CMS Energy (CMS) Arm to Power Walmart Stores With Clean Energy

CMS Energy Corp.’s CMS subsidiary, Consumers Energy, recently entered into a partnership agreement with Walmart Inc. to supply clean energy to 44 Walmart locations in Michigan. This should boost CMS Energy’s footprint in the rapidly expanding renewable energy market.

Per the deal, Walmart has agreed to meet 90% of the energy consumption at its 44 stores with renewable energy sourced from future projects developed by Consumers Energy in Michigan.

CMS’ Transition in Energy Space

Amid increasing electricity demand across the United States, utility providers in the nation, like CMS Energy, are rapidly shifting their focus from fossil fuels toward cleaner energy sources to earn the economic, environmental, social and governance incentives offered by the utility-scale renewable energy market.

As part of its clean energy portfolio expansion strategy, CMS Energy has a capital expenditure plan of $3.4 billion for clean energy generation, which includes investments in wind, solar and hydroelectric generation resources for the 2024-2028 period. This represents 20% of the company’s total capital expenditure.

Through these investments, CMS Energy plans on adding 8,000 megawatts (MW) of solar and 550 MW of battery storage by 2040. The company owns and operates five wind parks in Michigan as of Dec 31, 2023.

Under Consumers Energy’s Large Customer Renewable Energy Program, businesses can subscribe to match a given percentage of their energy use with clean energy. The program is approved to grow up to 1,000 MW. Currently, more than 30 businesses that Consumers Energy serves have committed to approximately 600 MW of clean energy.

Such initiatives, along with the latest deal with Walmart, should enable CMS to duly achieve its clean energy goal of net-zero carbon emissions by 2040.

Growth Prospects

The global economy has been witnessing increasing demand for clean energy, with the United States dominating the renewable energy market. This sector benefits from the declining renewables cost and favorable government policies. To this end, a report from the Grand View Research firm estimates that the global renewable energy market is expected to witness a CAGR of 17.2% during 2024-2030. To reap the benefits of the expanding renewable energy market, utilities are enhancing their clean energy portfolio significantly, with CMS Energy being no exception.

Of its latest developments in this space, Consumers Energy started the operation of Heartland Farms Wind in Gratiot County, providing 201 MW of energy, in 2024. The company also announced a partnership to develop its first large-scale solar project, the Muskegon Solar Energy Center, a 250 MW facility.

Peer Moves

Other utility players that are indulging in the expansion strategy to meet the growing demand of the renewable energy market are as follows:

Duke Energy DUK: For the 2024-2028 period, Duke Energy has a capital investment plan of approximately $19 billion for regulated zero-carbon generation, which represents 26% of its total capital expenditure. The company plans to bring 6,500 MW of new solar and 2,700 MW of battery storage in service by 2031 and 1,200 MW of onshore wind in service by 2033.

DUK has a long-term (three-to-five-years) earnings growth rate of 6.3%. The Zacks Consensus Estimate for 2024 sales implies a rise of 4.5% from 2023.

American Electric Power AEP: For 2024-2028, AEP has a capital expenditure plan of $9.4 billion focused on regulated renewables. As of Dec 31, 2023, American Electric’s regulated utilities own and operate 1,639 MW of wind, 816 MW of hydro and 41 MW of solar power. The company further plans to add 20 gigawatts (GW) of new resource opportunities between 2024 and 2033.

AEP has a long-term earnings growth rate of 5.1%. The Zacks Consensus Estimate for 2024 sales indicates a rise of 9% from the 2023 projected figure.

Consolidated Edison ED: In 2023, ED’s clean energy businesses had a capital expenditure of $49 million. Over the next 10 years, Consolidated Edison aims to spend $19 billion to support clean energy generation. It will develop clean energy hubs to facilitate 6,000 MW of offshore wind, new substations, local transmission projects and peak demand reduction strategies.

ED has a long-term earnings growth rate of 2%. The Zacks Consensus Estimate for 2024 sales implies a rise of 3.9% from 2023.

Price Performance

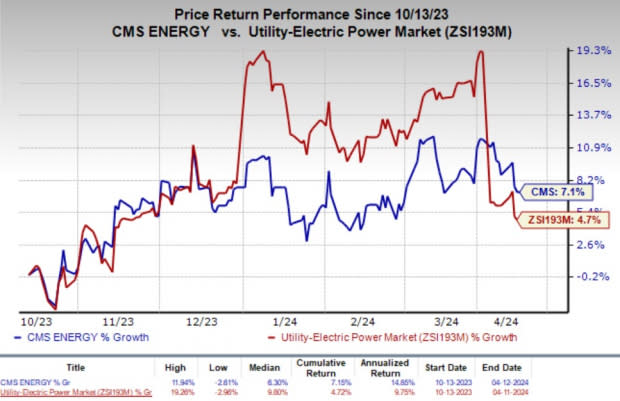

Over the past six months, shares of CMS have gained 7.1% compared with the industry’s 4.7% growth.

Image Source: Zacks Investment Research

Zacks Rank

CMS Energy currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance