CNO Financial Group Reports Strong First Quarter 2024 Earnings, Surpassing Analyst Projections

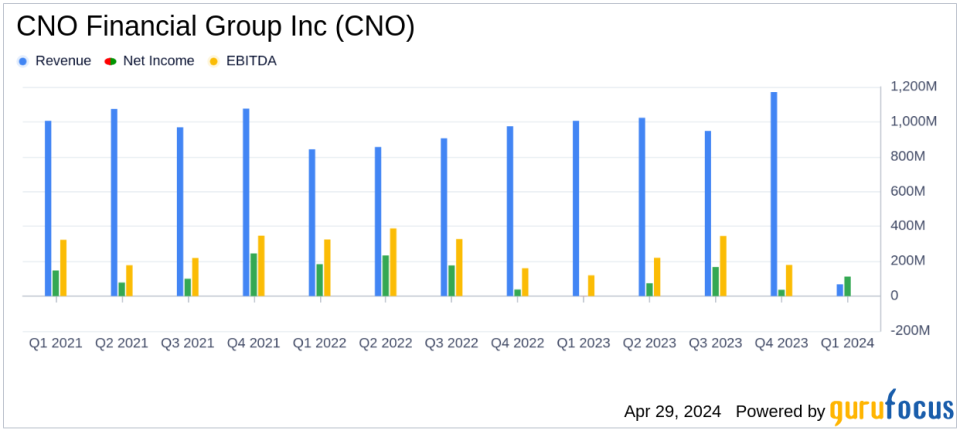

Net Income: Reported at $112.3 million, a significant recovery from a net loss of $0.8 million in the previous year, surpassing the estimated $73.18 million.

Earnings Per Share (EPS): Achieved $1.01 per diluted share, considerably exceeding the estimated $0.66.

Revenue: Total revenues reached $1,156.5 million, showing robust growth from $1,006.0 million in the previous year and surpassing the estimated $944.76 million.

Book Value Per Diluted Share: Increased to $34.97, up from $31.82 year-over-year, indicating a stronger equity position.

Return on Equity (ROE): Marked at 18.8%, although it shows a decrease from 21.8% in the previous year, it still highlights strong profitability.

Shareholder Returns: Returned $57.3 million to shareholders through dividends and share repurchases, emphasizing a commitment to returning value.

Investment Portfolio: The fair value of fixed maturities in the investment portfolio stood at $21.6 billion, with a slight decrease in unrealized losses compared to the previous period.

CNO Financial Group Inc (NYSE:CNO) released its 8-K filing on April 29, 2024, revealing a robust financial performance for the first quarter of 2024. The company reported a net income of $112.3 million, or $1.01 per diluted share, a significant recovery from a net loss of $0.8 million in the same quarter of the previous year. This performance notably exceeds the analyst estimates of an earnings per share of $0.66 and a net income of $73.18 million.

CNO Financial Group Inc is a prominent insurance holding company, catering primarily to middle-income American consumers through a variety of insurance and financial products. The company operates through different segments including annuity, health, and life insurance, with health products generating the maximum revenue. Annuities, comprising fixed index, traditional fixed-rate, and single-premium immediate annuity products, form a significant part of the company's premium collection.

The first quarter results demonstrated strong sales and distribution force growth, with total new annualized premiums increasing by 8%. The Consumer Division saw a 7% increase in new annualized premiums and an 8% rise in producing agent count. The Worksite Division experienced even more substantial growth, with new annualized premiums up by 19% and producing agent count increasing by 28%. Medicare Supplement new annualized premiums rose by 24%, and Medicare Advantage policies sold increased by 38%.

CEO Gary C. Bhojwani commented on the results, stating,

First quarter results were among the best operating metrics weve delivered in the past several years with respect to Consumer and Worksite sales, our distribution force and new products."

He also noted the impact of unfavorable mark-to-market pre-tax impacts on real estate partnerships within the alternative investment portfolio, which was the only significant offset to the quarter's strong operating results.

The company's financial health remains robust, as evidenced by a return on equity of 18.8% and an operating return on equity, as adjusted, of 9.7%. The book value per diluted share, excluding accumulated other comprehensive loss, was reported at $34.97, reflecting the company's strong capital position and growth.

During the quarter, CNO Financial returned $57.3 million to shareholders and maintained its full-year guidance unchanged, signaling confidence in its operational strategy and financial planning.

The company's investment portfolio remains solid with a total of $22.7 billion in fixed maturities and a fair value of $21.6 billion for available-for-sale fixed maturity securities. The statutory risk-based capital ratio of CNO's U.S. based insurance subsidiaries was estimated at 391% as of March 31, 2024.

In conclusion, CNO Financial Group's first quarter of 2024 sets a positive tone for the year, with significant improvements in net income and sustained growth across its core business segments. The company's strategic focus on serving the middle-income consumer market and its strong financial health positions it well for continued success.

Explore the complete 8-K earnings release (here) from CNO Financial Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance