Coffee chains seek fresh ideas as appetites wane

After years of astonishing growth, a highly caffeinated Britain may be approaching peak coffee.

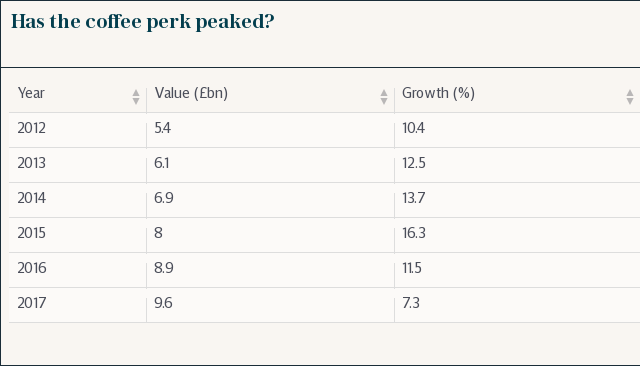

Industry monitor Allegra shows UK coffee shop sales grew by 7.3pc last year. The figure appears impressive compared with anaemic economic growth and even high inflation, but by the recent standards there is cause for concern. Growth was down a third on 2016 and less than half the rate of 2015.

The increasingly cautious consumer, rising wage costs and the demand on coffee shops to offer healthy food, fast Wi-Fi and mobile apps could put added pressure on the sector. That is before the spectre of a potential levy on non-recyclable coffee cups.

Incumbents are also facing a growing invasion from the independent coffee sector and big businesses using coffee to get customers into their stores, such as supermarket Waitrose.

EY leisure expert Christian Mole says he would be “pleasantly surprised” if the growth rate announced by Allegra was the same in 2018, especially given the slowdown in like-for-like sales at some of the biggest chains, including Costa Coffee.

“We have seen huge growth in coffee shops,” he says. “But now they have these sites, they need to work out how to get people to keep spending money.”

Mole says this is a particular issue for larger companies, with consumers always looking for something new.

“We are seeing a bit of a rise in the more premium end, which relates more to independent names,” he adds.

Allegra’s managing director, Jeffrey Young, agreed that the artisan scene developed in the mid-2000s had become widespread in the UK and had now entered a “new era of exceptional professionalism”, which had seen fresher entrants hone their offering in a way that made a store roll-out easier.

“Specialised artisanal chains, such as Gail’s, Grind and Joe & The Juice, gained momentum in 2017, all embracing the latest trend to cater to more discerning and less brand-loyal millennials with premium-quality coffee and service,” Young says.

While he says the coffee industry has produced “nearly two decades of unbridled growth”, Young acknowledges that coffee chains would be “more cautious” with their opening plans, given the fragility of the economy. “The industry has had cost pressures recently with the declining pound, which made import costs of coffee and packaging higher,” he says. “There are tough times ahead and perhaps a little bit of slowing growth from operators and not so much optimism.”

Consumers are being more careful with their disposable income given pressure on earnings. Data from the Office for National Statistics showed in the year to March 2017, consumers’ spending increased 4pc even though incomes only grew by 2.3pc.

Such conditions will make the market even more competitive as companies will have to battle harder for consumers’ cash. For the likes of Costa, convenience is king and could mean higher property spending is required in spite of the tougher market. Costa is targeting coffee lovers away from the high street, at railway and petrol stations. Retail parks, which accounted for one in 50 new outlets a few years ago, are now nearly one in five.

Still, the coffee business appears to be getting tougher for Costa and its rivals. Trish Caddy, from market research firm Mintel, suggests traditional coffee shops will have to work even harder to maintain custom given the country’s high streets were now “congested” with specialist and non-specialist vendors of coffee.

She said the likes of Greggs and McDonald’s were now competing heavily for the out-of-home coffee drinker, meaning it was “much harder to make money today” for the normal coffee shop. “This has led to brands slowing down their store openings and focusing on existing sites,” she says.

While other fixes, such as a broader range of food and the latest consumer fad for oat, almond or coconut lattes, might move the dial a bit in the short term, Ms Caddy reckons the long-term growth of the industry could be spurred on by some overseas invaders.

“I would hope growth from international names coming to the UK, such as Tim Hortons and Second Cup, might help fuel future growth,” she said.

Tim Hortons, the coffee and doughnut chain, recently launched in the UK under a franchise model. The firm is backed by 3G Capital, the controlling shareholder of Burger King.

Mintel’s recent forecast on the coffee shop market said consumers were spreading their budgets across a larger number of establishments selling coffee, a trend that is likely to rise.

Because of this, Mintel expects the UK coffee shop market value to have grown by just 0.9pc in 2017 with sales of £3.4bn. “Much of the growth seen in 2015-16 came in the form of [a rise in footfall] helped by the expansive store presence of leading players,” it said.

“However, the slow growth projection suggests that the coffee shops market is now saturated.”

Yahoo Finance

Yahoo Finance