Clinical Hold on Sarepta's (SRPT) DMD Candidate Lifted by FDA

Sarepta Therapeutics SRPT announced that the FDA removed the clinical hold placed on its next-generation exon-skipping pipeline candidate, SRP-5051 (vesleteplirsen), being evaluated for treating Duchenne muscular dystrophy (DMD) patients with skipping exon 51.

Sarepta will modify the global protocols for clinical studies evaluating SRP-5051 to include expanded monitoring of urine biomarkers as part of the condition for removing the clinical hold.

The FDA placed a clinical hold earlier in June following reports of a serious adverse event of hypomagnesemia in part B of the phase II MOMENTUM study. Hypomagnesemia is when an individual has lower-than-normal levels of magnesium in his body. If left untreated, it can lead to life-threatening complications. Based on these reports, the regulatory authority requested information from the company to assess the adequacy of the risk mitigation and safety monitoring plan.

The clinical hold placed by the FDA only affected the U.S. portion of the MOMENTUM study, which is being conducted globally. The study continued to enroll and dose participants in ex-U.S. regions. Management expects to complete enrollment in the MOMENTUM study by the end of this year.

Sarepta intends to make the requisite changes in the clinical studies evaluating SRP-5051 swiftly to resume dosing U.S. participants in the study. Management intends to design its monitoring plan to mitigate the risk of hypomagnesemia.

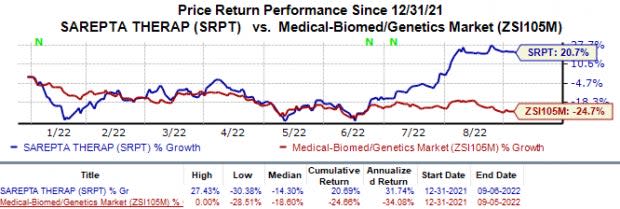

Shares of Sarepta have risen 20.7% in the year-to-date period against the industry’s 24.7% decline.

Image Source: Zacks Investment Research

Before submitting the information requested by the FDA, Sarepta had already claimed that hypomagnesemia was transient and the magnesium levels returned to normal in patients following additional supplementation.

SRP-5051 is being evaluated in a similar patient population targeted by Sarepta’s lead drug Exondys 51. SRP-5051 has the potential to offer DMD patients a better alternative with a much lower dose and a new drug with longer patent protection

SRP-5051 achieved a 1.6-fold increase in exon skipping and a five-fold increase in the percentage of normal dystrophin compared to Exondys 51 at 24 weeks, per previous data readout from the MOMENTUM study.

Presently, Sarepta has a portfolio of three commercialized DMD drugs — Exondys 51, Vyondys 53 and Amondys 45. The strong performance of these DMD drugs has been the key driver for Sarepta in the past few years.

Sarepta also focuses on developing novel treatments for DMD as well as other muscular atrophies. Apart from the next-generation SRP-5051, the company is developing several gene therapies targeting muscular atrophies. Sarepta is also one of the pioneers in gene therapy development.

Zacks Rank & Stocks to Consider

Sarepta currently carries a Zacks Rank #3 (Hold). Some better-ranked stock in the overall healthcare sector includes Kamada KMDA, Morphic MORF and Sesen Bio SESN, each of which has a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Kamada’s 2022 earnings per share have risen from 1 cent to 26 cents. Shares of Kamada have lost 27.7% in the year-to-date period.

Earnings of Kamada missed estimates in three of the last four quarters and beat the mark just once, witnessing a negative surprise of 212.50%, on average. In the last reported quarter, KMDA’s earnings beat estimates by 450%.

In the past 60 days, estimates for Morphic’s 2022 loss per share have narrowed from $3.47 to $1.75. Loss estimates for 2023 have narrowed from $3.96 to $3.77 during the same period. Shares of Morphic have lost 41.6% in the year-to-date period.

Earnings of Morphic beat estimates in three of the last four quarters and missed the mark just once, witnessing a surprise of 48.29%, on average. In the last reported quarter, MORF delivered an earnings surprise of 183.95%.

Estimates for Sesen Bio’s 2023 bottom line have narrowed from 27 cents to 1 cent in the past 60 days. Share prices of Sesen Bio have fallen 26.4% in the year-to-date period.

Earnings of Sesen Bio beat estimates in each of the last four quarters, the average surprise being 89.49%. In the last reported quarter, Sesen Bio delivered an earnings surprise of 61.54%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Kamada Ltd. (KMDA) : Free Stock Analysis Report

SESEN BIO, INC. (SESN) : Free Stock Analysis Report

Morphic Holding, Inc. (MORF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance