Commerce Bancshares (CBSH) Stock Up 2.1% on Q3 Earnings Beat

Shares of Commerce Bancshares, Inc. CBSH gained 2.1%, following the release of third-quarter 2019 results. Its earnings per share of 98 cents surpassed the Zacks Consensus Estimate of 93 cents. The figure was in line with the prior-year quarter.

Results benefited from improvement in non-interest income. Moreover, the company’s balance sheet position remained strong in the quarter. However, an increase in expenses, lower net interest income and higher provisions were the undermining factors.

Net income attributable to common shareholders was $107 million, down 3% from the prior-year quarter.

Revenues Improve, Expenses Rise

Total revenues for the quarter under review were $336.3 million, reflecting a year-over-year increase of nearly 1.4%. However, the reported figure marginally lagged the Zacks Consensus Estimate of $336.9 million.

Net interest income was $203.5 million, down 2% year over year.

Non-interest income was $132.7 million, up 7.3% year over year. The rise was due to an improvement in all components of fee income.

Non-interest expenses rose 3.2% year over year to $191 million. The rise was due to an increase in almost all expense components, except for deposit insurance costs, community service costs and other expenses.

Efficiency ratio increased to 56.66% from 55.73% reported in the year-ago quarter. A rise in efficiency ratio indicates lower profitability.

Balance Sheet Strong

As of Sep 30, 2019, total loans were $14.5 billion, up nearly 1.4% from the prior quarter. Total deposits as of the same date were nearly $20.3 billion, up 2.4% from the previous quarter.

Total stockholders’ equity was $3.1 billion as of Sep 30, 2019, reflecting a decline from $3.2 billion recorded in the prior quarter.

Credit Quality: A Mixed Bag

Provision for loan losses for the reported quarter was $11 million, up 9.6% year over year. Moreover, the ratio of net loan charge-offs to average loans was 0.32%, up from 0.28% witnessed in the prior-year quarter. However, allowance for loan losses as a percentage of total loans was 1.11%, down 3 bps year over year.

Capital Ratios Mixed, Profitability Ratios Worsen

As of Sep 30, 2019, Tier I leverage ratio was 11.32%, down from 11.38% recorded in the year-ago quarter. However, tangible common equity to tangible assets ratio grew to 10.95% from 10.10%.

At the end of the reported quarter, return on average assets was 1.72%, down from 1.81% witnessed in the year-ago quarter. Return on average common equity was 14.21%, down from 16.43% in the prior-year quarter.

Our Take

Commerce Bancshares’s top-line growth remains on track, driven by continued rise in loan balances. Moreover, the company's steady capital deployments indicate strong balance sheet position. However, its significant exposure to real estate loans might pose near-term risks. Also, continuously rising operating expenses (as witnessed in the third quarter as well) are likely to hurt bottom-line growth.

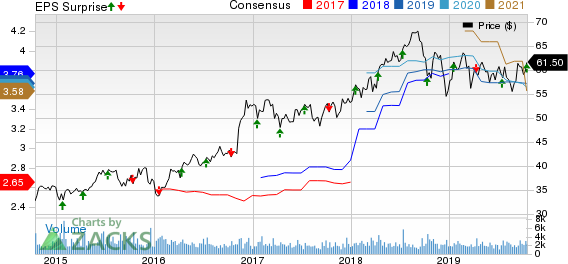

Commerce Bancshares, Inc. Price, Consensus and EPS Surprise

Commerce Bancshares, Inc. price-consensus-eps-surprise-chart | Commerce Bancshares, Inc. Quote

Currently, Commerce Bancshares carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Dates of Other Banks

Among other banks, BankUnited, Inc BKU is scheduled to report quarterly results on Oct 23. Huntington Bancshares Incorporated HBAN and Associated Banc-Corp ASB are slated to report numbers on Oct 24.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BankUnited, Inc. (BKU) : Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report

Associated Banc-Corp (ASB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance