CommScope (COMM) Q4 Earnings Top Estimates Revenues Up Y/Y

CommScope Holding Company, Inc. COMM reported mixed fourth-quarter 2022 results; with the bottom line beating the Zacks Consensus Estimate but top line missing the same. The company’s steady approach and solid execution in the face of supply chain issues and high input costs combined with substantial growth in Connectivity and Cable Solutions (CCS) and Networking, Intelligent Cellular and Security Solutions (NICS) segments supported the year-over-year top line expansion.

Bottom Line

On a GAAP basis, the net loss in the December quarter was $1,108.8 million or $5.39 cents per share against a net loss of $87.1 million or a loss of 50 cents per share in the year-ago quarter. In spite of top-line growth, significantly higher operating expenses stemming from the impairment charge of $1.12 billion hampered the company’s fourth-quarter earnings.

Non-GAAP net income came in at $123.3 million or 49 cents per share compared with $77.5 million or 31 cents per share in the prior-year quarter. Bottom line beat the consensus estimate by 2 cents.

For 2022, CommScope reported a GAAP net loss of $1,286.9 million or a loss of $ 6.49 per share compared with a net loss of $462.6 million or $2.55 per share in 2021. Non-GAAP adjusted net income rose to $412.8 million or $1.66 per share, compared with respective tallies of $343.7 million or $1.39 per share in 2021.

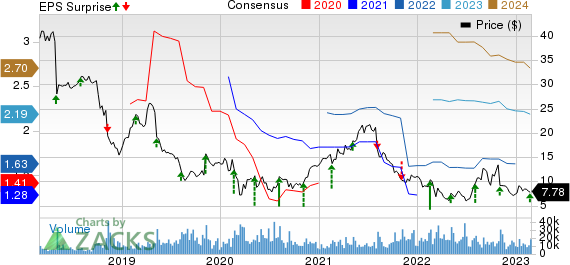

CommScope Holding Company, Inc. Price, Consensus and EPS Surprise

CommScope Holding Company, Inc. price-consensus-eps-surprise-chart | CommScope Holding Company, Inc. Quote

Revenues

Revenues from reported quarters were $2,317.9 million, up 4.2% from $2,224.1 million reported in the prior-year quarter. The upside was largely driven by good performance in Connectivity and Cable Solutions (CCS) and Networking, Intelligent Cellular and Security Solutions (NICS) and Access Network Solutions (ANS) segments. However, the decline in Home Networks and Outdoor Wireless Networks business reverse this positive trend. The top line missed the consensus estimate by $8 million.

Sales in Connectivity and Cable Solutions (CSS) were up 18.8% to $957.1 million compared with $805.9 million in the prior-year quarter, driven by healthy fiber and connectivity demand. Greater volume and price supported the top-line gains from this segment.

Sales in Outdoor Wireless Networks (OWN) came in at $304.8 million, down 18.8% year over year; Decline is primarily due to a fall in Base Station Antennas and HELIAX products.

Sales in Networking, Intelligent Cellular and Security Solutions (NICS) increased 20.3% to $288.5 million from $239.9 million in the previous-year quarter due to growth in Ruckus Networks and strong execution in an adverse supply environment.

Sales in Access Network Solutions (ANS) totaled $375.1 million, up 15% year over year, backed by growth in Access Technologies.

Sales from the Home Networks business declined to $392.4 million from $476.4 million in the year-ago quarter. The sluggish demand situation and decline in Broadband Home Solutions and Home Media Solutions led to a 17.7% fall in net sales year over year.

For 2022, Net sales stood at $9,228.1 million, up 7.5% from prior year levels of $8,586.7 million.

Region wise, revenues from the United States climbed 13.1% from $1,312.6 million in the prior quarter to $1,484 million this quarter. Europe, the Middle East and Africa also witnessed a 1.7% top-line improvement year over year as revenues rose to $414.2 million from $407.3 million in the year-ago quarter. However, Asia Pacific revenues were $187.1 million, down 22.3% from $240.7 million in the year-ago quarter. Caribbean and Latin American revenue fell by 16.2% to 134.4 million and revenues from Canada were $98.2 million, down 4.8% from the prior-year quarter’s level of $103.1 million.

Other Details

Gross profit improved to $748.3 million from $685.8 million in the year-ago quarter due to greater revenues. Due to significantly greater impairment charges, total operating expenses surged to $1,707.5 million from $648.7 million in the year-ago quarter. Operating loss totaled $959.2 million against an operating income of $37.1 million in the year-ago quarter. Non-GAAP adjusted EBITDA was $376.2 million compared with $260.6 million in the year-ago quarter.

Cash Flow & Liquidity

For 2022, CommScope generated $190 million in cash from operating activities compared with an operating cash flow of $122.3 million in the prior-year period. As of Dec 31, 2022 the company had $398.1 million in cash and cash equivalents with 9,469.6 million long term debt compared with respective tallies of $360.3 million and 9,478.5 million in 2021. The company had no outstanding debt under its asset-based revolving credit facility and had a borrowing capacity of $908.8 million.

Outlook

Core adjusted EBITDA for 2023 is expected in the range of $1.35–$1.5 billion. Connectivity and Cable Solutions (CSS) segment is likely to witness a sequential decline due to seasonality and inventory adjustments. The company anticipates that performance for Networking, Intelligent Cellular and Security Solutions (NICS) will remain will strong. Seasonality and lower carrier capital expenditures are expected to affect Outdoor Wireless Networks (OWNS) earnings. Management anticipates sequential mix and project timing likely to negatively impact first-quarter earnings from Access Network Solutions (ANS) segment.

Management expects CommScope NEXT initiatives are expected to give the business a solid foundation to continue expanding and adding value, despite the short-term economic uncertainty.

Zacks Rank & Stocks to Consider

CommScope currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Splunk Inc. SPLK, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 222%, on average, in the trailing four quarters. It has an Earnings ESP of +0.39%.

Splunk Inc. provides software solutions that enable enterprises to gain real-time operational intelligence by harnessing the value of their data. The company’s offerings enable users to investigate, monitor, analyze and act on machine data and big data, irrespective of format or source and help in operational decision-making

Arista Networks, Inc. ANET, sporting a Zacks Rank #1, delivered an earnings surprise of 14.17%, on average, in the trailing four quarters. Earnings estimates for ANET for the current year stand at $5.76 per share.

Arista Networks, Inc. is engaged in providing cloud networking solutions for data centers and cloud computing environments. The company offers 10/25/40/50/100 Gigabit Ethernet switches and routers optimized for next-generation data center networks.

United States Cellular Corporation USM, carrying a Zacks Rank #2, delivered an earnings surprise of 13.1% in the last reported quarter.

United States Cellular Corporation (U.S. Cellular) is the fourth largest full-service wireless carrier in the United States. The company provides a range of wireless products and services, and a high-quality network to increase the competitiveness of local businesses and improve the efficiency of government operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Cellular Corporation (USM) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report

CommScope Holding Company, Inc. (COMM) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance