate since Liz Truss’ government. The deal is a 3.99pc five-year fixed rate for those with a 40pc deposit, and is part of cuts that the lender is introducing across its mortgages.

Read which other lenders have announced reductions.

02:34 PM GMT

Wall Street slides at the open

The main US stock indexes opened lower as investors took a breather from a rally that was sparked by the Federal Reserve’s likely pivot to interest rate cuts next year.

The Dow Jones Industrial Average fell 37.79 points, or 0.1pc, at the open to 37,520.13.

The S&P 500 opened lower by 3.64 points, or 0.1pc, at 4,764.73, while the Nasdaq Composite dropped 29.86 points, or 0.2pc, to 14,973.36 at the opening bell.

02:33 PM GMT

Government borrowing costs plummet as inflation falls sharply

The cost of Government borrowing has fallen to its lowest level since April after a larger than expected fall in inflation made markets bet on large interest rate falls.

Bond yields have plummeted in the wake of the sharp drop in the consumer prices index from 4.6pc to 3.9pc in November, which has raised hopes of interest rate cuts early next year.

The benchmark 10-year UK bond yield dropped to as low as 3.51pc from 3.64pc the previous day, its lowest level since April.

The two-year Government gilt, which is sensitive to changes in interest rate expectations, has plunged from 4.24pc to as low as 4.06pc.

Bond prices move inversely to yields, which are the return the Government promises to pay buyers of its debt.

The inflation data has fuelled bets by traders that interest rates will fall sharply as a result, with money markets pricing in five interest rate cuts to 4pc by November next year.

Grant Fitzner, chief economist at the ONS, described the drop in inflation as “good news for a change”.

Chancellor Jeremy Hunt said: “Alongside the business tax cuts announced in the Autumn Statement this means we are back on the path to healthy, sustainable growth.”

02:23 PM GMT

Rishi Sunak slapped down by watchdog for claiming public debt is falling

Rishi Sunak has been criticised by the statistics watchdog after he claimed public sector debt is falling.

Our political correspondent Dominic Penna has the details:

The Prime Minister said “debt is falling” in a video posted to his Twitter account last month and also told MPs “we have indeed reduced debt” during Prime Minister’s Questions on Nov 22, the day of the Autumn Statement.

However, Sir Robert Chote, chairman of the UK Statistics Authority, highlighted the fact that national debt has continued to rise, and warned Mr Sunak he risks “undermining trust” in how the Government uses data.

“Members of the public cannot be expected to understand the minutiae of public finance statistics and the precise combination of definitional choices that might need to be made for a particular claim to be true,” Sir Robert said.

See how debt is forecast to rise.

02:06 PM GMT

World’s largest offshore wind farm gets go-ahead off UK coast

The UK’s leading offshore wind developer has agreed to push ahead with plans for its flagship project off the coast of Norfolk.

Ørsted, the Danish renewable energy giant, had been understood to be in talks with the Department for Energy Security and Net Zero about securing more generous subsidy arrangements for its Hornsea 3 wind farm project.

The company has taken the final investment decision on the scheme, which will see 231 turbines installed off the coasts of Norfolk and Lincolnshire, generating power for 3m homes. It is expected to be completed by the end of 2027.

Subsidies for Hornsea 3 were agreed with the Government last year through contracts for difference (CfDs), with operators guaranteed a minimum price per megawatt hour (MWh) known as the strike price. Ørsted was promised £37.35.

It will support up to 5,000 jobs during its construction phase, with up to a further 1,200 permanent jobs both directly and in the supply chain in the long operational phase.

Ørsted chief executive Mads Nipper said:

Offshore wind is an extremely competitive global market, so we also welcome the attractive policy regime in the UK which has helped secure this investment.

We look forward to constructing this landmark project, which will deliver massive amounts of green energy to UK households and businesses and will be a significant addition to the world’s largest offshore wind cluster.

01:45 PM GMT

Gas prices rise amid Red Sea tensions

Gas prices have edged higher as uncertainty remains over the shipping of good through the Red Sea.

Europe’s benchmark contract for wholesale gas has edged up 1.4pc today to more than €33 per megawatt hour.

The UK equivalent has gained about 2pc.

01:23 PM GMT

Rail freight to grow by 75pc in 27 years under Government targets

An “ambitious” target of growing rail freight by at least 75pc by 2050 has been set by Transport Secretary Mark Harper.

The Cabinet minister said this will lead to economic and environmental benefits. Rail industry body Rail Partners previously called for an ambition of trebling rail freight by 2050.

Mr Harper believes setting a target for increasing the amount of goods moved by train will encourage more private sector investment in the sector.

One freight train can replace up to 129 lorries, while moving a tonne of freight by rail produces a quarter of the carbon emissions compared with road transport, according to the Department for Transport.

Mr Harper said:

Rail freight helps keeps this country moving, ensuring our supermarket shelves are stocked and materials are supplied to our construction workers.

Not only is it the most efficient and environmentally friendly way of transporting many goods, but it helps grow the economy across the country.

This ambitious plan demonstrates this Government’s confidence in the rail freight sector, and I hope it encourages businesses to capitalise on the extra opportunities, so the industry continues to thrive and deliver for our country.

01:04 PM GMT

LadBible owner cheers growth in audience

The media group which owns digital publisher LadBible has revealed it is expecting a jump in sales and earnings over 2023 after building its audience and advertisers.

Manchester-based LBG Media, which also owns brands SportBible, Tyla and UniLad, said it was performing well in the UK and Ireland despite profits dragging in Australia.

Social media followers across its brands have surged to more than 440m, up from 410m in June, the group revealed.

The youth publisher said it expects to report revenue growth from nearly £63m last year to about £67m this year.

Meanwhile, adjusted earnings are set to have grown by about 8pc from £15.7m in 2022 to at least £17m in 2023.

LadBible was launched by friends Solly Solomou and Arian Kalantari while studying at university in 2012, aged 21.

The London-listed group spans social media platforms including Facebook, Instagram, X and TikTok with a predominantly young audience of 18 to 34-year-olds.

The term “lad” is described as an “everyday hero” and gender neutral term by the company, with women making up about 40pc of its audience.

12:48 PM GMT

Wall Street on track to open lower

US stock markets inched lower in premarket trading after a rally that was sparked by the Federal Reserve’s likely pivot to a dovish policy.

All the three main indexes have advanced over 2pc since the Fed held interest rates steady earlier this month, projecting lower policy rates by the end of 2024.

Blue-chip companies on the Dow Jones Industrial Index have hit record highs every other day since and the S&P 500 is within reach of its highest closing levels since January 2022.

Chicago Fed President Austan Goolsbee tried to keep euphoria in check this week as he said further progress on beating back inflation will be the decisive factor in any decision next year to reduce interest rates.

Still, traders expect the Fed to ease credit conditions by more than 125 basis points by September next year, with a 71.1pc chance that the first quarter of a percentage point cut could come in as early as March.

Ahead of the opening bell, Dow Jones and S&P 500 futures were down 0.2pc, while the Nasdaq 100 had lost 0.3pc.

12:12 PM GMT

German bunds drop below 2pc for first time since March

It is not just UK bonds enjoying a rally today amid hopes of interest rate cuts next year.

Germany’s 10-year bund yield dropped below 2pc for the first time in nine months after figures showed producer prices fell by more than expected in November.

Meanwhile, US Treasury yields have fallen to 3.89pc.

Italy’s bond yields edged downward below 3.6pc, having fallen by more than 73 basis points in the last month as markets increasingly bet on interest rate cuts by the US Federal Reserve and European Central Bank early next year.

10y German Bund yields have dropped <2% for 1st time since Dec 2022. pic.twitter.com/1RFV9I3ZZ1

— Holger Zschaepitz (@Schuldensuehner) December 20, 2023

11:58 AM GMT

Mortgage rates expected to dive – when to ditch your tracker for a fixed deal

After a tumultuous year, there are signs of hope for mortgage borrowers as November’s inflation figures dipped to 3.9pc – with mortgage rates expected to fall further as a result.

Our deputy money advice editor Danielle Richardson weighs up the options for mortgage holders:

Several major lenders had already cut rates ahead of last week’s Bank Rate decision – as banks correctly guessed the Bank of England would hold the rate at 5.25pc once again.

It’s now possible to find a two-year fix comfortably below 5pc, while the cheapest five-year deal is 4.6pc.

Huge numbers of home owners have been waiting on “tracker” mortgages for the past two years, hoping for fixed deals to come down before securing their home loans.

With the cheapest fixed deals now below the 5.25pc Bank Rate, anyone currently on a tracker may be wondering if it’s time to switch.

Read our quick guide to the mortgage market.

11:43 AM GMT

Bank of England must act to avoid recession, warns think tank

In October last year, inflation was at 41-year highs of 11.1pc. In the last two months, however, the consumer prices index has dropped from 6.7pc in September to 3.9pc in November.

Economist Julian Jessop of the Institute of Economic Affairs think tank fears the Bank of England now risks slowing down the economy too much if it maintains interest rates at 15-year highs of 5.25pc. He said:

The sharp fall in inflation in November makes the Bank of England’s position on interest rates look even shakier. Almost every leading indicator has been pointing firmly downwards for some time, notably the monetary aggregates, but some on the Monetary Policy Committee (MPC) still want to raise rates further.

In reality, inflation is well on track to hit the MPC’s 2pc target in the first half of 2024, which would be at least a year earlier than the Bank has been forecasting. Deflation is now the bigger risk and interest rates are too high.

Unfortunately, the Monetary Policy Committee has continued focus on hypothetical ‘second-round effects’ and ‘wage-price spirals’. But with pay pressures now easing too, the MPC will soon run out of reasons not to cut rates.

The longer the Bank waits, the greater the risks that the economy is tipped into a recession that is wholly unnecessary to bring inflation down.

11:28 AM GMT

Tortilla fears consumers are still wary as it reduces sales forecast

The UK’s largest Mexican fast-casual restaurant chain, Tortilla, has flagged subdued consumer confidence and thinning high streets leading to lower-than-expected sales growth.

But the group said it is planning to grow in busier areas and improve its brand awareness outside London.

Tortilla Mexican Grill, which has nearly 70 restaurants in the UK and several franchised outlets in the United Arab Emirates, said revenues are set to increase by nearly 14pc to £66m over 2023, compared with 2022.

On a like-for-like basis, which strips out the impact of new stores opened during the year, sales are expected to grow by 3.7pc year on year.

The performance is slightly below the company’s previous predictions due to subdued consumer confidence affecting demand for eating out, especially during the last few months of the year, Tortilla said.

11:08 AM GMT

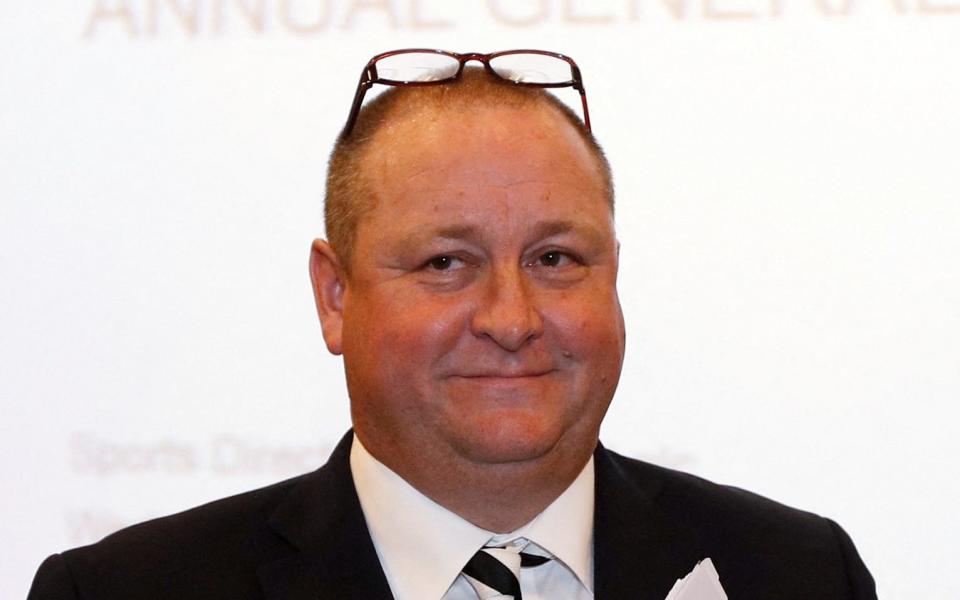

Frasers Group buys Matches for £52m

Mike Ashley’s Frasers Group has snapped up luxury clothing retailer Matches Fashion in a deal worth around £52m.

Frasers, which owns Sports Direct and House of Fraser, said it will buy Matches from its parent firm MF Intermediate Limited, which is backed by private equity firm Apax Partners.

It said the online retailer has been loss-making in recent years, as it reported a loss of £33.5m for the year to January 31.

Michael Murray, chief executive of Frasers, said:

Matches has always been a leader in online luxury retail and has incredible relationships with its brand partners.

This acquisition will strengthen Frasers’ luxury offering, further deepening our relationships and accelerating our mission to provide consumers with access to the world’s best brands.

10:30 AM GMT

Brent crude back above $80 amid Red Sea crisis

Oil prices have continued to move higher as traders and shippers brace for more disruption in the Red Sea amid attacks from Yemeni militants supporting Hamas.

Global benchmark Brent climbed 1.1pc to tip back above $80 a barrel after rising more than 3pc over the previous two days. It was worth less than $73 a week ago.

US-produced West Texas Intermediate has climbed 1.3pc toward $75 a barrel.

The US and its allies are considering possible military strikes against Iran-backed Houthi rebels in Yemen in recognition that a previously announced task force may not be enough to eliminate the threat to shipping in the vital waterway.

Companies have already diverted their ships away from the waterway this week, while insurance costs have soared after a barrage of recent attacks on merchant vessels in the region.

10:14 AM GMT

Wages will rise after inflation's fall, suggests Hunt

Jeremy Hunt said Rishi Sunak had “more than delivered” on his pledge to halve inflation this year and raised the prospect of improving living standards.

He told broadcasters: “Once you do the hard work to squeeze inflation out of the system, you can start looking forward to the kind of growth that will see people’s wages go up.”

NEWS - Inflation falls to 3.9%

"Once you do the hard work to squeeze inflation out of the system, you can start looking forward to the kind of growth that will see people's wages go up".

Chancellor @Jeremy_Hunt on today's fall in inflation. pic.twitter.com/Sg1VDhLcbW— HM Treasury (@hmtreasury) December 20, 2023

09:57 AM GMT

London suffers steepest fall in house prices in October, official figures show

Average house prices in the year to October decreased by 1.4pc in England to £306,000 and by 3pc in Wales to £214,000, according to the Office for National Statistics.

However, prices increased in Scotland by 0.2pc to £191,000 and 2.1pc to £180,000 in Northern Ireland.

Among the regions, London saw the largest fall, down 3.6pc, while the North East was the only one to manage a gain, rising 0.2pc.

Aimee North, head of housing market indices at the ONS, said:

London saw the steepest fall in average house prices and its annual inflation rate now stands at its lowest level since 2009.

While housing prices are generally falling, the surge in rental prices continues with another record-breaking increase in the year to November.

Private rental prices paid by tenants in the UK rose by 6.2% in the 12 months to November 2023📈

This is up from 6.1% in the 12 months to October 2023.

➡️ https://t.co/iv6bUM47c1 pic.twitter.com/nOTvF7SceW— Office for National Statistics (ONS) (@ONS) December 20, 2023

09:47 AM GMT

House prices fell 1.2pc in October, says ONS

The average house price decreased by 1.2pc in the year to October, according to official figures.

The average UK house price was £288,000 during the month, the Office for National Statisitics said, which was £3,000 lower than a year earlier.

Average UK house prices decreased by 1.2% in the 12 months to October 2023 (provisional estimate)🏠

This is down from a fall of 0.6% in the 12 months to September 2023.

➡️ https://t.co/4izJZqn4eT pic.twitter.com/lQADUv9gi8— Office for National Statistics (ONS) (@ONS) December 20, 2023

09:29 AM GMT

Bank of England officials 'won’t be getting too carried away'

Matthew Ryan, head of market strategy at Ebury, is sceptical about whether the Bank of England will react quickly to the steeper than expected fall in inflation. He said:

This morning’s UK inflation data will clearly be very welcome news indeed to the Bank of England in its fight against elevated prices pressures, although we suspect that committee members won’t be getting too carried away just yet.

Last week, the Monetary Policy Committee (MPC) stressed that it was still far too soon to even discuss the possibility of lower UK interest rates, and one good inflation print won’t be enough for the bank to drastically change in tune.

Core inflation, in particular, still remains elevated and well over double the MPC’s 2pc target, while risks to further upside remain in place, most notably from the continued sharp increases in annual wages.

We think that the Bank will hold the line for now, and continue to dampen expectations for imminent rate cuts. The first 25 basis point cut is now fully priced in for the bank’s May meeting, with a decent chance of a start to cuts in March.

For our money, this appears far too soon, and we are not pencilling in the beginning of easing until June, which would be a clear positive development for the pound.

09:18 AM GMT

Markets 'right' to price in more cuts, say analysts

The pound remains down significantly against the dollar and the euro as traders realign their positions after the steep drop in inflation.

The pound was last down 0.6pc at $1.26, having been down around 0.2pc immediately before the data. It also softened versus the euro, which was up 0.4pc at 86p.

It comes as money markets are now fully pricing in a a quarter of a percentage point cut to interest rates by May, and show nearly a 50pc chance of such a cut by March.

James Smith, developed markets economist at ING, said:

Markets are right to be pricing a number of rate cuts for 2024. Investors now expect 140 basis points of cuts in 2024 after this latest downside surprise on inflation, starting in May.

That’s maybe pushing it, and we still think the Bank will prefer to tread a little more cautiously with 100bp of cuts starting in August.

But interestingly, this data has also seen investors reassess where the Bank of England stands relative to the Federal Reserve and European Central Bank.

Up until now, markets had been expecting both of the latter to be much more aggressive than the BoE, but that narrative seems to be fading.

09:09 AM GMT

UK markets surge amid hopes for rate cuts

The FTSE 100 hit a three-month high after the surprise drop in inflation, which spurred hopes that the Bank of England could consider interest rate cuts early next year.

The UK’s blue-chip index was last up 1pc, while the more domestically-focused FTSE 250 midcap index added 0.9pc.

The pound was down 0.5pc after official data showed inflation fell by more than expected to 3.9pc, pushing the pace of price rises to its lowest since September 2021.

Rate-sensitive real estate, real estate investment trusts and housebuilders advanced between 1.6pc and 2pc.

Heavyweight energy stocks added 2.2pc, while banks jumped 1.8pc.

Yields on UK government bonds also fell, with the yield on the benchmark 10-year gilt last at 3.54pc.

08:45 AM GMT

Interest rates could mean interest rate cuts 'more quickly', says minister

Work and Pensions Secretary Mel Stride said the fall in inflation could allow the Bank of England to ease interest rates, helping homeowners struggling with mortgage costs.

He told LBC Radio:

The interesting thing is that this 3.9pc is a rather better number than was anticipated - many economists were thinking about 4.3pc.

So it could be that this is coming down a bit faster than many had imagined.

And I think this is really good news. I think this is a turning point. I think the economy will definitely start to benefit from this.

A greater decrease in inflation of course means that monetary policy might be loosened a little bit more quickly than it would otherwise be - in other words, interest rates coming down.

Those are matters for the independent Bank of England, they are not for me to predict, but if inflation comes down faster than expected, then that does take some pressure off the Bank of England in terms of keeping interest rates higher, which of course in time and in turn feeds into mortgage rates.

08:38 AM GMT

Prices are still going up, says Reeves

As inflation fell to 3.9pc, Labour’s shadow chancellor Rachel Reeves said:

The fall in inflation will come as a relief to families.

However, after 13 years of economic failure under the Conservatives, working people are still worse off.

Prices are still going up in the shops, household bills are rising, and more than a million people face higher mortgage payments next year after the Conservatives crashed the economy.

08:35 AM GMT

Government borrowing costs drop amid hopes of rate cuts

Bond markets have rallied after the fall in inflation to 3.9pc, as it boosted hopes that the Bank of England will cut interest rates next year.

The yield on the 10-year UK Government gilt, which moves inversely to prices, has fallen about 12 basis points to 3.53pc - its lowest level since April.

The yield on shorter two-year bonds, which are more sensitive to changes in the outlook for interest rates, has plunged 17 basis points to 4.07pc - its lowest since May.

Bond yields are the return that the Government promises to pay buyers of its debt, so falling yields mean the Treasury has lower borrowing costs.

08:05 AM GMT

FTSE 100 leaps higher after inflation's steep fall

The FTSE 100 has surged higher after the steep drop in inflation delivered an early Christmas present to the markets.

The UK’s blue chip index leapt 1.2pc higher after the open to 7,729.11 while the midcap FTSE 250 also jumped 1.2pc to 19,549.18.

08:00 AM GMT

Traders bet interest rates to fall to below 4pc

Money markets are pricing in five interest rate cuts by the end of next year after inflation fell more sharply than expected to 3.9pc.

Traders have ramped up bets on interest rate cuts. A week ago, markets thought rates would be close to 4.5pc in November 2024.

After the latest inflation data, derivatives trades now indicate that rates will be below 4pc by the end of next year.

They believe interest rates will be close to 3pc by the end of the following year.

07:47 AM GMT

Falling inflation 'likely' encouraging for Bank of England, says ONS chief

Grant Fitzner, chief economist at the ONS, described the drop in inflation as “good news for a change”.

Our economics editor Szu Ping Chan has the latest:

Mr Fitzner told the BBC that the drop in inflation was driven by falling petrol and diesel costs, as well as easing food price rises, including cheaper bread as well as the falling price of second hand cars.

He also said the fall was broad based, which he said was likely to be “encouraging” for the Bank of England, which sets interest rates.

Goods inflation now stands at 2pc, which is the same as the Bank’s target. UK inflation is also more closely aligned with Europe, matching the rate seen in France.

“[It’s] not just the headline inflation rate. But if you also look at other measures, which are closely watched such as core CPI or the price of goods or services, they all fell in November.

“There are various measures of underlying inflation. But the fact that goods price [inflation is] down now to 2pc over the past year and services prices which we know the Bank of England watches closely is also heading lower, I think would be encouraging to not just the Bank but other financial commentators out there watching these numbers.”

He added that while food price inflation, at more than 9pc over the past year, remained “high”, he added: “Around one in five businesses are now saying that they have seen the price of goods or services go up in the past month, but that’s down from three in five, 18 months ago. So yes, there are still price pressures faced in business, but there are a lot lower than they were last year. And that’s reflected in the fact they don’t have to pass on price pressures to the extent that they have been doing in the past.”

07:41 AM GMT

Bank of England may soon be at 'risk of over-tightening' monetary policy

Ed Monk, associate director at pension investor Fidelity International, said:

Another significant drop in inflation in November only adds to the case that interest rates will fall sooner than expected.

The Bank of England has been talking tough, but price rises appear on a rapid decline back towards the Bank’s target range and it may soon be that the risk for rate-setters is not under-tightening but over-tightening.

The last portion of above-target inflation may still prove difficult to shift - wages may have peaked but remain high by historical standards - and the Bank of England will want to be sure that enough demand has seeped out of the economy before it eases borrowing costs.

For investors, today’s fall in inflation is good news and may add to the momentum in markets that has been gathering for the past month or so. However, markets are priced for perfection, with inflation falling back to target next year with no accompanying recession. Anything less than that could see a sharp correction to today’s market levels.

The further fall in inflation means cash savers should continue to see a real terms return on their money. Savers should understand, however, that falling inflation benefits not only cash returns but also those of risk-assets like shares, where returns this year have far exceeded those from cash accounts.

07:32 AM GMT

UK 'looking less of an outlier' on inflation

There’s no doubt about it, this fall in inflation is good news, and brings the UK into line with other developed economies:

Early Christmas present for all of us - inflation falls to 3.9% in November, another very chunky (and broad based) reduction. Very good news. pic.twitter.com/7Bx5PJ9jyd

— Torsten Bell (@TorstenBell) December 20, 2023

Not sure this gives the BoE latitude to guide to rate cuts. Despite v weak monetary growth/ real GDP growth, NGDP is still growing at an annualised 8% & big set of indexation events (pensions, benefits, NLW) to come in Q2 2024. MPC keen to see those events play out before moving

— Simon French (@shjfrench) December 20, 2023

07:24 AM GMT

Pound plunges amid hopes of interest rate cuts

The value of the pound dropped steeply after official figures showed the rate of inflation fell more than expected from 4.6pc to 3.9pc in November.

Sterling has sunk 0.5pc against the dollar toward $1.26 amid hopes that the Bank of England will not need to keep interest rates higher for an extended period of time to slow down price rises.

07:21 AM GMT

Core inflation drops sharply to 5.1pc

In a welcome sign for policymakers at the Bank of England, underlying inflation also fell at a sharper than expected pace.

So called core inflation, which strips out volatile food and energy prices, fell to 5.1pc in November, according to the Office for National Statistics.

Economists had predicted it would fall from 5.7pc to 5.6pc.

07:17 AM GMT

We will continue to prioritise cutting cost of living, says Hunt

After the sharp fall in inflation from 4.6pc to 3.9pc, Chancellor Jeremy Hunt said:

With inflation more than halved we are starting to remove inflationary pressures from the economy.

Alongside the business tax cuts announced in the Autumn Statement this means we are back on the path to healthy, sustainable growth.

But many families are still struggling with high prices so we will continue to prioritise measures that help with cost of living pressures.

07:12 AM GMT

Inflation drops after slowdown in fuel and food costs, says ONS

Office for National Statistics chief economist Grant Fitzner said:

Inflation eased again to its lowest annual rate for over two years, but prices remain substantially above what they were before the invasion of Ukraine.

The biggest driver for this month’s fall was a decrease in fuel prices after an increase at the same time last year.

Food prices also pulled down inflation, as they rose much more slowly than this time last year.

There was also a price drop for a range of household goods and the cost of second-hand cars.

Factory gate prices remain little changed over the past year, while on an annual basis the change in costs that producers pay for raw materials and fuel was negative for the sixth consecutive month.

07:06 AM GMT

Inflation falls to lowest annual rate for more than two years

Inflation has fallen to its lowest level since September 2021.

Transport, recreation and culture, and food and non-alcoholic beverages were the biggest drivers of inflation’s larger than expected fall from 4.6pc to 3.9pc.

In the year to November 2023:

▪️ Consumer Prices Index including owner occupiers’ housing costs rose by 4.2%, down from 4.7% in October

▪️ Consumer Prices Index (CPI) rose by 3.9%, down from 4.6% in October

➡️ https://t.co/RZCLXrRVqp pic.twitter.com/NA7C8hnrHY— Office for National Statistics (ONS) (@ONS) December 20, 2023

07:01 AM GMT

Good morning

Thanks for joining me. Money markets and analysts will shortly deliver their reaction to official data showing inflation fell more than expected to 3.9pc in November.

The reading comes as financial markets had hoped a falling inflation picture would lead to just over four reductions in interest rates next year from their present level of 5.25pc, starting by May.

We will have everything you need to know in the live blog.

5 things to start your day

1) Softbank and Arm chiefs meet Hunt as City reforms open door to secondary listing in London | The Financial Conduct Authority has unveiled proposals to streamline London’s listing regime to attract secondary listings

2) Care companies at fault in digital landline crisis, claims Virgin Media O2 | As phone lines are updated, local authorities need to step up

3) Scottish battery factory goes bust in fresh blow to UK’s net zero industry | AMTE Power has seen its finances tip into the red due to a lack of orders and investment

4) Debt-laden Asda’s interest bill to surge above £400m | Issa brothers scramble to sell off assets in order to pay down borrowings

5) Matthew Lesh (IEA): Britain’s only growth area is regulation and red tape | Our economic prospects are under serious threat – it’s time to rein in the regulators

What happened overnight

Asian shares mostly advanced amid hopes that Japan’s moves to keep interest rates easy for investors could augur similar trends in the rest of the world.

Oil prices were virtually unchanged after two days of gains.

Building on gains from Tuesday, Tokyo stocks closed higher as they were helped by a relatively cheaper yen against the dollar after the Bank of Japan indicated it plans to keep its super-loose monetary policy in place.

The benchmark Nikkei 225 index advanced 1.4pc, or 456.55 points, to 33,675.94, while the broader Topix index ended up 0.7pc, or 15.57 points, at 2,349.38.

The rises came despite Japan experiencing a slight decline in its export performance for the first time in three months in November, a worrisome slowdown for the world’s third-largest economy.

Exports to China, Japan’s biggest single market, fell 2.2pc, while shipments to the US rose 5.3pc from a year earlier. Total imports fell nearly 12pc.

Hong Kong’s Hang Seng index added 1pc to 16,669.44 while the Shanghai Composite index lost 0.4pc to 2,920.63 after China kept its benchmark lending rates unchanged at the monthly fixing on Wednesday.

The S&P/ASX 200 in Sydney gained 0.6pc to 7,533.90, while South Korea’s Kospi was 1.4pc higher to 2,603.85. Bangkok’s SET rose 0.6pc, and India’s Sensex climbed 0.3pc.

Wall Street extended its rally on Tuesday, advancing as investors looked ahead to crucial inflation data.

The S&P 500 rose 0.6pc and is just shy of its record set nearly two years ago. The Dow Jones Industrial Average of 30 leading US companies gained 0.7pc, and set its own record for a fifth straight day, while the Nasdaq Composite index climbed 0.7pc.

The yield on benchmark 10-year US Treasuries were down 2.3 basis points to 3.933pc, from 3.956pc late on Monday.

Yahoo Finance

Yahoo Finance