Comcast (CMCSA) Beats on Q1 Earnings, Submits Bid for Sky

Comcast CMCSA delivered first-quarter 2018 adjusted earnings of 62 cents per share that beat the Zacks Consensus Estimate by 3 cents. The figure increased 17% year over year driven by solid top-line growth.

Revenues increased 10.7% year over year to $22.79 billion, which comfortably surpassed the Zacks Consensus Estimate of $22.72 billion.

Comcast announced that it has submitted a £22 billion ($30.7 billion) bid for Sky, which equates to £12.50 per share. Notably, 21st Century Fox FOXA is another company that has shown interest in Sky Plc.

Comcast expects to generate roughly $500 million in synergies, including revenue benefits and recurring cost savings from the Sky acquisition.

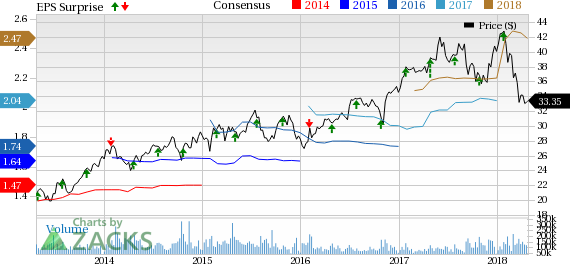

Comcast Corporation Price, Consensus and EPS Surprise

Comcast Corporation Price, Consensus and EPS Surprise | Comcast Corporation Quote

Cable Communications Details

Revenues climbed 3.6% from the year-ago quarter to $13.52 billion.

High-Speed Internet revenues increased 8.2% year over year to $4.16 billion, driven by an increase in the number of residential high-speed Internet customers and rate adjustments.

Business Services revenues were up 11.9% to $1.73 billion, primarily due to increasing number of customers adopting small and medium-sized product offerings.

Advertising and other revenues advanced 4.9% and 4.5% to $582 million and $388 million, respectively, on a year-over-year basis. Advertising revenues were driven by higher political advertising revenues and improved revenues from advanced advertising businesses.

Growth in other revenues came on the back of strong adoption of Xfinity Home and increase in revenues from X1 licensing agreements. At the end of the first quarter, 69.3% of Comcast’s residential customers received at least two Xfinity products.

Voice revenues were $1.01 billion, down 2.7% year over year, primarily due to declining number of residential voice customers. Video revenues also dipped 0.8% to $5.66 billion.

Total Customer Relationships increased by 273K. Total Revenue per Customer Relationship increased 0.9%.

Total high-speed Internet customer net additions were 379K. Total security and automation customer net additions were 46K at the end of the quarter. Total video customer net losses were 96K, while total voice customer net losses were 54K.

NBCUniversal Details

Revenues surged 21.3% from the year-ago quarter to $9.53 billion. Comcast stated that successful broadcasts of the 2018 PyeongChang Olympics and Super Bowl LII Generated an incremental $1.6 billion in segment revenues.

Management also noted that NBC Remains Ranked #1 among adults aged 18-49.

Cable Networks revenues increased 21% from the year-ago quarter to $3.19 billion, primarily due to higher distribution (up 20.8%) and advertising revenues (up 19.6%). Excluding revenues related to Winter Olympics, Cable Networks revenues increased 6.6% to $2.82 billion.

Broadcast Television revenues soared 58.3% from the year-ago quarter to almost $3.50 billion, primarily owing to higher advertising (up 84.9%) and distribution & other revenues (up 42.9%). Excluding revenues related to Winter Olympics & Super Bowl, revenues increased 4.3% to $2.30 billion.

Filmed Entertainment revenues plunged 16.3% from the year-ago quarter to $1.65 billion. Theatrical revenues decreased 35% due to weak performance from Fifty Shades Freed, Pacific Rim Uprising, Darkest Hour and Pitch Perfect 3, as compared with year-ago quarter’s strong release slate.

Theme Parks revenues were $1.28 billion, increasing 14.5% year over year, primarily due to higher per capita spending. The segment not only benefited from the timing of spring holidays but also continued success of Volcano Bay in Orlando, Minion Park in Japan and The Wizarding World of Harry Potter in Hollywood.

Operating Details

Consolidated adjusted EBITDA increased 3.3% from the year-ago quarter to $7.24 billion. However, adjusted EBITDA margin contracted 230 basis points (bps) to 31.8%, primarily due to higher programming & production costs.

Consolidated programming & production costs surged 22.6% from the year-ago quarter to $7.43 billion. As percentage of revenues, programming & production costs expanded 320 bps on a year-over-year basis.

Cable Communications adjusted EBITDA increased 4.7% from the year-ago quarter to $5.42 billion. Adjusted EBITDA margin expanded 50 bps to 40.1%. Notably, adjusted EBITDA per Customer Relationship was up 2%.

Video programming costs were up 3%, primarily reflecting higher retransmission consent fees and sports programming costs. Non-programming expenses increased 2.8%, primarily due to increases in technical and product support expenses, advertising, marketing and promotion costs and other operating costs, partially offset by a decline in customer service expenses.

NBCUniversal adjusted EBITDA increased 13.1% from the year-ago quarter to $2.29 billion. Cable Networks, Broadcast Television and Theme Parks adjusted EBITDA grew 13.7%, 57.5% and 24.6%, respectively. However, filmed Entertainment adjusted EBITDA plunged 45.2% year over year.

Consolidated operating income increased 2.3% year over year to $4.65 billion. However, operating margin contracted 170 bps from the year-ago quarter to 20.4%.

Cash Flow & Liquidity

In first-quarter 2018, Comcast generated $5.50 billion of cash from operations compared with $5.44 billion in the previous quarter. Free cash flow was $3.10 billion compared with $2.05 billion in the previous quarter.

As of Mar 31 2018, cash and cash equivalents were $6.03 billion, up from $3.43 billion as of Dec 31, 2017.

During the first quarter 2018, Comcast paid dividends totaling $738 million and repurchased shares worth $1.5 billion. As of Mar 31, 2018, the company had $5.5 billion available under its share repurchase authorization.

Guidance

For 2018, Comcast expects Cable Communications capital expenditures as percentage of Cable revenues to decline by up to 50 bps over 2017. However, NBCUniversal capital expenditures are expected to continue to increase, driven by investments in Theme Parks.

Comcast expects to repurchase at least $5 billion of its Class A common stock during 2018.

Zacks Rank & Key Picks

Currently, Comcast carries a Zacks Rank #3 (Hold).

Cable One CABO and AMC Networks AMCX are stocks worth considering in the broader consumer discretionary sector. Both stocks sport Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cable One is expected to report first-quarter 2018 results on May 3, while AMC is scheduled to report first-quarter 2018 results on May 10.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMC Networks Inc. (AMCX) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

Cable One, Inc. (CABO) : Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance