Is Coca-Cola (NYSE:KO) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, The Coca-Cola Company (NYSE:KO) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Coca-Cola

What Is Coca-Cola's Debt?

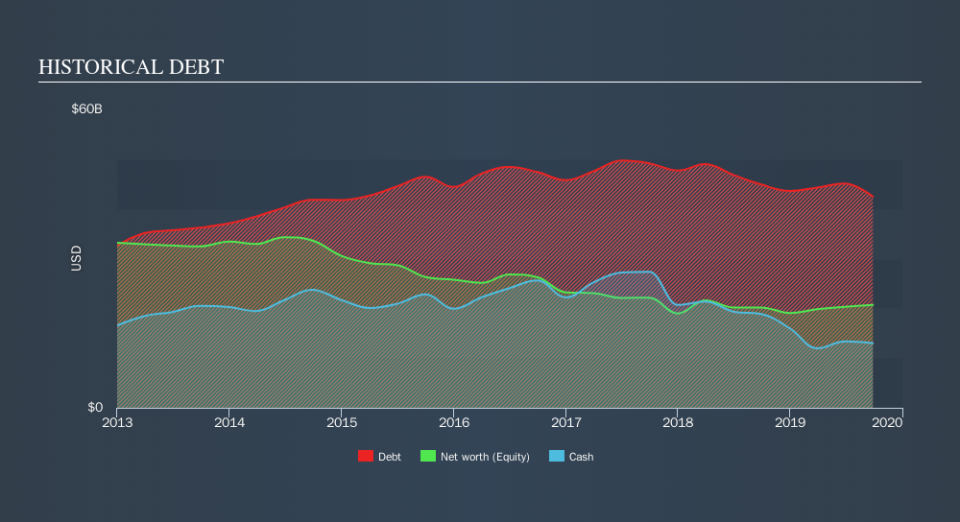

As you can see below, Coca-Cola had US$41.1b of debt at September 2019, down from US$44.9b a year prior. However, it also had US$13.0b in cash, and so its net debt is US$28.1b.

How Healthy Is Coca-Cola's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Coca-Cola had liabilities of US$25.1b due within 12 months and liabilities of US$41.7b due beyond that. On the other hand, it had cash of US$13.0b and US$4.35b worth of receivables due within a year. So it has liabilities totalling US$49.4b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Coca-Cola is worth a massive US$234.7b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Coca-Cola has a debt to EBITDA ratio of 2.6, which signals significant debt, but is still pretty reasonable for most types of business. However, its interest coverage of 28.6 is very high, suggesting that the interest expense may well rise in the future, even if there hasn't yet been a major cost attached to that debt. Sadly, Coca-Cola's EBIT actually dropped 2.1% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Coca-Cola's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Coca-Cola produced sturdy free cash flow equating to 68% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Coca-Cola's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its net debt to EBITDA does undermine this impression a bit. All these things considered, it appears that Coca-Cola can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. We'd be motivated to research the stock further if we found out that Coca-Cola insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance