CNA or RE: Which Property & Casualty Insurer Has an Edge?

The Zacks Property and Casualty Insurance industry has been gaining momentum on the back of improved pricing, increased technology advancements, exposure growth, underwriting profitability, favorable reserve development and global expansion as well as an impressive solvency level.

The industry has risen 14.4% in the past year against the Zacks S&P 500 composite’s decline of 12.4% and the Finance sector’s 7.8% decline.

Image Source: Zacks Investment Research

Here we focus on two property and casualty insurers, namely Everest Re Group, Ltd. RE and CNA Financial Corporation CNA.

Everest Re, with a market capitalization of $12.9 billion, provides commercial property and casualty insurance products through wholesale and retail brokers. It provides reinsurance and insurance products in the United States and internationally. CNA Financial, with a market capitalization of $11.4 billion, provides commercial property and casualty insurance products primarily in the United States. Both insurers carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Per the Global Insurance Market Index by Marsh, global commercial insurance prices increased 6% in the third quarter of 2022. This marked the 20th consecutive quarter in which composite pricing rose, continuing the longest run of increases since the inception of the index in 2012. Price hikes, operational strength, higher retention, strong renewal and the appointment of retail agents should help write higher premiums.

Per Deloitte Insights, The Swiss Re Institute estimates an increase in demand for insurance coverage across the globe, in turn driving a 3.9% rise in premiums in 2022. Per Deloitte Insights, life insurance premium is estimated to increase 4%, while non-life insurance premium is expected to increase 3.7% in 2022.

The P&C insurers remain exposed to catastrophe loss from natural disasters and weather-related events, which induce volatility in their underwriting results. Per Colorado State University, the 2022 above-average hurricane season may have 19 named storms, including nine hurricanes and four major hurricanes. Global estimated insured losses from natural catastrophes in the first half of 2022 were $35 billion, 22% above average of the past 10 years ($29 billion), per a report by Swiss Re Institute.

Exposure growth, better pricing, prudent underwriting and favorable reserve development will help withstand the blow. Also, frequent occurrences of natural disasters should accelerate the policy renewal rate.

The solid capital level continues to aid insurers in pursuing strategic mergers and acquisitions, investing in growth initiatives, engaging in share buybacks, increasing dividends or paying out special dividends. Consolidation is likely to continue as players look to diversify their operations into new business lines and geographies.

With the reopening of the economy and robust capital level of the insurers, 2021 witnessed 869 deals, which increased 40% from 620 in 2020 while the total deal value surged 165% to $57.5 billion per Deloitte. However, with high inflation and a rise in interest rate (the Fed has already made five rate hikes this year), the momentum in the M&A environment is likely to slow down. Per Deloitte, so far this year, the number of deals dropped about 30% while deal value dropped by about 25% and is estimated to hit a low point.

The interest rate environment has started to improve. In November 2022, Fed officials declared to raise interest rates by 75 basis points, shifting the target range to 3.75%-4%. This marked the sixth consecutive rate hike in 2022. Thus, insurers are poised to benefit as net investment income is an important component of their top line.

The insurers have increased investment in emerging technologies in a bid to drive efficiency, enhance cybersecurity as well as expand automation capabilities across the organization. The adoption of technologies such as robotic process automation, Chatbot and RoboAdvisory, artificial intelligence and data analytics, insurtech solutions, telematics and cloud computing is gaining steam. Deloitte’s Global survey projects insurers’ technology budget to increase 13.7% in 2022.

Now let’s take a look at how RE and CNA are poised.

Price Performance

Everest Re has gained 25.9% in the past year, outperforming the industry’s increase of 15.2%. CNA Financial shares have declined 1.9% in the said time frame.

Image Source: Zacks Investment Research

Return on Equity (ROE)

Everest Re, with a return on equity (ROE) of 10.5%, exceeds CNA Financial’s ROE of 10.1% and the industry average of 6.7%.

Image Source: Zacks Investment Research

Valuation

The price-to-book value is the best multiple used for valuing insurers. Compared with Everest Re’s P/B ratio of 1.70, CNA Financial is cheaper, with a reading of 1.41. The P&C insurance industry’s P/B ratio is 1.55.

Image Source: Zacks Investment Research

Dividend Yield

CNA Financial’s dividend yield of 3.8% betters Everest Re’s dividend yield of 2%. Thus, CNA Financial has an advantage over Everest Re on this front.

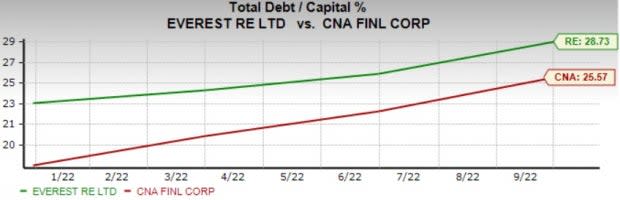

Debt-to-Capital

Everest Re’s debt-to-capital ratio of 28.7 is higher than the industry average of 20.5 and CNA Financial’s reading of 25.6. Therefore, CNA Financial has an advantage over Everest Re on this front.

Image Source: Zacks Investment Research

Combined Ratio

Everest Re’s combined ratio was 98.8 in the first nine months of 2022, whereas that of CNA Financial was 93% in the said time frame. Thus, the combined ratio of CNA Financial betters that of Everest Re.

To Conclude

Our comparative analysis shows that CNA Financial is better positioned than Everest Re with respect to dividend yield, combined ratio, leverage and valuation. Meanwhile, Everest Re scores higher in terms of price and return on equity. With the scale significantly tilted toward CNA Financial, the stock appears to be better poised.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance