Coca-Cola Bottling (COKE) Q1 Earnings: What's in Store?

Coca-Cola Bottling Co. Consolidated COKE is scheduled to report first-quarter 2018 financial numbers on May 8, after the closing bell.

This large independent bottler of The Coca-Cola Company KO has an encouraging strategy to grow both organically and through the acquisition of additional manufacturing and distribution territory.

A Look at Its Sales Performance

The company’s fourth quarter was one of the busiest quarters, in which System Transformation acquisition transactions with the Coca-Cola Company came to an end. With the company’s expanded footprint, net sales increased 33.8% in the last reported quarter. The upside can be attributed to acquisitions and higher comparable net sales.

Comparable net sales improved 6.7%, driven by 1.5% rise in comparable equivalent unit case volumes. Sparkling product comparable volumes were down 0.7%, while that of still products increased 8.3%.

In 2017, Coca-Cola Bottling reported net sales growth of 37% year over year, primarily on acquisitions and a 3.1% hike in comparable net sales owing to 1.6% rise in comparable equivalent unit case volumes. The trend is expected to continue in the first quarter as well.

The sparkling product portfolio and higher margin still product range drove comparable net sales of the company. Sparkling product comparable volumes grew 0.2% year over year and that of still products increased 4.9% in 2017. This trend is expected to continue in the to-be-reported quarter as well.

Higher Expenses a Woe

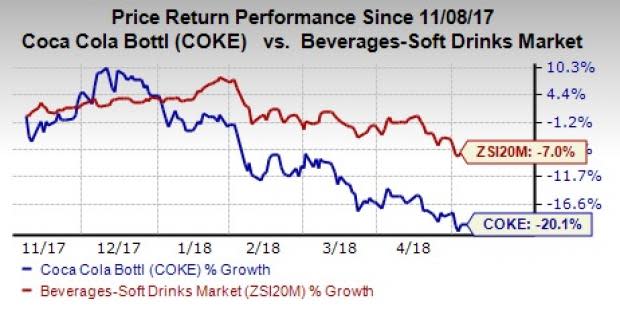

Higher expenses (such as expansion transaction and amortization expenses) might dent the company’s bottom line. Notably, the stock witnessed dismal trading in the past six months, with the stock plunging 20.1% compared with the industry’s 7% decline.

In the fourth quarter, the company’s income from operations declined 104.2% year over year and in 2017, the same decreased 24.8%. Income from operations was impacted by a challenging retail sales environment.

Peer Releases

The Coca-Cola Company started off 2018 on a strong note, beating the Zacks Consensus Estimate on both counts in first-quarter 2018.

PepsiCo, Inc. PEP reported first-quarter 2018 (ending Mar 24) results, with earnings and revenues both beating the Zacks Consensus Estimate. Notably, this is the eighth consecutive quarter of positive earnings surprise. The improvement was mainly attributable to strong performances in its international divisions, propelled by higher revenue growth in developing and emerging markets.

Upcoming Peer Release

Monster Beverage Corporation MNST is scheduled to report first-quarter 2018 results on May 8, after the closing bell.

PepsiCo and Coca-Cola carry a Zacks Rank #3 (Hold), while Monster Beverage holds a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Coca-Cola Company (The) (KO) : Free Stock Analysis Report

Pepsico, Inc. (PEP) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance