Colgate (CL) Stock Up on Q4 Sales Beat, Earnings In Line

Colgate-Palmolive Company CL reported fourth-quarter 2019 results, wherein the bottom line was in line with the Zacks Consensus Estimate while sales surpassed the consensus mark. In the reported quarter, gains from strong volume growth and robust price increases were offset by unfavorable foreign currency. The company provided its earnings and sales guidance for 2020.

Shares of Colgate increased 5.3% in the pre-market session after the robust earnings results. In the past three months, shares of this Zacks Rank #2 (Buy) stock have gained 4%, outperforming the industry’s growth of 1.4%.

Adjusted earnings of 73 cents per share dipped 1.4% from the prior-year quarter and were in line with the Zacks Consensus Estimate. Including one-time items, earnings were 75 cents per share compared with 70 cents in the year-ago period.

Total net sales of $4,015 million rose 5.4% from the year-ago period and beat the Zacks Consensus Estimate of $3,942 million. The year-over-year improvement can be primarily attributed to 5.5% increase in global unit volume and 1.5% rise in pricing, somewhat offset by a negative currency impact of 1.5%. On an organic basis, the company’s sales improved 5%. This marked the fifth consecutive quarter of sequential improvement in organic sales growth.

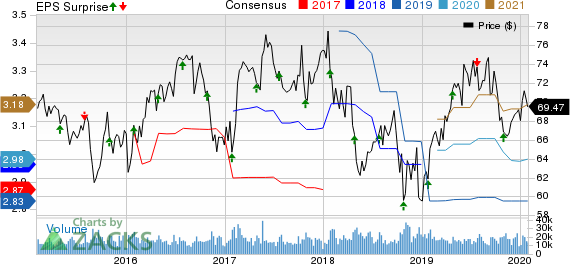

Colgate-Palmolive Company Price, Consensus and EPS Surprise

Colgate-Palmolive Company price-consensus-eps-surprise-chart | Colgate-Palmolive Company Quote

Let's Delve Deeper

Adjusted gross profit margin of 60.2% increased 80 basis points (bps) from the prior-year quarter, driven by cost savings under funding-the-growth program and higher pricing. This was somewhat offset by escalated raw and packaging material expenses.

In the reported quarter, adjusted operating profit of $938 million remained flat with the year-ago quarter. However, adjusted operating margin contracted 120 bps to 23.4%. Operating margin was mainly impacted by rise in adjusted selling, general & administrative expenses. Higher advertising investment caused rise in SG&A expenses and other cost, which was partially offset by increase in gross margin.

Colgate’s market share of manual toothbrushes reached 41.1% at the end of 2019. Further, the company continued with its leadership position in the global toothpaste market, with market share at 31.6%.

Segmental Discussion

North America’s net sales (21% of total sales) improved 1.5%, reflecting 3.5% rise in unit volume offset by 2% decrease in pricing along with flat currency rates. On an organic basis, sales grew 1.5%.

Latin America’s net sales (23% of total sales) rose 2% year over year on unit volume growth of 3% and price increases of 3.5%, partly offset by negative currency impact of 4.5%. During the quarter under review, volume benefited from gains in Colombia and Mexico. On an organic basis, sales were up 6.5%.

Europe’s net sales (16% of total sales) increased 10% year over year on 13% rise in unit volume somewhat offset by 0.5% decline in pricing and 2.5% adverse impact of unfavorable currency exchange. Volume benefited from gains in France and the Nordic region, offset by a decline in Germany and United Kingdom. Further, organic sales in Europe increased 0.5% and organic unit volume grew 1%.

The Asia Pacific’s net sales (17% of total sales) improved 7%, attributable to 4.5% rise in unit volume, 2% pricing gains, and 0.5% positive impact of favorable currency rates. Volume growth stemmed from gains in the Philippines and Greater China. On an organic basis, sales for the Asia Pacific rose 6.5%.

Africa/Eurasia’s net sales (6% of total sales) grew 7.5% year over year, owing to 8% rise in unit volume, offset by 0.5% decrease in pricing while foreign exchange remained flat. Volume gains were driven by growth in Russia and South Africa. Organic sales for Africa/Eurasia improved 6% and organic unit volume improved 6.5%.

Hill’s Pet Nutrition’s net sales (17% of total sales) rose 8% from the year-ago quarter. Results gained from a 3.5% increase in unit volume and 5% rise in pricing, offset by a 0.5% negative impact of currency. Volume growth in the United States and Western Europe were partly negated by soft volume in Japan and South Africa. On an organic basis, sales were up 8.5%.

Other Financial Details

Colgate ended fourth-quarter 2019 with cash and cash equivalents of $883 million, and total debt of $7,847 million. Net cash provided by operating activities amounted to $3,133 million as of Dec 31, 2019.

Outlook

Colgate is on track to expand its oral care portfolio with the recent announcement of the agreement to buy Hello Products LLC, a leading oral care brand in the United States that produces eco-friendly and organic products. The company’s guidance includes this acquisition.

Going into 2020, the company expects top-line gain of 4-6% and organic sales growth of 3-5%, based on current spot rates. This growth indicates the company’s plan to continue to invest behind brands and global capabilities.

Moreover, the company anticipates increase in gross margin in 2020, on both GAAP and adjusted basis. Further, it continues to expect higher advertising spending in 2020. On a GAAP basis, earnings per share for 2020 are likely to increase in a mid to high-single digit. Meanwhile, adjusted earnings per share are expected to rise in a low to mid-single digit.

3 Other Stocks to Consider

Helen of Troy Limited HELE presently has an expected long-term earnings growth rate of 9.3% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Procter & Gamble Company PG has a long-term earnings growth rate of 7.6% and carries a Zacks Rank #2.

General Mills, Inc. GIS has a long-term earnings growth rate of 7%. Currently, it carries a Zacks Rank #2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Helen of Troy Limited (HELE) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance