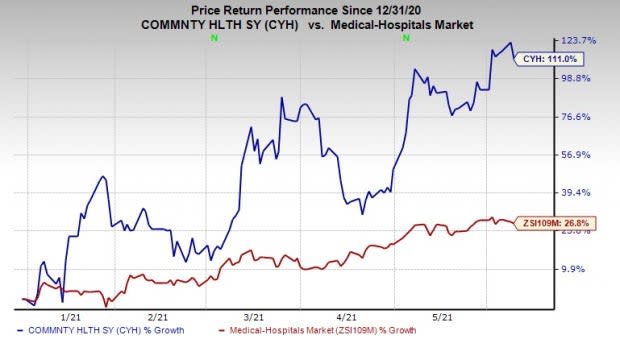

Community Health (CYH) Soars 111% YTD: More Room to Run?

Community Health Systems, Inc. CYH has been in investors’ good books on the back of its strategic initiatives, divestitures and cost-reduction efforts.

Shares of this currently Zacks Rank #3 (Hold) company have skyrocketed 111% year to date compared with its industry’s growth of 26.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

The price performance looks stellar when compared to stocks like HCA Healthcare, Inc. HCA, Tenet Healthcare Corporation THC and MEDNAX, Inc. MD, which too have rallied 27.6%, 69.6% and 32.7%, respectively, in the same time frame.

This hospital company has been gaining from a slew of acquisitions. It continues to buy hospitals to expand its number of licensed beds. It generally targets hospitals that cater to relatively non-urban and suburban communities where management can enhance value through specialty medical service expansion, economies of scale, additional investment in new technology and an improved process management. In the first quarter of 2021, it spent $4 million on buyouts.

Apart from that growing demand for healthcare services, an aging population has been contributing to its upside for a while now.

The company also opened two hospitals in Indiana and Arizona and has further plans to unveil one in Fort Wayne later this year. The hospital company have added around 300 beds to the core portfolio over the past three years along with more than 50 new surgical and procedural suites. In the first quarter, it opened a freestanding ER and two additional ASCs.

Its robust guidance also impresses. After the March-quarter results, it expects Adjusted EBITDA in the range of $1.7-$1.8 billion, higher than the previous guidance of $1.6-$1.8 billion. Net income per share is expected between 25 cents and 60 cents per share, narrower than the past outlook of 0-60 cents. Net operating revenues are still expected between $11.7 billion and $12.5 billion, indicating an upside of 2.5% from the 2020 reported figure.

Community Health is consistently shedding small assets to intensify focus on its core business. As of Mar 31, 2021, the company already sold its Lea Regional Medical Center, Tennova Healthcare (Tullahoma), Tennova Healthcare (Shelbyville) and Northwest Mississippi Medical Center.

Its restructuring initiatives lowered its costs to a great extent. In the first quarter of 2021, total operating costs and expenses fell 7.8% owing to decline in salaries and benefits, supplies, lease cost and rent, and depreciation and amortization. Going forward, its expenses are expected to improve further on the back of a planned business rejig.

Further Upside Left?

We believe that the company is well-poised for growth on the back of various strategic actions. Moreover, against the current backdrop, demand for telehealth services is likely to stay, which in turn, will provide the company with an extra cushion going forward.

The stock carries an impressive VGM Score of A. Here V stands for Value, G for Growth and M for Momentum with the score being a weighted combination of all three factors.

The Zacks Consensus Estimate for the company’s 2021 earnings indicates an improvement of 51.1% from the year-ago reported figure.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Community Health Systems, Inc. (CYH) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

MEDNAX, Inc. (MD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance