Comerica (NYSE:CMA) Will Pay A Dividend Of $0.71

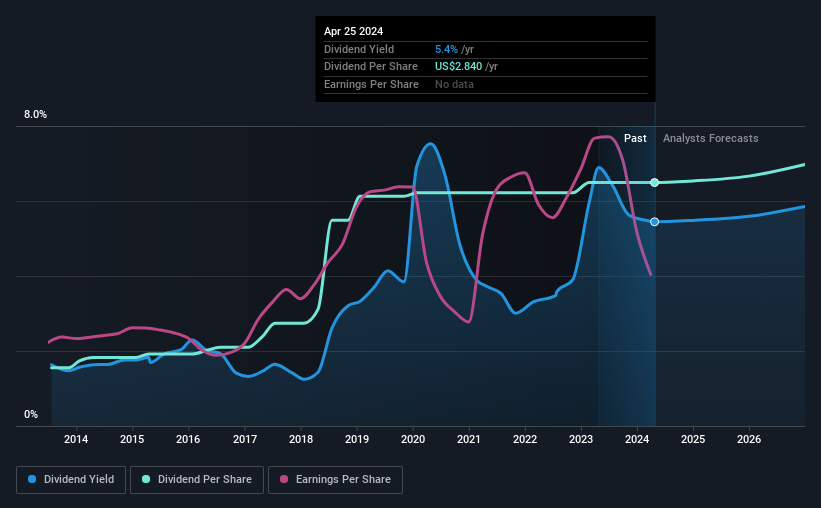

Comerica Incorporated (NYSE:CMA) has announced that it will pay a dividend of $0.71 per share on the 1st of July. The dividend yield will be 5.4% based on this payment which is still above the industry average.

Check out our latest analysis for Comerica

Comerica's Dividend Forecasted To Be Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained.

Comerica has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio shows 56%, which means that Comerica would be able to pay its last dividend without pressure on the balance sheet.

Looking forward, EPS is forecast to rise by 29.0% over the next 3 years. Analysts estimate the future payout ratio will be 50% over the same time period, which is in the range that makes us comfortable with the sustainability of the dividend.

Comerica Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2014, the annual payment back then was $0.68, compared to the most recent full-year payment of $2.84. This implies that the company grew its distributions at a yearly rate of about 15% over that duration. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

Dividend Growth Is Doubtful

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Unfortunately things aren't as good as they seem. Comerica has seen earnings per share falling at 8.4% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

In Summary

In summary, we are pleased with the dividend remaining consistent, and we think there is a good chance of this continuing in the future. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 1 warning sign for Comerica that investors should know about before committing capital to this stock. Is Comerica not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance