Cloudera's (CLDR) Q3 Earnings and Revenues Increase Y/Y

Cloudera CLDR reported third-quarter fiscal 2021 adjusted earnings of 15 cents per share in contrast to the Zacks Consensus Estimate of a loss of 4 cents per share. The company had reported a loss of 3 cents per share in the year-ago quarter. The robust bottom-line improvement was mainly driven by steady revenue growth and efficient cost management.

Revenues of $217.9 million beat the consensus mark by 4.3% and increased 9.9% year over year driven by rapid adoption of its cloud-based products and services.

The company reported better-than-guided third-quarter fiscal 2021 results. Annualized recurring revenues (ARR) were $756 million, up 12% year over year.

Similar to its Zacks Internet-Software industry peers like Anaplan PLAN, Nice NICE and Zuora ZUO, Cloudera benefited from subscription-based business model. Subscription revenues (90.6% of revenues) rose 18.2% year over year to $197.4 million, benefiting from rapid adoption of its cloud-based products and services.

Anaplan’s third-quarter fiscal 2021 subscription revenues (91.4% of total revenues) soared 31.4% year over year to $104.7 million. NICE’s third-quarter 2020 cloud revenues rose 33.9% year over year to $201.7 million. Zuora reported third-quarter fiscal 2021 subscription revenues of $62 million, an increase of 14.8% year over year.

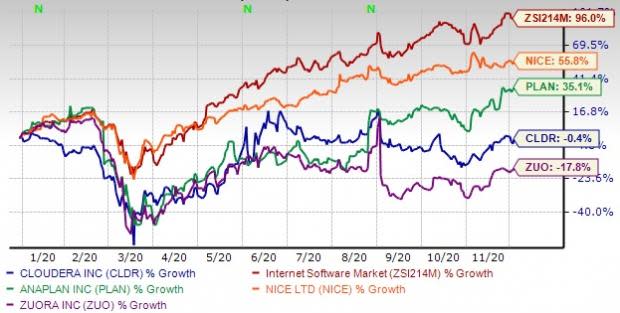

Cloudera has underperformed Nice, Anaplan and the industry while outperforming Zuora on a year-to-date basis.

Year to Date Performance

Quarter Details

Cloudera’s services (9.4% of revenues) declined 34.5% year over year to $20.5 million mainly due to coronavirus-led business disruption globally.

In the reported quarter, non-GAAP gross margin expanded 800 basis points (bps) on a year-over-year basis to 84.8%. Non-GAAP subscription gross margin expanded 440 bps year over year to 90.5%. Meanwhile, non-GAAP services gross margin expanded 240 bps on a year-over-year basis to 29.8%.

Research and development (R&D), sales and marketing (S&M) and general and administrative (G&A) expenses declined 15%, 16.3% and 14.8% on a year-over-year basis to $39.9 million, $69.5 million and $26 million, respectively. Moreover, as a percentage of revenues, R&D, S&M and G&A expenses declined 540 bps, 1000 bps and 340 bps, respectively.

For the third quarter of fiscal 2021, this Zacks Rank #3 (Hold) company reported non-GAAP income from operations of $49.3 million against non-GAAP loss from operations of $8.2 million reported in the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Balance Sheet & Cash Flow

As of Oct 31, 2020, Cloudera had total cash, cash equivalents, marketable securities and restricted cash of $567.5 million compared with $568.7 million reported in the previous quarter.

Moreover, reported operating cash outflow was $18.3 million compared with $32.4 million in the previous quarter.

Guidance

Fourth-Quarter Fiscal 2021

Cloudera expects revenues between $219 million and $222 million. The Zacks Consensus Estimate for revenues is currently pegged at $208.7 million, which indicates year-over-year growth of 5.2%.

Subscription revenues are estimated between $199 million and $202 million.

Non-GAAP net earnings are expected between 10 cents and 12 cents per share. The Zacks Consensus Estimate is pegged at 9 cents per share.

Fiscal 2021

Cloudera expects revenues between $862 million and $865 million. The Zacks Consensus Estimate for revenues is currently pegged at $849.7 million, which suggests year-over-year growth of 7%.

Subscription revenues are estimated between $775 million and $778 million.

Non-GAAP net earnings are expected between 40 cents to 42 cents. The Zacks Consensus Estimate for earnings is pegged at 33 cents per share.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nice Ltd. (NICE) : Free Stock Analysis Report

Cloudera, Inc. (CLDR) : Free Stock Analysis Report

Zuora, Inc. (ZUO) : Free Stock Analysis Report

Anaplan, Inc. (PLAN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance