Commercial real estate is out of favour right now – but watch this landlord slowly open new doors

This column’s studious silence on long-term portfolio pick CLS Holdings is telling, and full marks to anyone who guesses that it means we are not quite sure what to do with the shares.

Clouds still hang over the economies of its target markets of France, Germany and the UK and while the shares look cheap on an asset value basis, they lack an obvious catalyst, especially as the commercial real estate sector is well and truly out of favour right now.

However, that could just be the most interesting thing about the shares at the moment and, having let a healthy book profit slip away, we will sit tight in the view that sentiment is just so downbeat toward real estate right now that it may not take much to stimulate even a modicum of interest.

Nearly half of CLS’s real estate portfolio is situated in the UK, with more than 40pc of it in Germany and the rest in France.

The biggest generators of rental payments across the three nations are their respective governments as well as local authorities, followed by a range of professional service providers and IT specialists.

In sum, the customer base is of blue-chip quality and between them in 2022 they paid 99pc of their rent on time, or about £100m. It is rent that pays dividends, not asset valuations, and this offers comfort to those investors who are toughing it out with CLS.

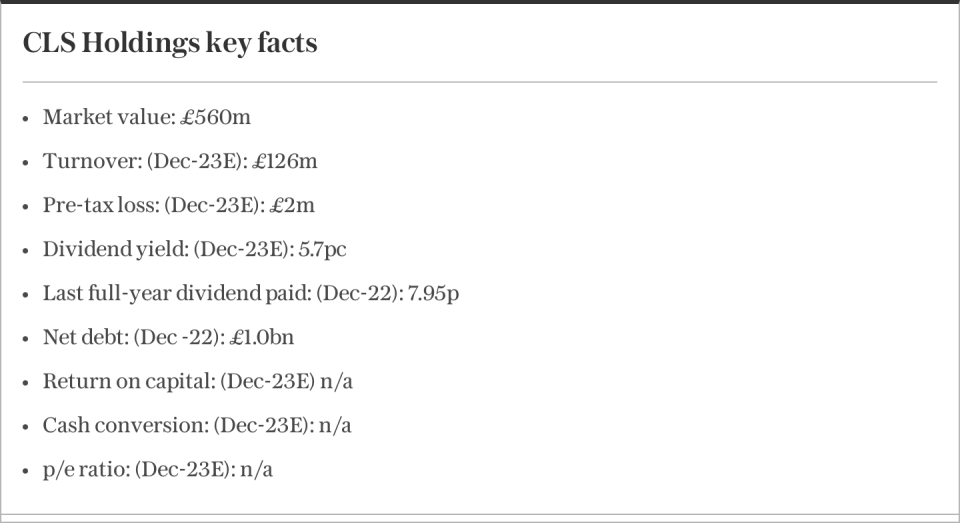

The company paid out £32m in dividends last year, and the 7.95p a share declared for 2022 take our total haul to 83.9p a share, to cover our paper loss on the stock and more.

However, net asset value per share fell 6pc last year, as vacancies, interest bills and the company’s loan-to-value ratio all rose, to give bears quite enough about which they could certainly growl and leave the shares stuck at seven-year lows.

Yet the share price is also potentially forming a bit of a base, as it is no lower than it was last autumn, when fears about high oil and energy prices hammering the French, German and British economies and demand for commercial property were at their peak, as all three nations headed into winter.

The result is the shares trade at a 56pc discount to the statutory net asset value per share of 307p and such a yawning gap surely prices in an awful lot of bad news.

That may at least provide a degree of downside protection even if CLS’s three target markets suffer economic weakness from here. It also offers some potential upside if those three real estate markets show any unexpected signs of life.

Just look at what happened in the US last month when SLGreen Realty sold a 49.9pc stake in 245 Park Avenue, New York. The implied $2bn (£1.5bn) price tag implied a much smaller discount to net asset value than the stock had priced in after a 75pc swan dive in 2022 and the share price promptly jumped.

That shows just what could happen simply if real estate turns out to be less bad than the markets currently think, and CLS is doing its best to offer some encouraging signs across the market as well.

Last month, the FTSE 250 member sold three properties for £49m, including one in Westminster and one in Maidenhead, an average 7.5pc premium to their stated book value (rather than the whacking discount suggested by the share price).

It then followed up with a 30-year lease deal in Essen, Germany, to mean the building, known as the Brix, is now fully let, barely two years after its purchase with a 28pc vacancy rate.

Granted, Essen might not be New York or London, but this knocks a bit hole in many a bear case on commercial property, especially as real estate deals are getting done, despite fears that the asset class could prove illiquid during a period of rising interest rates and economic uncertainty.

Moreover, while it is tempting to argue that commercial real estate is dead and buried, these transactions beg to differ and this column still questions whether working from home is here to stay.

Workers may have the whip hand at the moment, when unemployment is low and the scramble for talent is on, but if a recession ever lands then showing your face in the office on a much more regular basis might just be the smart thing to do.

Add to this, further interest rate increases could hold back the shares in the near-term, for sure, but the future may just not be as black as the valuation suggests.

Questor says: CLS simply feels undervalued.

Questor says: HOLD

Ticker: CLI

Share price at close: 140p

Russ Mould is investment director at AJ Bell, the stockbroker

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 6am.

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance