Cognizant (CTSH) Q4 Earnings Beat, Revenues Increase Y/Y

Cognizant Technology Solutions CTSH reported fourth-quarter 2019 non-GAAP earnings of $1.07 per share that beat the Zacks Consensus Estimate by 2.9%. Moreover, the figure increased 9.2% from the year-ago quarter.

Revenues of $4.3 billion surpassed the consensus mark by 1.5%. The figure improved 4.2% year over year at constant currency (cc).

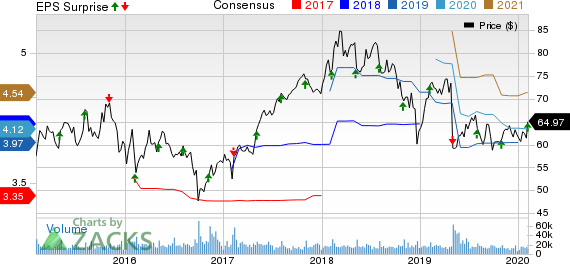

Cognizant Technology Solutions Corporation Price, Consensus and EPS Surprise

Cognizant Technology Solutions Corporation price-consensus-eps-surprise-chart | Cognizant Technology Solutions Corporation Quote

Quarter Details

Segment-wise, Financial services (34.3% of revenues) grew 1.5% on a year-over-year basis at cc to $1.47 billion, primarily driven by insurance.

Moreover, growth in banking sector was stable, driven by the partnership with three Finnish financial institutions to transform and operate a shared core banking platform. The growth was partially offset by softness with a few of Cognizant’s largest banking and insurance clients.

Healthcare (28.5% of revenues) increased 1.8% year over year at cc to $1.22 billion. The upside was driven by double-digit growth in life sciences, due to robust demand for digital operations, industry-specific platform solutions and the contribution of Zenith Technologies, which was acquired in July 2019.

However, healthcare growth was partially offset by the negative impact of industry consolidation and the movement of work to a captive at a large North American client.

Products and Resources’ (22.4% of revenues) momentum continued and improved 8.6% year over year at cc to $963 million, driven by growth in retail and consumer goods, travel and hospitality, and manufacturing, logistics, energy and utilities.

The company stated that demand for core modernization services of enterprise applications and services within digital business drove segment revenues.

Communications, Media and Technology revenues (14.8% of revenues) were $632 million, up 9% from the year-ago quarter at cc, driven by broad-based growth across all industries in this segment.

However, technology revenue growth was hurt by the company’s decision to exit certain portions of its content services business.

Digital revenues grew above 20% on a year-over-year basis and accounted for almost 38% of total revenues in the reported quarter.

Further, Consulting & Technology services accounted for 59.9% of revenues. Outsourcing services contributed 40.1% of revenues. Additionally, roughly 37.3% of Cognizant’s revenues were from fixed-price contracts.

Region-wise, revenues from North America increased 3.1% year over year at cc and represented 75.7% of total revenues.

Revenues from Europe increased 5.3% from the year-ago quarter at cc and accounted for 17.9% of total revenues. Rest of the World revenues rose 14.5% at cc and represented 6.4% of total revenues.

Operating Details

Selling, general & administrative (SG&A) expenses, as a percentage of revenues, contracted 280 basis points (bps) from the year-ago quarter to 15.8%.

Headcount increased 3.9% year over year. Quarterly annualized attrition was 21%, up 2% year over year but down 3% sequentially.

Cognizant reported non-GAAP operating margin of 17%, which was flat year over year.

Balance Sheet

As of Dec 31, 2019, cash and cash equivalents (and short-term investments) were $3.42 billion, up from $3.08 billion as of Sep 30, 2019.

Cognizant generated $938 million in cash from operations compared with $717 million reported in the previous quarter.

Free cash flow was $845 million compared with $620 million reported in the previous quarter.

Cognizant bought back 2.5 million shares in the fourth quarter.

Guidance

For the first quarter of 2020, Cognizant expects revenues to grow between 2.8% and 3.8% at cc to $4.21-$4.25 billion.

The Zacks Consensus Estimate for revenues is currently pegged at $4.18 billion, indicating growth of 1.8% from the year-ago quarter’s reported figure.

Management expects revenues to have a negative 60 bps impact from the exit of certain content services business.

For 2020, revenues are projected to grow between 2% and 4% year over year at cc.

The consensus mark for revenues is currently pegged at $17.16 billion, indicating growth of 2.6% from the year-ago quarter.

For 2020, adjusted operating margin is expected to be in the range of 16-17%.

Non-GAAP earnings for 2020 are projected between $3.97 and $4.13 per share.

The Zacks Consensus Estimate for 2020 earnings is currently pegged at $4.12 per share, indicating growth of 4% from the year-ago reported quarter.

Per the 2020 Fit for Growth Plan, which was announced in the third quarter, the company expects to complete optimization of its cost structure by 2020. Efforts to streamline cost structure will result in partial funding for investments in sales and marketing, talent re-skilling, acquisitions, and partnerships apart from technology.

For 2020, Cognizant expects total charges toward the low-end of $150-200 million, primarily related to severance and facility exit costs and annualized gross savings of more than $500-550 million in 2021.

Zacks Rank & Stocks to Consider

Cognizant currently carries a Zacks Rank #3 (Hold).

Perion Network Ltd. PERI, Alteryx, Inc. AYX and CEVA Inc. CEVA are some better-ranked stocks in the broader computer and technology sector. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Perion, Alteryx and CEVA are set to report quarterly results on Feb 12, 13 and 18, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Perion Network Ltd (PERI) : Free Stock Analysis Report

Cognizant Technology Solutions Corporation (CTSH) : Free Stock Analysis Report

CEVA, Inc. (CEVA) : Free Stock Analysis Report

Alteryx, Inc. (AYX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance