Codorus Valley Bancorp Inc (CVLY) Reports Q1 2024 Earnings: A Detailed Review Against Analyst ...

Net Income: Reported at $4.3 million, falling short of the estimated $4.6 million.

Earnings Per Share (EPS): Achieved $0.44 per diluted share, below the estimated $0.47.

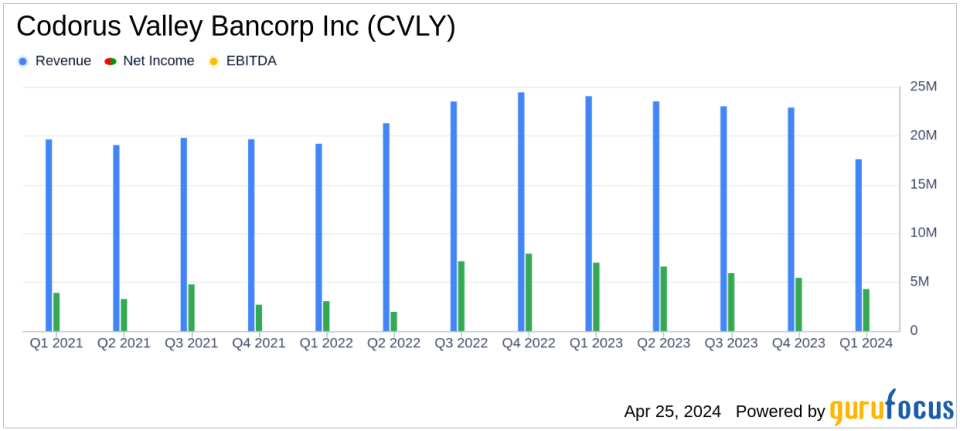

Revenue: Net interest income for the quarter was $17.6 million, indicating a decrease from previous periods and not meeting the estimated revenue of $22.3 million.

Loan Growth: Loans increased by $32.5 million, showing an annualized growth rate of 7.8%, with significant growth in commercial loans.

Deposits: Total deposits rose by $41.7 million to $1.92 billion, with a notable increase in interest-bearing accounts.

Noninterest Income: Increased by $196,000 to $4.2 million, primarily due to reduced losses on sales of securities compared to the previous year.

Merger Update: Continuing progress on the merger with Orrstown Financial Services, expecting to incur additional merger-related expenses in 2024.

Codorus Valley Bancorp Inc (NASDAQ:CVLY) released its 8-K filing on April 25, 2024, detailing the financial results for the first quarter ended March 31, 2024. The company reported a net income of $4.3 million, or $0.44 per diluted common share, which fell short of analyst estimates predicting earnings of $0.47 per share and a net income of $4.60 million. The reported revenue for the quarter was not directly disclosed but can be inferred from the net interest income and noninterest income totaling approximately $21.8 million, slightly missing the anticipated $22.30 million.

Codorus Valley Bancorp Inc, headquartered in York, Pennsylvania, operates primarily through its subsidiary PeoplesBank, offering a comprehensive range of consumer, business, wealth management, and mortgage services. The bank operates in a single segment, community banking, with a significant revenue derived from interest income.

Financial Performance Overview

The first quarter saw a decrease in net income both year-over-year and sequentially, with significant declines from $7.0 million in Q1 2023 and $5.5 million in Q4 2023. This reduction is partly attributed to increased noninterest expenses and a challenging banking environment, which impacted the net interest margin and overall profitability.

Loans showed a positive trajectory, increasing by $32.5 million, driven by growth in commercial loans and commercial real estate. However, the bank also faced a rise in nonperforming assets, which increased by 85.0 percent to $7.4 million, indicating potential credit quality issues.

Investment securities experienced a decrease due to maturities and paydowns, and the bank's portfolio of securities saw an unrealized loss increase, reflecting the impact of market conditions on investment valuations.

Challenges and Strategic Actions

The bank is navigating a tough banking landscape with proactive measures to manage credit risk and enhance its balance sheet. According to Craig L. Kauffman, President, and CEO, the focus remains on "retaining and expanding client relationships" and preparing for the upcoming merger with Orrstown Financial Services, which is expected to create a leading regional community bank.

Merger and Future Outlook

The impending merger with Orrstown Financial Services is a significant move for Codorus Valley Bancorp Inc, aiming to expand its market presence and operational capabilities. This strategic initiative is anticipated to bring about integration challenges but also long-term growth opportunities for the combined entity.

Capital and Liquidity

The bank maintains strong capital levels, with shareholders equity increasing to $201.0 million. It also reported a robust liquidity position, with a significant portion of its deposits insured or fully collateralized, enhancing financial stability.

Dividend Announcement

Reflecting confidence in its financial stability, Codorus Valley declared a quarterly cash dividend of $0.17 per share, payable on May 14, 2024, to shareholders of record as of May 7, 2024.

Conclusion

While Codorus Valley Bancorp Inc faced several challenges in Q1 2024, its strategic initiatives, including the forthcoming merger and strong focus on risk management and client relationships, position it to potentially capitalize on future growth opportunities. Investors and stakeholders will be watching closely how the merger with Orrstown Financial Services unfolds and impacts the banks trajectory in the competitive banking sector.

Explore the complete 8-K earnings release (here) from Codorus Valley Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance