CNH Industrial (CNHI) Up 2.7% Since Q3 Earnings & Sales Beat

CNH Industrial CNHI announced third-quarter 2021 results on Nov 4, before the opening bell. The company’s comprehensive beat and improved year-over-year performance have pushed the stock 2.7% higher since then.

CNH Industrial posted third-quarter 2021 adjusted earnings per share of 36 cents, increasing from 11 cents reported in the prior-year period and surpassing the Zacks Consensus Estimate of 22 cents. Higher-than-anticipated revenues across all but the Powertrain segment resulted in this outperformance.

For the third quarter, consolidated revenues climbed 23% from the year-ago level to $7,972 million and topped the consensus mark of $7,623 million. The company’s net sales for industrial activities came in at $7,537 million, up 23% year on year.

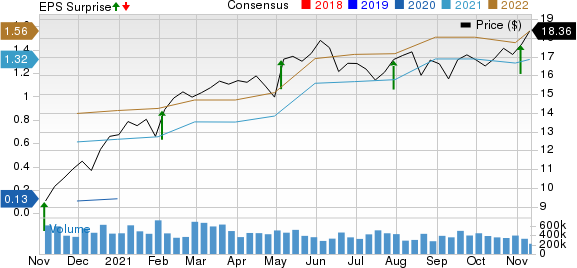

CNH Industrial N.V. Price, Consensus and EPS Surprise

CNH Industrial N.V. price-consensus-eps-surprise-chart | CNH Industrial N.V. Quote

Segmental Performance

For the September-end quarter, net sales in the Agricultural Equipment segment jumped 31.3% year over year to $3,563 million. The metric also surpassed the Zacks Consensus Estimate of $3,263 million. The segment’s adjusted EBIT came in at $415 million, surging 141% from the year-ago quarter on higher volumes, positive price realization and favorable mix, partially offset by rising raw material and freight costs as well as increased selling, general & administrative (SG&A) and research & development (R&D) spend.

The Construction Equipment segment’s sales escalated 34.2% year over year to $773 million for third-quarter 2021. Revenues from the unit also outpaced the Zacks Consensus Estimate of $612 million. Adjusted EBIT came in at $21 million, reversing the loss of $24 million posted in the prior-year period on the back of favorable volume and better price realization.

Revenues in Commercial and Specialty vehicles increased 21.4% year on year to $2,879 million, beating the consensus mark of $2,788 million. Adjusted EBIT came in at $51 million against the loss of $7 million reported in the prior-year period. This upside primarily stemmed from higher volumes, positive price realization and favorable mix, partially offset by rising raw material costs as well as higher SG&A and R&D spend.

The Powertrain segment’s quarterly revenues edged up 4.8% year over year to $953 million for the third quarter. The reported figure missed the consensus mark by a penny. Adjusted EBIT from the segment declined 16% from the prior-year quarter to $44 million amid high freight and commodity, and SG&A costs.

The Financial Services segment revenues came in at $450 million, up 10.3% year over year. The reported figure also topped the consensus mark of $420 million. Net income from the segment jumped 62% from the prior-year quarter to $118 million, primarily on lower risk costs and improved pricing on used-equipment sales.

Financial Details

CNH Industrial had cash and cash equivalents of $7,149 million as of Sep 30, 2021. The company’s debt totaled $23,749 million at the end of the third quarter of 2021. The firm had available liquidity of $13,476 million as of Sep 30, 2021 compared with $15,871 million at 2020-end.

CNH Industrial’s cash provided by operating activities was $521 million during the reported quarter. Free cash flow (FCF) from industrial activities came in at a negative $728 million for the third quarter.

2021 View

CNH Industrial expects net sales from industrial activities (including currency-translation effects) for 2021 to increase from the lower end of the prior forecast (24-28% sales growth year on year). The company envisions FCF from industrial activities for the ongoing year to be roughly $1 billion. R&D expenses and capex are projected at around $2 billion.

Zacks Rank & Key Picks

CNH Industrial currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the industry include Tesla TSLA, Harley-Davidson HOG and Goodyear Tire GT, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Tesla has an expected earnings growth rate of 63% for the current year. The Zacks Consensus Estimate for the current year has been revised upward by 6 cents over the past seven days.

Tesla beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed once, with an average surprise of 25.4%. Shares of this electric vehicle king have rallied around 51% year to date.

Harley-Davidson has an expected earnings growth rate of an astounding 34,500% for the current year. The Zacks Consensus Estimate for the current year has been revised upward by 18 cents over the past 30 days.

The motorcycle giant beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed once, with an average negative surprise of 138.5%. Shares of Harley Davidson have inched up around 3% year to date.

Goodyear has an expected earnings growth rate of 174.8% for the current year. The Zacks Consensus Estimate for the current year has been revised upward by 38 cents over the past 30 days.

Goodyear beat the Zacks Consensus Estimate for earnings in each of the last four quarters, with an average of 228.5%. Shares of this leading tire company have rallied around 115% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HarleyDavidson, Inc. (HOG) : Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

CNH Industrial N.V. (CNHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance