Comerica's (CMA) Q4 Earnings, Revenues Beat Estimates

Comerica Inc. CMA pulled off a positive earnings surprise of 5.8% in fourth-quarter 2017. Adjusted earnings per share of $1.28 surpassed the Zacks Consensus Estimate of $1.21. Also, the bottom line compares favorably with the prior-year quarter figure of 99 cents.

Results reflected an increase in revenues supported by easing margin pressure and higher fee income. Strong capital position and improving credit quality were the positives. However, higher expenses and a fall in loans balance remained major headwinds.

After considering the charges from tax legislation of $107 million and other adjustments, the company reported net income of $112 million in the fourth quarter.

For full-year 2017, adjusted earnings per share were $4.73 per share, surpassing the Zacks Consensus Estimate of $4.70. Also, earnings compared favorably with the prior-year figure of $3.02. For 2017, net income of $743 million was reported, up 55.8% year over year.

Segment wise, on a year-over-year basis, its Retail Bank performed well. It reported net income of $21 million against net loss of $4 million in the prior-year quarter. Also, net income increased 9.1% at Wealth Management while it declined 14.1% at Business Bank. The Finance segment incurred a net loss of $2 million compared with net loss of $60 million in the prior-year quarter.

Increase in Revenues Partly Offset by Higher Expenses

For 2017, the company reported revenues of $3.17 billion, up 11.2% on a year-over-year basis. Results surpassed the Zacks Consensus Estimate of $3.16 billion.

Comerica’s revenues for the quarter were $830 million, up 15% year over year. Also, the figure surpassed the Zacks Consensus Estimate of $819.6 million. The increase in revenues was supported by expanded net interest margin and higher fee income.

Net interest income increased 19.8% on a year-over-year basis to $545 million. Moreover, net interest margin expanded 63 basis points (bps) to 3.28%.

Total non-interest income came in at $285 million, up 6.7% year over year. Increased card fees, fiduciary income and service charges on deposit accounts primarily led to the rise.

Further, non-interest expenses totaled $483 million, up 4.8% year over year. The rise was chiefly due to higher salaries, advertising and software expenses, partly offset by lower restructuring expenses.

Loans Decline, Deposits Increase

As of Dec 31, 2017, total assets and common shareholders' equity were $71.6 billion and $8 billion, respectively, compared with $73 billion and $7.8 billion as of Dec 31, 2016.

Total loans were down slightly on a sequential basis, to $49.2 billion. However, total deposits increased marginally from the previous quarter to $57.9 billion.

Credit Quality Improves

Total non-performing assets decreased 31.6% year over year to $415 million. Also, allowance for loan losses was $712 million, down 2.5% from the prior-year period. Additionally, allowance for loan losses to total loans ratio was 1.45% as of Dec 31, 2017, down 4 bps year over year.

Moreover, net loan charge-offs decreased 55.6% on a year-over-year basis to $16 million. In addition, provision for credit losses declined 51.4% to $17 million.

Capital Position Strengthens

The company's tangible common equity ratio improved 43 bps year over year to 10.32% as of Dec 31, 2017. Further, common equity Tier 1 and tier 1 risk-based capital ratio was 11.55%, up from 11.09% in the prior-year quarter. Total risk-based capital ratio was 13.71%, up 44 bps from the prior-year quarter.

Capital Deployment Update

Notably, during the reported quarter, Comerica repurchased 1.9 million shares under its existing equity repurchase program. This, combined with dividends, resulted in a total payout of $200 million to shareholders.

For 2017, the company repurchased 7.3 million shares under its existing equity repurchase program. It returned a total of $724 million to its shareholders in the year.

Impressive Outlook for Full-Year 2018

Comerica provided guidance for full-year 2018 assuming continuation of the current economic environment and low rates, along with $270 million of benefits from the GEAR Up initiative.

The company anticipates net interest income to benefit from loan growth and increase in interest rates. Full-year benefit from the rate hikes in 2017 is expected to be $110-$125 million (assuming a 20-40% deposit beta for the December rate increase). Notably, elevated interest recoveries of $28 million in 2017 are not expected in 2018.

Non-interest income is expected to increase 4%, benefitting from GEAR Up opportunities, which will drive modest growth in treasury management, card fees, brokerage fees and fiduciary income. This expectation excludes deferred compensation of $8 million in 2017.

Non-interest expenses are predicted to be up 1%, affected by restructuring expenses of about $47-$57 million and an additional $50 million benefit from the GEAR Up initiatives. Also, expenses related to revenue growth such as outside processing expenses are likely to increase. Pressure will also be created from higher technology expenses and inflationary conditions.

Provision for credit losses is expected to reflect continued solid performance in its overall portfolio. Notably, net charge-offs are expected to remain low while provisions are expected to be in the range of 20-25 bps.

Income tax expenses are anticipated to be approximately 23% of pre-tax income on the assumption of no tax impact from employee stock transactions.

Comerica expects average loans to increase in line with the gross domestic product, reflecting rise in most lines of business while remaining stable in Energy and Corporate Banking.

Our Viewpoint

Comerica reported another strong quarter. The company remains well poised to benefit from its ongoing strategic initiatives. Additionally, its strong capital position continues to lend support. Further, the top line continues to benefit from easing pressure on margins. Lower tax rates and improving economic conditions are likely to continue supporting its financials going forward.

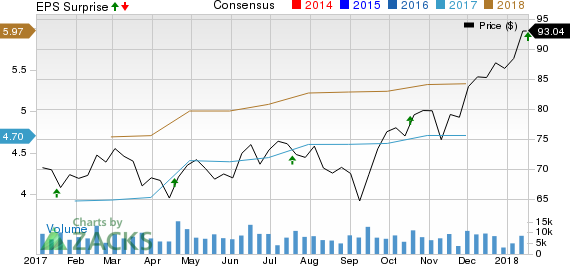

Comerica Incorporated Price, Consensus and EPS Surprise

Comerica Incorporated price-consensus-eps-surprise-chart | Comerica Incorporated Quote

Currently, Comerica sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here..

Wells Fargo & Company’s WFC fourth-quarter 2017 adjusted earnings of 97 cents per share improved from the prior-year quarter earnings of 96 cents. The Zacks Consensus Estimate was $1.04.

Amid an expected trading weakness, strong investment banking results and higher rates drove JPMorgan Chase’s JPM fourth-quarter 2017 earnings of $1.76 per share, which handily surpassed the Zacks Consensus Estimate of $1.69. Results exclude one-time tax related charge of $2.4 billion or 69 cents per share.

Riding on higher revenues, The PNC Financial Services Group PNC delivered a positive earnings surprise of 4.1% in fourth-quarter 2017. Adjusted earnings per share of $2.29 beat the Zacks Consensus Estimate of $2.20. Moreover, the bottom line reflected a 16.2% increase from the prior-year quarter.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

J P Morgan Chase & Co (JPM) : Free Stock Analysis Report

PNC Financial Services Group, Inc. (The) (PNC) : Free Stock Analysis Report

Comerica Incorporated (CMA) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance