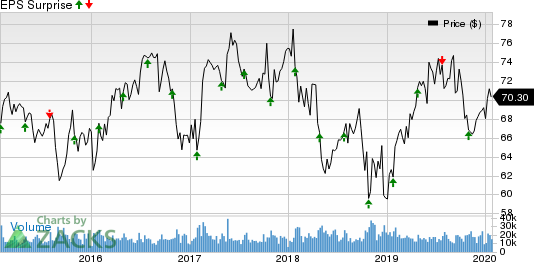

Will Colgate (CL) Retain Its Positive Earnings Trend in Q4?

Colgate-Palmolive Company CL is scheduled to report fourth-quarter 2019 numbers on Jan 31, before the opening bell. In the last reported quarter, the global consumer product manufacturer delivered a positive earnings surprise of 1.4%. Moreover, its bottom line beat the Zacks Consensus Estimate by 0.7%, on average, over the trailing four quarters.

The Zacks Consensus Estimate for the company’s fourth-quarter earnings stands at 73 cents, suggesting a decline of 1.4% from the year-ago quarter’s reported figure. The consensus mark has been unchanged in the past 30 days. For fourth-quarter revenues, the consensus mark is pegged at $3.94 billion, suggesting a 3.4% increase from the prior-year quarter’s reported figure.

Colgate-Palmolive Company Price and EPS Surprise

Colgate-Palmolive Company price-eps-surprise | Colgate-Palmolive Company Quote

Key Factors to Note

Colgate has been on track with product innovation and execution, which have been the key aspects of its growth strategies. The company has a solid innovation pipeline, with product launches lined up in every quarter. This is also likely to get reflected in its top and bottom-line results for the to-be-reported quarter.

Furthermore, the company’s positive pricing across all regions and strong volume have been aiding organic revenues. On the last earnings call, management had predicted top-line gains for the fourth quarter, backed by accelerated investment in brands, higher pricing and strong innovation. Moreover, the company’s Global Growth and Efficiency Program (or 2012 Restructuring Program) and the Funding the Growth plan have been helping it reduce costs, which are likely to get reflected in its margins for the to-be-reported quarter.

However, Colgate has been grappling with a weak margins trend, owing to escalated raw and packaging-material expenses as well as higher SG&A expenses, for a while now. On the last earnings call, management had anticipated a slight decline in gross margin for the near term, both on GAAP and adjusted basis. Further, the company expects higher advertising spending to have continued to mar its quarterly performance. Moreover, unfavorable movements in foreign currency have been taking a toll on its top line to some extent.

Zacks Model

Our proven model predicts an earnings beat for Colgate this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Colgate has a Zacks Rank #2 and an Earnings ESP of +1.37%.

Other Stocks With Favorable Combination

Post Holdings, Inc. POST has an Earnings ESP of +0.65%. It currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kellogg Company K has an Earnings ESP of +1.33% and a Zacks Rank #2 at present.

e.l.f. Beauty Inc. ELF currently has an Earnings ESP of +2.85% and a Zacks Rank #3.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained an impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

e.l.f. Beauty Inc. (ELF) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Kellogg Company (K) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance