Collegium (COLL) to Report Q1 Earnings: Here's What to Expect

Investors are expected to focus on top and bottom-line growth when Collegium Pharmaceutical COLL reports first-quarter 2024 results on May 9, 2024.

Let's see how things might have shaped up prior to the announcement.

Factors to Consider

Collegium generates product revenues primarily from the sales of Xtampza ER, the Nucynta Products, Belbuca and Symproic.

Belbuca and Symproic were added to Collegium’s portfolio following the acquisition of BioDelivery Sciences International, Inc. in 2022.

The top line is likely to have been fueled by growth in the sales of pain drugs, Belbuca and Xtampza ER. The bottom line is expected to have been driven by cost structure optimization. The Zacks Consensus Estimate for total sales in the first quarter is pinned at $148 million.

Belbuca prescriptions grew 3.2% in the previous quarter and a similar trend is likely to have driven sales of this drug in the first quarter.

COLL renegotiated a major Medicare Part D contract for Belbuca, maintaining its access position and materially reducing the rebate, and won a new Medicare Part D plan for Belbuca, representing approximately 1 million covered lives.

Xtampza ER is an abuse-deterrent, extended-release, oral formulation of oxycodone. Sales of this drug are likely to have been driven by lower gross-to-net adjustments primarily related to provisions for rebates and higher gross prices.

Collegium successfully completed contract renegotiations for Xtampza ER with payors that represented 30% of Xtampza ER total prescriptions in 2023. As a result, Xtampza ER gross-to-net is expected to be in the range of 56-58% in 2024.

However, Nucynta franchise revenues are likely to be under pressure in 2024, because of the American Recovery Act eliminating the Medicaid cap. Hence, sales in the first quarter are likely to have been negatively impacted.

Operating expenses declined in the fourth quarter. The first quarter, too, might have witnessed a decline in costs and expenses.

Earnings Surprise History

The company beat estimates in all of the trailing four reported quarters, the average surprise being 7.54%.

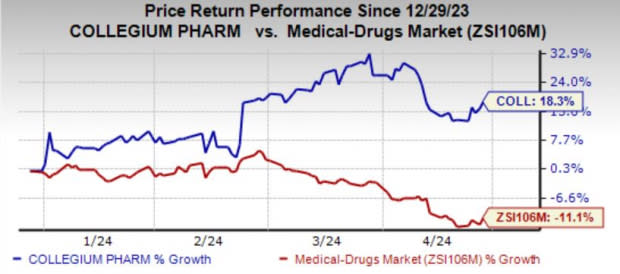

Year to date, shares of COLL have gained 18.3% against the industry’s 11.1% decline.

Image Source: Zacks Investment Research

Earnings Whisper

Our proven model does not conclusively predict an earnings beat for Collegium this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Collegium has an Earnings ESP of 0.00% as the Most Accurate Estimate and the Zacks Consensus Estimate are both pegged at $1.50.

Zacks Rank: Collegium currently carries a Zacks Rank #3.

Stocks to Consider

Here are some stocks worth considering from the healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

United Therapeutics UTHR has an Earnings ESP of +0.91% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of United Therapeutics have gained 6.4% in the year-to-date period. UTHR’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 12.95%. UTHR is set to report first-quarter 2024 results on May 1.

Sarepta Therapeutics SRPT has an Earnings ESP of +108.99% and a Zacks Rank #3 at present.

Shares of Sarepta Therapeutics have gained 33.6% in the year-to-date period. SRPT’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 464.56%.

Exelixis EXEL has an Earnings ESP of +9.11% and a Zacks Rank #3 at present.

EXEL beat earnings estimates in two of the last four quarters and missed the mark on the other two occasions, delivering an average surprise of 6.06%. EXEL is set to report first-quarter 2024 results on Apr 30.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Therapeutics Corporation (UTHR) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Collegium Pharmaceutical, Inc. (COLL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance