CME Group's (CME) Q1 Earnings Top Estimates, Revenues Up Y/Y

CME Group Inc. CME reported first-quarter 2020 adjusted earnings per share of $2.33, which surpassed the Zacks Consensus Estimate by 4.5%. The bottom line also improved 43.8% year over year, primarily due to higher revenues.

Performance in Detail

CME Group’s revenues of $1.5 billion increased 29% year over year courtesy of strong clearing and transaction fees. Moreover, the top line beat the Zacks Consensus Estimate by 1.4%. The year-over-year improvement in revenues can be attributed to higher clearing and transaction fees, which improved 34.2% year over year.

Total expenses increased 2.5% year over year to $562.2 million during the reported quarter on account of higher professional fees and outside services; depreciation and amortization; licensing and other fee agreements plus other expenses.

Operating income improved 52.1% from the prior-year quarter to $959.9 million.

Average daily volume surged 45% year over year to 27 million contracts in the quarter.

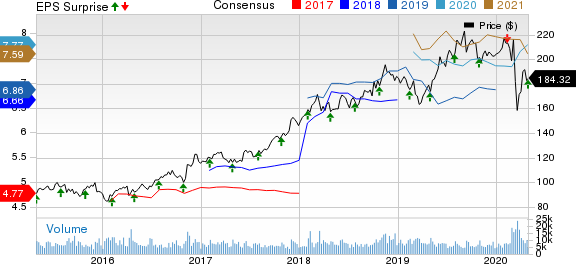

CME Group Inc. Price, Consensus and EPS Surprise

CME Group Inc. price-consensus-eps-surprise-chart | CME Group Inc. Quote

Financial Update

As of Mar 31, 2020, CME Group had $851.7 million of cash and cash equivalents, down 45.1% from the level at 2019 end. As of Mar 31, 2020, long-term debt of $3.5 billion slipped 5.4% from the figure at 2019 end.

The company exited the first quarter with total assets worth $137.9 billion, up 83.4% from the number at 2019 end.

Capital Deployment

CME Group announced dividends of $1.2 billion for the first quarter including the annual variable dividend worth $894 million. The company returned $13.5 billion to its shareholders via since the implementation of the variable dividend policy in early 2012.

Zacks Rank

CME Group currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Securities Exchange Industry Players

First-quarter earnings of Nasdaq, Inc. NDAQ and MarketAxess Holdings Inc. MKTX beat the respective Zacks Consensus Estimate

Upcoming Release

A stock worth considering from the finance sector with the perfect mix of elements to also beat on earnings in the respective upcoming release:

Virtu Financial, Inc. VIRT has an Earnings ESP of +39.67% and a Zacks Rank #1. The company is slated to announce first-quarter 2020 earnings on May 7.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CME Group Inc. (CME) : Free Stock Analysis Report

Nasdaq, Inc. (NDAQ) : Free Stock Analysis Report

MarketAxess Holdings Inc. (MKTX) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance