As Close Brothers Group (LON:CBG) lifts 6.7% this past week, investors may now be noticing the company's three-year earnings growth

Close Brothers Group plc (LON:CBG) shareholders should be happy to see the share price up 26% in the last quarter. Meanwhile over the last three years the stock has dropped hard. Tragically, the share price declined 68% in that time. Some might say the recent bounce is to be expected after such a bad drop. While many would remain nervous, there could be further gains if the business can put its best foot forward.

While the stock has risen 6.7% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Close Brothers Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Close Brothers Group actually managed to grow EPS by 9.2% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The company has kept revenue pretty healthy over the last three years, so we doubt that explains the falling share price. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

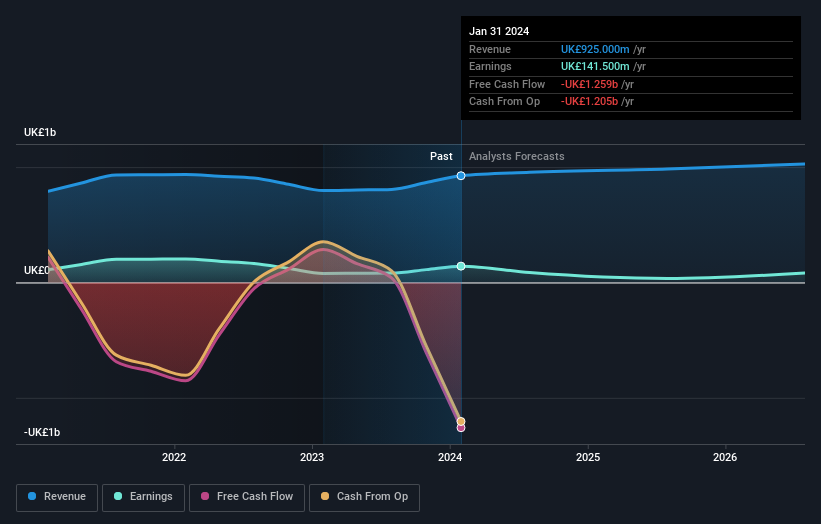

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Close Brothers Group has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Close Brothers Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Close Brothers Group's TSR of was a loss of 62% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Close Brothers Group shareholders are down 41% for the year, but the market itself is up 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Close Brothers Group , and understanding them should be part of your investment process.

We will like Close Brothers Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance