CMC Markets' (LON:CMCX) Upcoming Dividend Will Be Larger Than Last Year's

CMC Markets plc (LON:CMCX) has announced that it will be increasing its dividend on the 9th of September to UK£0.21. This takes the dividend yield from 6.7% to 6.7%, which shareholders will be pleased with.

Check out our latest analysis for CMC Markets

CMC Markets Is Paying Out More Than It Is Earning

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, CMC Markets was quite comfortably covering its dividend with earnings and it was paying more than 75% of its free cash flow to shareholders. The company is clearly earning enough to pay this type of dividend, but it is definitely focused on returning cash to shareholders, rather than growing the business.

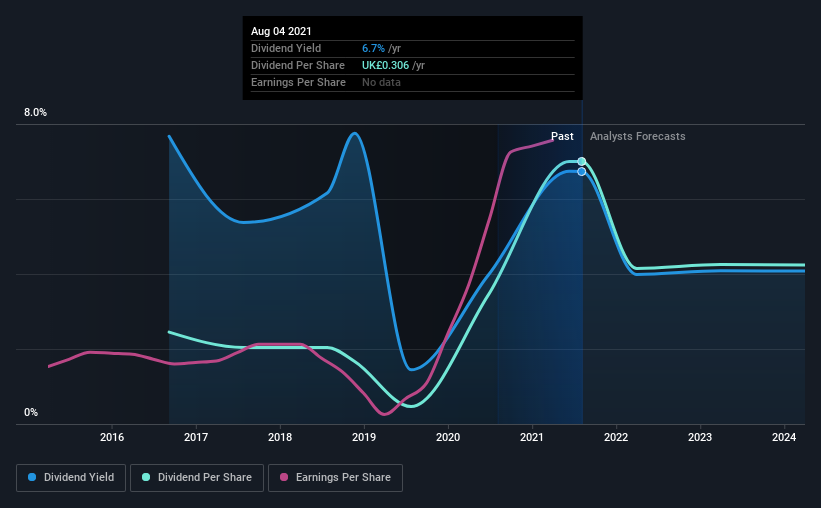

Looking forward, earnings per share is forecast to fall by 39.5% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 105%, which could put the dividend under pressure if earnings don't start to improve.

CMC Markets' Dividend Has Lacked Consistency

Looking back, CMC Markets' dividend hasn't been particularly consistent. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The first annual payment during the last 5 years was UK£0.11 in 2016, and the most recent fiscal year payment was UK£0.31. This means that it has been growing its distributions at 23% per annum over that time. CMC Markets has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that CMC Markets has grown earnings per share at 32% per year over the past five years. The company's earnings per share has grown rapidly in recent years, and it has a good balance between reinvesting and paying dividends to shareholders, so we think that CMC Markets could prove to be a strong dividend payer.

Our Thoughts On CMC Markets' Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments CMC Markets has been making. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 3 warning signs for CMC Markets you should be aware of, and 2 of them don't sit too well with us. We have also put together a list of global stocks with a solid dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance